The commercial real estate market is still progressing, but May brought the first clear signs of a slight moderation in the pace of transactions. The LightBox CRE Activity Index declined for the first time this year, slipping to 105.5—still well above 2024 levels, but a signal that Q1’s momentum is giving way to a more measured pace.

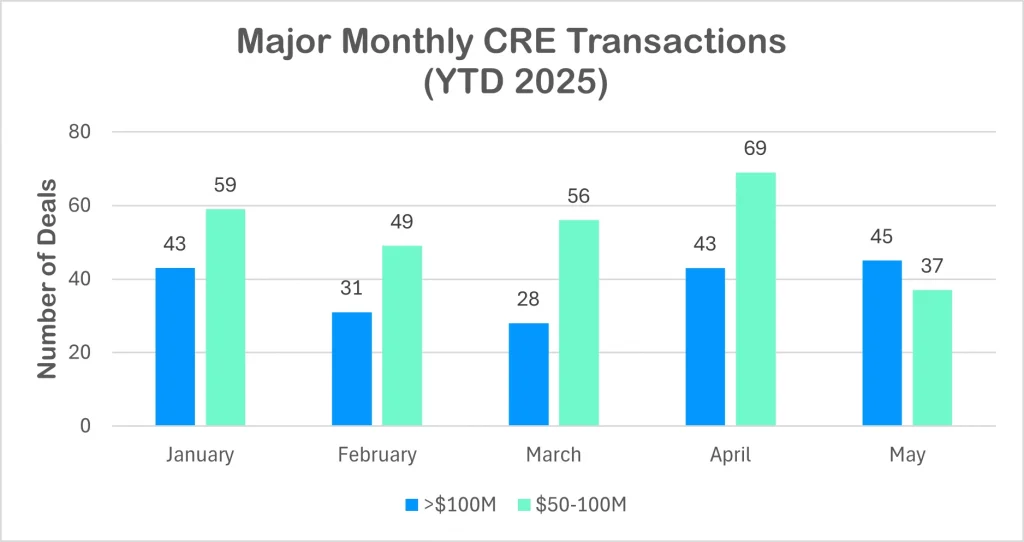

That recalibration showed up most clearly in deal composition. According to the LightBox Transactions Tracker, 45 nine-figure deals closed in May, a slight uptick from 43 in April—a signal that well-capitalized buyers are still pursuing marquis assets. But further down the stack, activity cooled: $50–100 million transactions dropped to just 37, nearly half of April’s 69. The divergence points to a bifurcated market, where institutional and private equity capital remains aggressive at the top, while smaller sponsors—often reliant on tighter lending channels—are increasingly sidelined.

“After a fast start to the year, May’s Index confirms that the market is starting to tap the brakes,” said Manus Clancy, head of Data Strategy at LightBox. “The investment community isn’t retreating, but it is recalibrating. We’re still seeing major nine-figure deals close at a healthy clip, but capital is gravitating toward specific asset classes and markets where the fundamentals can support long-term performance.”

“The $50 to $100 million tier is where we’re seeing the first signs of slowdown,” said Clancy, “Institutional buyers and private equity funds remain aggressive at the top end, but smaller sponsors—often relying on more restrictive financing channels—are increasingly sidelined as tighter debt markets and recalibrated underwriting slow things down.”

Even as the middle market cooled, deals in core asset classes moved forward—with sharper pricing discipline and highly selective execution.

