Locate.

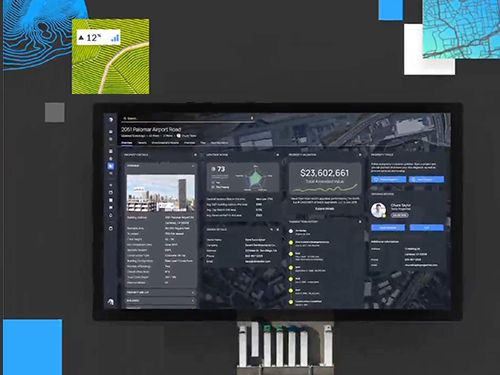

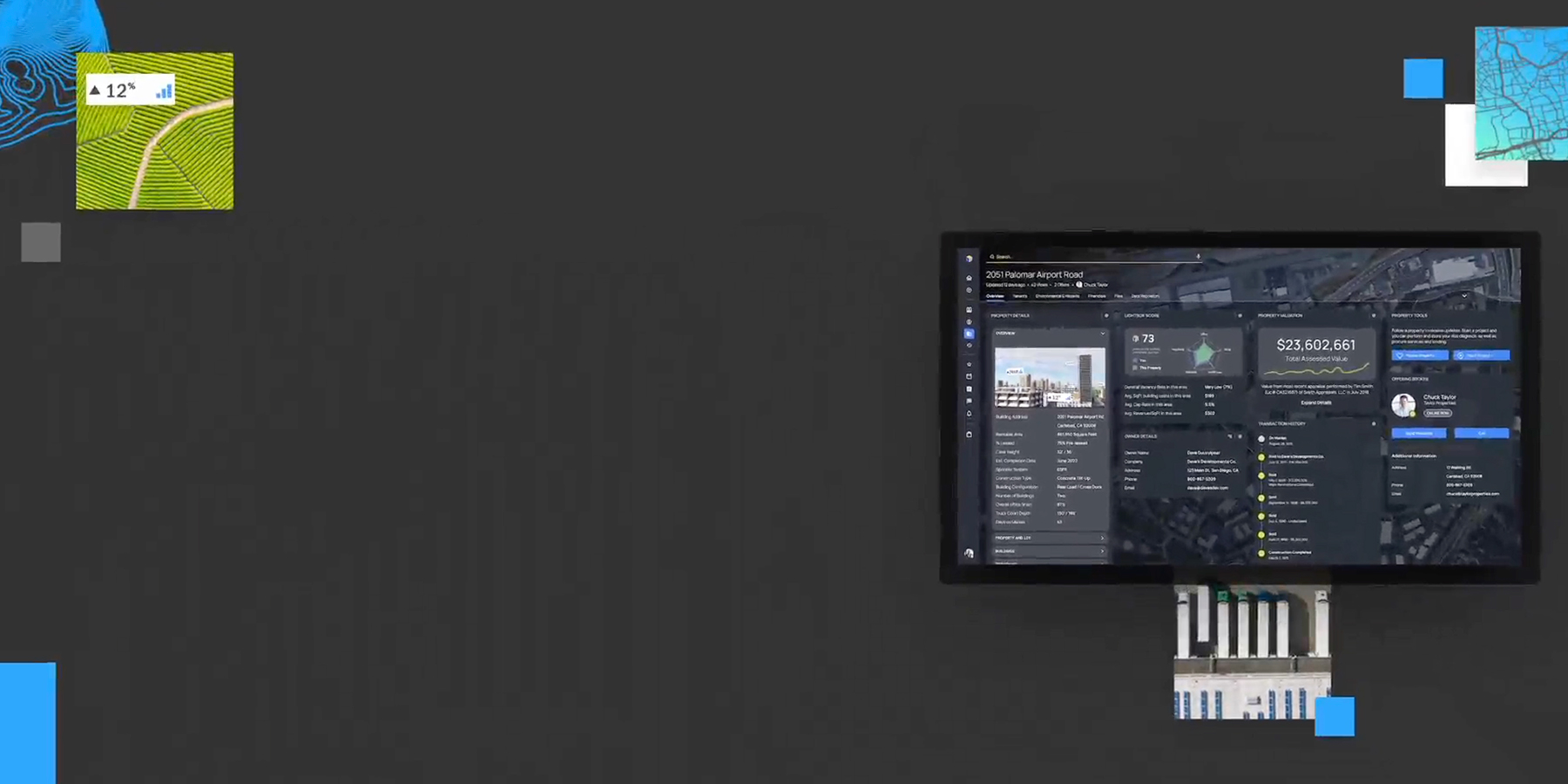

The most comprehensive set of property characteristics, tax parcels and building footprints, and spatial & environmental data.

Three simple words that empower decision makers in the commercial real estate market by delivering the most authoritative property data, integrated CRE workflows & unmatched industry connections.

The most comprehensive set of property characteristics, tax parcels and building footprints, and spatial & environmental data.

A deeper understanding of all facets of property data along with location intelligence and a simplified workflow to help you move forward.

Know you have the most comprehensive commercial real estate database and most detailed analytics so you can act on decisions with the highest degree of confidence.

From location intelligence to environmental due diligence to lending, valuation and broker resources, we offer solutions that deliver depth, speed and accuracy to help transform how you do business.

We unify and optimize the world’s broadest, deepest data sources — boundaries, neighborhoods, property and environmental — to ensure you can make every decision with confidence.

Our pioneering CRE solutions facilitate thousands of decisions daily across diverse industry sectors, including:

Let’s chat about your needs. Talk to support specialist or request a demo.

We provide solutions for customers ranging from the world’s leading mobile and web applications to government agencies and regional real estate developers. And we never stop seeking new ways to solve our customers’ unique challenges.

Discover how LightBox Labs harnesses the power of data and creative problem solving to pioneer innovative solutions within the industry.