This blog explores U.S. Phase I ESA volume year-to-date and results from LightBox EDR’s 2023 Benchmark Survey of Environmental Consultants on how they feel about the near-term forecast.

As we head into the final quarter of 2023, environmental due diligence consultants are challenged to forecast Phase I ESA volume amid growing market uncertainty. Commercial real estate transaction volume has been challenged this year by the Fed’s four more increases in interest rates and the bid-ask gap between buyers and sellers as property prices recalibrate to new market conditions. More expensive debt capital and price uncertainty resulted in double-digit declines in commercial property deals and the functions that support transactions, including environmental due diligence. In a potentially positive development for the 4th quarter, the Fed just decided at its September meeting to pause on another interest rate hike (although it did leave the door open for one more increase before year-end). The stage is set for a challenging fourth quarter and early 2024.

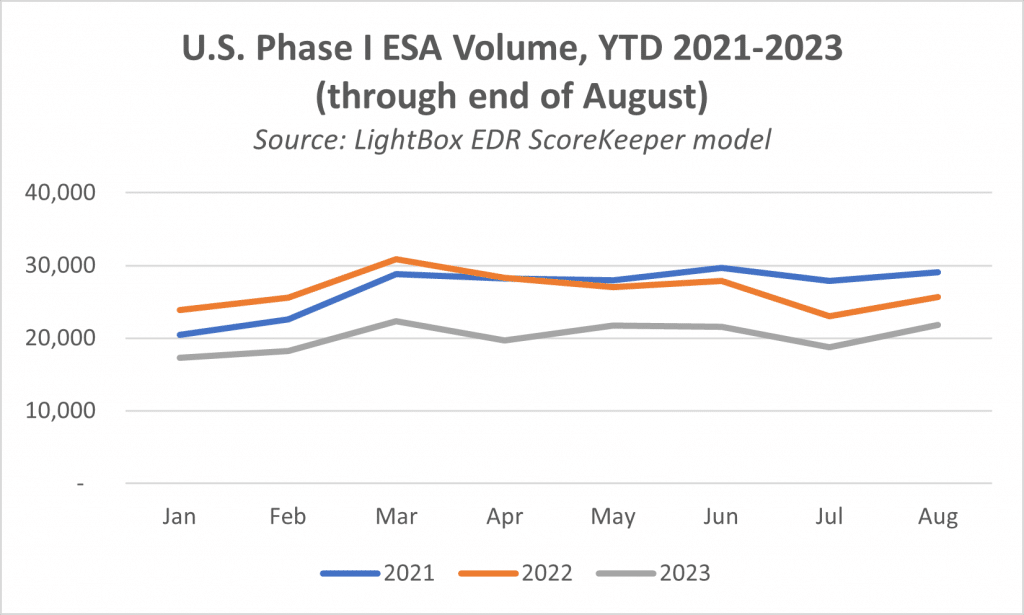

Phase I ESA volume down 19% YTD

By the end of August, U.S. Phase I environmental site assessment volume was running approximately 19% below the same timeframe last year and 24% below 2021 levels, according to the latest LightBox EDR ScoreKeeper model output. These volume declines are consistent with overall CRE deal volume and lending trends, as some investors are “pencils down” until interest rates stabilize. Lenders continue to proceed very cautiously in extending debt capital. As noted by one survey respondent, “Things have slowed down this year, and deals are dying before they close.”

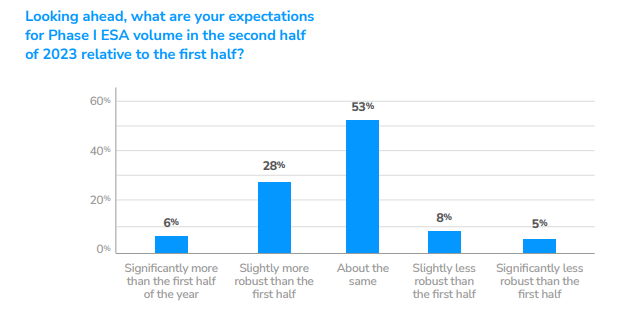

Outlook hazy for Environmental Consultants

Given the high degree of market uncertainty heading into the final quarter of 2023, it is unsurprising that the 2023 Benchmark Survey of Environmental Professionals survey’s responses about the forecast were a mixed bag. Given the uncertainty in the broader market, the results reflect a neutral market forecast and the challenges associated with anticipating future volume and staffing needs. The majority, or 53%, expect a similar volume for the year’s second half to the first half, while 33% expect an increase. Only 13% expected a slower second half.

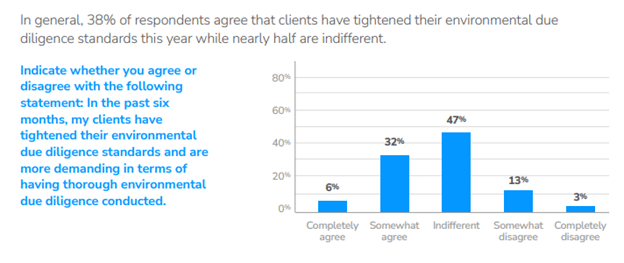

Another impact of market uncertainty this year has been increased risk aversion. Financial institutions have pulled back the reins on their commercial real estate lending, and investors are scrutinizing deals in a risk-averse climate. The latest survey results show that 38% of environmental consultants report that their clients have tightened their environmental due diligence standards in response to market conditions and are more demanding to conduct thorough investigations.

What to watch

The 2023 Benchmark Survey of Environmental Professionals results reflect the challenges of projecting future Phase I ESA volume in a challenging market environment. The stage is set for a challenging fourth quarter amidst concerns about constrained debt capital, price uncertainty, declining property values, loan defaults and a spike in distressed assets. Market barometers to watch include whether the Fed implements a fifth interest rate increase before year-end or holds fast, signaling the market that the days of higher debt capital costs could be in the rear view mirror. For transactions to accelerate, the market also needs sellers and buyers to narrow the bid-ask gap that thwarted deals in the first three quarters of 2023. In this transition, the commercial real estate market is entering a new cycle phase as it adjusts to higher interest rates, shifting demands for space, the coming wave of distress and intense pressures on market participants to close deals quickly.

ABOUT THE 2023 BENCHMARK SURVEY

LightBox EDR is dedicated to tracking and understanding trends in the property due diligence market and responding to our client’s requests for current industry benchmarks. In Q2 23, LightBox EDR invited a sample of environmental consultants and engineers across the United States to complete a survey with questions on market performance, Phase I ESA pricing and turnaround time, clients’ risk tolerance, the near-term outlook, and top business challenges. More than 300 environmental professionals responded to the survey over three weeks, representing almost every U.S. state and a wide cross-section of firm sizes and types.

You can view a complete report of LightBox’s 2023 Benchmark Survey Results here.