Multifamily and Office Lead as Institutional Capital Stays Focused

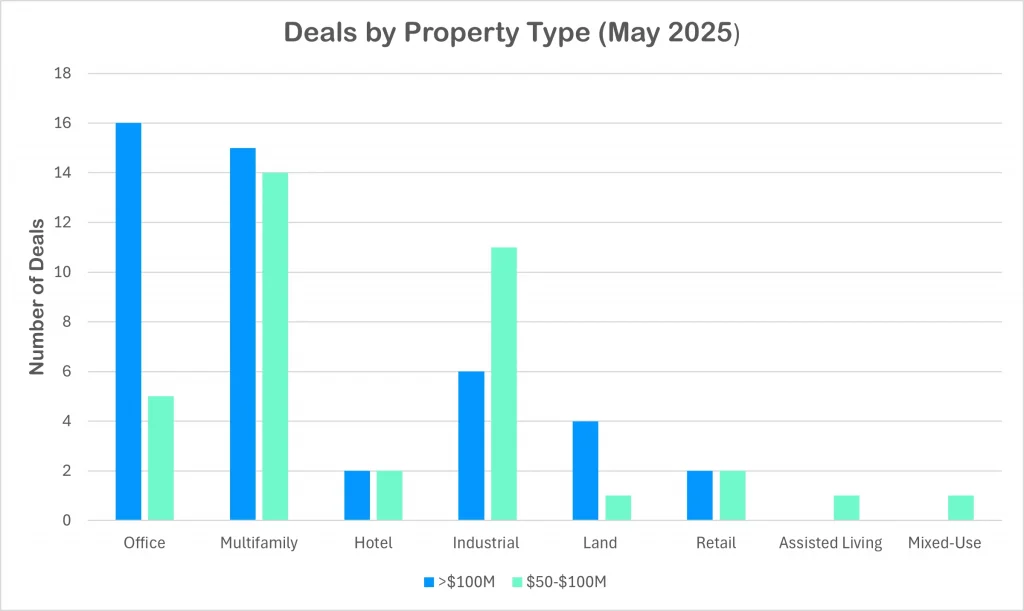

In May, capital continued to concentrate in multifamily and office, with each accounting for more than 15 nine-figure transactions—outpacing all other asset classes. Multifamily remains a key target for investors focused on long-term yield, particularly in select coastal and Sun Belt markets—though near-term momentum varies across metros as the sector navigates elevated rates and shifting fundamentals. Meanwhile, office surprised again with 16 nine-figure deals, proving that capital is still in play for high-quality, well-leased assets—especially in major markets like New York, where two of the month’s largest sales occurred.

Industrial, by contrast, saw most of its action in the $50–$100 million range, with 11 mid-tier trades compared to 6 nine-figure deals. This trend reflects both the high cost of newer facilities and rising investor interest in mid-market, last-mile logistics properties. CBRE’s 2025 outlook predicted a flight to quality—but May’s deal data shows that strategically-located, older Class B properties are also in demand.

Altogether, May’s distribution confirms that capital hasn’t exited the market—it’s concentrating, flowing into sectors and assets that align with today’s underwriting expectations and tomorrow’s demand drivers.

Multifamily: Demand Surges Amidst Supply Slowdown

The multifamily sector continued to demonstrate resilience in May, bolstered by strong renter demand and a deceleration in new supply. The national vacancy rate decreased to 4.8% in Q1 2025, falling below the long-term average of 5.0%, according to a CBRE report. This decline was driven by a net absorption of 100,600 units—the highest first-quarter total since 2000 and more than triple the pre-pandemic average. Concurrently, construction completions slowed to 70,600 units in Q1, a trend expected to persist, further tightening the market. “Multifamily fundamentals continue to strengthen due to strong renter demand and a diminishing construction pipeline. We expect the gains to continue this year and accelerate in 2026,” said Kelli Carhart, head of Multifamily Capital Markets for CBRE. She predicts that economic uncertainty will continue to impact consumer sentiment, causing capital markets volatility, but that the sector is “poised to remain resilient.”

In May, multifamily accounted for 15 of the 45 nine-figure transactions and 14 of the 37 deals in the $50M–$100M range, underscoring investor confidence in the sector.

Notable Transactions:

- Bellevue, WA: Soma Towers, a two-tower, 273-unit luxury apartment complex in downtown Bellevue, sold for $192 million to The Sobrato Organization. While this marks the firm’s first acquisition in Bellevue, it owns other assets in the greater Seattle area. With 95% occupancy and proximity to Amazon, Meta, and Microsoft hubs, the property reflects continued investor demand for trophy assets in tech-centric markets.

- Needham, MA: The Kendrick, a 390-unit Class A apartment community in the Boston suburbs, sold for $182 million. The buyer was Taurus Investment Holdings, which has been active in the Greater Boston market. The property was last assessed at $119 million, but the recent transaction values each unit at roughly $467,000. With strong highway and commuter rail access, the asset underscores sustained interest in well-located suburban properties offering both scale and stability.

- Chandler, AZ: Zaterra, a newly built 392-unit garden-style apartment complex in the Phoenix metro, sold for $137.7 million in an all-cash deal to Ares Management. Completed in 2023, the property spans 30 two- and three-story buildings across 22 acres. Located near Chandler Municipal Airport and less than 25 miles from downtown Phoenix, the asset reflects continued interest in high-growth Sun Belt markets.

