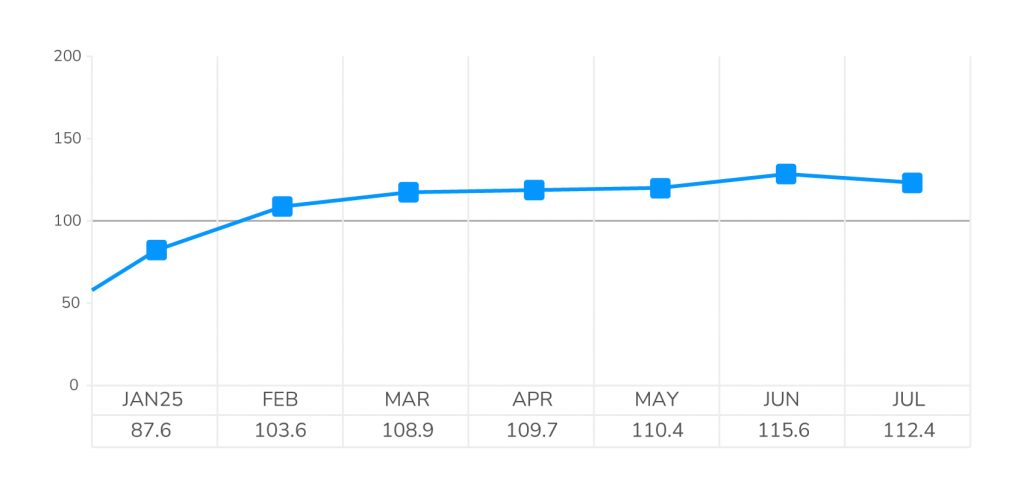

The LightBox CRE Activity Index posted a strong July reading of 112.4, just shy of June’s 2025 high-water mark of 115.6. While momentum eased slightly from the prior month, the Index continues to reflect a market actively engaged, supported by available capital, robust lending, and selective demand across multifamily, retail, and even office sectors.

The Index aggregates daily activity across three core CRE functions, environmental due diligence, commercial property listings, and lender-driven appraisals, drawing from more than 30,000 data points supporting lending and investment decisions. In July, brokers sustained a steady flow of new listings for the seventh consecutive month, Phase I ESA volume remained at June’s elevated levels, and appraisal activity by lenders climbed to its highest monthly total of the year.

Three Signals from July’s CRE Index

The CRE Activity Index is based on the average daily volume over the past month in each of the three functions that support CRE lending and investment:

- Commercial property listings contracted modestly, with daily volume down 7% below June’s strong activity but a healthy 47% higher than last July when the market was still on the sidelines.

- Volume of Phase I ESA activity was down 6% after a strong June performance, but up 5% year-over-year, in its third-strongest month of 2025 (behind June and March).

- Lender-driven commercial appraisal volume rebounded strongly with a 13% uptick from June, continuing its two-month trend after a brief and modest May slowdown.

Monthly LightBox CRE Activity Index (YTD 2025)

Manus Clancy

Head of Data Strategy LightBox

“July’s Index reflects a market actively executing across the deal pipeline. We’re seeing healthy activity across the core functions that power CRE deals: valuation, environmental due diligence and property listings. Each area is contributing to a foundation for increased transaction flow in the coming months”

CRE Market Outlook: Bullish by not Blind to Risk

With the second half of 2025 underway, the LightBox CRE Activity Index continues to reflect a market on solid footing, supported by resilient deal flow, active capital, and improving pricing clarity. July’s strong triple-digit reading points to sustained activity, with new listings, robust environmental due diligence, and increased appraisal volume all contributing to higher lending and transaction flow.

Still, the outlook is not without its caution flags as signs emerge on weakening labor market and challenges to corporate earnings as tariffs take hold. On top of that, the August 1 rollout of new tariffs, especially on steel, aluminum, and other imported components, is adding pricing uncertainty, particularly in housing and infrastructure-related projects.

The Fed’s fifth consecutive rate hold underscores its delicate balancing act. Inflation remains above target, but signs of cooling, and growing internal dissent, could pave the way for a rate cut later this year, potentially reigniting CRE lending and investment heading into Q4.

Even modest progress on interest rates or trade clarity could unlock greater momentum in the August and September Index and most CRE professionals remain cautiously optimistic. According to the LightBox Mid-Year Sentiment Survey, 69% expect the market to “soldier on” through year-end, so long as deals pencil out. This is a strong sign of an industry bracing for ongoing uncertainty but not retreating.

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.