Survey Results Point to Subdued CRE Investment Climate Over Near-Term

Investment over the next 12 to 18 months could be constrained, according to the investors, brokers, lenders, appraisers, and environmental due diligence consultants surveyed by LightBox this quarter. Among the five key takeaways from the LightBox Q4 Market Sentiment Survey was a notable shift in expectations for commercial real estate investment. The consensus from respondents is that the market will experience slow investment in the first half of 2024, with possible improvement by the 3rd or 4th quarter, with several noting that the presidential election could stall any market recovery late in the year. The LightBox survey results are consistent with other market forecasts being released as year-end approaches calling for only moderate transaction volume next year.

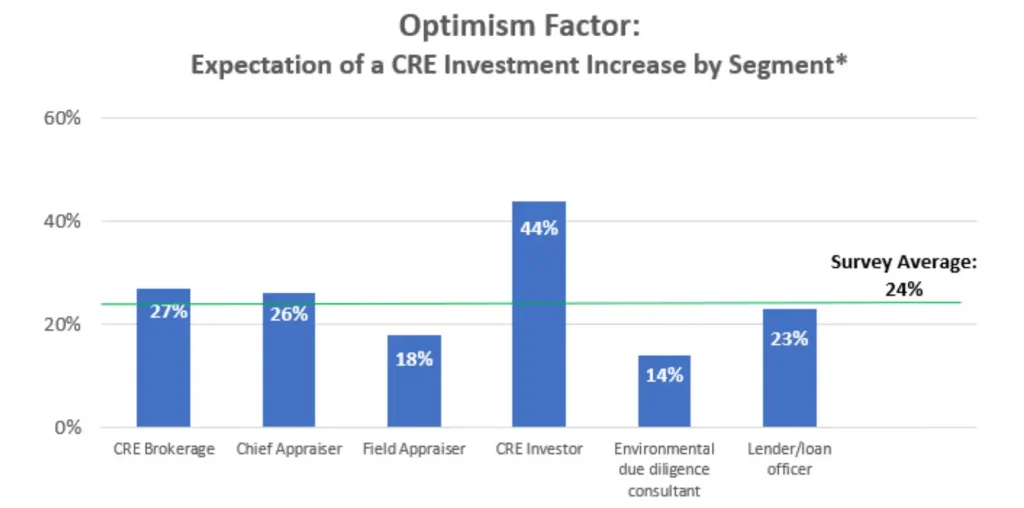

More Optimism from Investors/Brokers

In the mid-year sentiment survey, 32% of respondents expected to see either a “significant increase” or “moderate increase” in CRE investment over the next 12 to 18 months. By November, that percentage fell to 24%. There are, however, interesting differences in optimism levels by industry segment. Environmental due diligence consultants and field appraisers are the least bullish with only 14% and 18%, respectively, expecting an increase. Those respondents who are in the field, and closest to dealmaking—the investors and brokers—are more optimistic with 44% and 27% expecting to see investment rise over the near term.

SOURCE: LightBox Fall Market Sentiment Survey

NOTE TO READERS: * The Optimism Factor is the percentage of respondents in each industry sector who expect investment over the near-term to increase “significantly” or “moderately.”

Rate Uncertainty, Lack of Inventory Hinders Investment

High interest rates are widely blamed by respondents for this year’s low transaction volume and their cautious near-term forecast. If the market gets more clarity on rates from the Fed, not likely until mid to late 2024, investment forecasts could swing to a more optimistic stance, but for now, most respondents are expecting a slow rate of growth in the New Year. As one respondent observed, “Investors are playing the waiting game because of an expectation of a general economic downturn and price reductions in many property types.”

In addition to interest rate volatility, respondents noted other inhibitors to higher CRE transaction levels this year, including:

- the bid-ask spread between buyers and sellers;

- the challenges of cap rate discovery;

- the inherent difficulty in estimating current values given very low transaction volume and the lack of reliable comps; and

- a lack of inventory.

As noted by one broker, “I want to see more properties available as I have buyers but nothing available on the market.”

Brokerage respondents, in particular, observed the lack of properties on the selling block as owners sit back, awaiting more clarity on pricing and rates. Early quarter metrics from the LightBox RCM platform suggests that Q4 could signal a shift toward more seller activity. In Q3, property listings in the LightBox RCM platform declined 22% from Q3 2022. In October, however, property listings increased 9% year on year. It will be interesting to see if the increase in listings early in the quarter continues through year-end.

Industrial, Shopping Centers, Multifamily Attracting Interest

Respondents highlighted some key trends by asset class:

- Deteriorating investor interest in office due to hybrid/remote strategies;

- Growing concerns about office loan maturities;

- Continued evolution in the retail sector with high demand for suburban shopping centers;

- Favorable assessment of industrial out-performing other asset classes; and

- The expectation that multifamily will see healthy tenant demand and moderated rent growth.

Many respondents noted the challenges of securing CRE loans with banks proceeding very cautiously with loan originations. As one observed, “The opportunity lies with investors who have cash. There will be some very attractive purchase opportunities as we wrap up 2023 and head into 2024.”

2024 Hinges on Fed’s Policy

The survey results suggest that investors are likely to remain reluctant to move capital back into play as the market resets to new dynamics, notably, the “higher-for-longer” interest rate environment. Respondents had mixed views about the forecast:

“I would like to say I see a bright light heading our way in the industry, but I don’t think this will happen until mid- to late-2024.”

“I expect volumes for the first half of ’24 to remain muted, and transaction volume will stay low for as long as owners can hold on.”

“Until rates come down, I don’t see anything but slow conditions at least until the 3rd quarter of next year, and possibly some properties being sold out of necessity.”

“Everything feels frozen. I expect things will begin to thaw, either due to increased confidence from investors or increased distress if/when banks are forced to deal with assets that may have declined in value that have owners pressured with high interest rates and insurance expenses.”

“Investors who have been patiently waiting on the sidelines will finally get their moment to pounce. Depending on the election outcome, this could all change if interest rates drop back to near zero.”

The New Reality

In 2023, all eyes were on the Fed as interest rates continued to rise, creating an uncertain market dynamic that discouraged lending and investment. Over the past several months, the Fed opted to pause on raising the benchmark federal funds rates further but left the door open for still more hikes. Now, with 2024 around the corner, the market is forced to come to terms with the new reality: high interest rates are here to stay. Asset pricing equilibrium will settle on levels that account for higher rates and operating costs, narrowing the disconnect between buyers and sellers, and spur a new round of investment. But when? And by how much? remains anyone’s guess. The consensus of the survey respondents across multiple LightBox client sectors is that deal flow will be constrained over the near term, and 2024 will bring a slow thaw in investment activity, but only after interest rate clarity and stability emerges.