- Tampa, FL: Amberly Place, a 400-unit garden-style apartment community, sold for $97 million to S2 Capital, a Dallas-based multifamily investment firm. This marks the property’s first sale in over a decade, following its previous $63.4 million transaction in 2013—an appreciation of more than 50%. S2 Capital highlighted Tampa as one of its top growth markets. Investor interest was fueled by the region’s strong population gains and the asset’s value-add potential in a high-demand rental market.

- Memphis, TN: Waterford Place, a 300-unit Class A apartment complex, sold for approximately $56 million—double its previous $28 million sale price. The transaction underscores growing investor appetite for value-add opportunities in emerging secondary markets with room for rental growth.

These multifamily transactions reflect a strategic focus on markets with strong economic fundamentals, population growth, and limited new supply.

Office: A Barbell Market Emerges—Distress, Discounts, and Trophy Plays

The U.S. office market in May reinforced a growing truth: the sector is no longer monolithic. Instead, it’s split between distressed assets needing rescue and attractive properties worthy of nine-figure price tags—albeit with concessions. Clancy added, “Office is a barbell market right now—distress on one end, elite assets on the other.”

New York City saw two major trades that anchor the high end of the market. The $1.1 billion sale of 290 Madison Avenue and the $456 million acquisition of 522 Fifth Avenue captured headlines, not just for their scale, but for what they signal: liquidity still exists for trophy assets in gateway markets. The Fifth Avenue deal is particularly notable—resolving a distressed loan and recovering from a $350 million valuation.

At the opposite end of the spectrum, May also brought a wave of mid-market office transactions, where investors are targeting functional, well-located buildings at a significant discount. Several of these deals underscore how repricing and repurposing are shaping office strategy:

- Washington, DC: Post Brothers reacquired 2100 M St. NW through foreclosure auction with a winning bid of $60 million. The company plans to convert the 301,000-square-foot office building into 400 residential units—a vivid example of adaptive reuse as a path forward.

- San Jose, CA: The Santa Clara Valley Transportation Authority (VTA) purchased the 17-story Almaden Crossing tower at 488 South Almaden Boulevard for $63.7 million. VTA plans to relocate its headquarters to this downtown San Jose location, investing up to $43.4 million in renovations.

- Miami, FL: Bridge Investment Group sold a three-building office complex totaling approximately 400,000 square feet at 9675, 9725, and 10451 NW 117th Avenue in the Flagler Station business park for $64 million. The transaction involved a deed-in-lieu of foreclosure and a conventional sale, with entities tied to Hamilton Development acquiring the properties.

Even sales like the $52 million short sale of 768 Second Avenue in Manhattan show how buyers are betting selectively on value recovery—when pricing, tenancy, and potential upside align.

Altogether, these deals point to an office sector in flux. Capital is still active—but highly selective. Buyers want discounts, clarity on net operating income (NOI), or a repositioning story. And the biggest checks are being written for properties with either ironclad fundamentals or transformational potential.

Industrial: A Nuanced Flight to Quality in a Cooling Pipeline

The industrial sector continues to undergo a bifurcation: While tenant demand is concentrated in Class A facilities with high-clear heights and modern amenities, investor interest is also extending to well-positioned Class B and infill assets with long-term upside. That duality remains visible in May’s activity—but what’s becoming clearer is that the broader market may finally be approaching equilibrium.

Recent notable transactions reflect this dual-track trend across the Class A and older asset spectrum:

- Multi-State Deal: Hines acquired three Class A East Coast industrial assets totaling 2.5 million square feet for $309 million. The deal includes two fully leased distribution centers in Savannah’s Georgia International Trade Center, the partially leased Upton Crossing campus in Wilmington, MA, and the I-85 Logistics Center in South Carolina’s Greenville-Spartanburg metro.

- North Jersey, NJ: Bain Capital and Oliver Street Capital acquired an 11-property industrial portfolio from Blackstone for $208 million. The 784,000-square-foot Class B portfolio spans top infill submarkets in Northern New Jersey and is 88% leased. The light industrial buildings feature suite sizes averaging 23,000 square feet and cater to a mix of local and national tenants.

- Fort Myers, FL: Legacy at Oriole Park, a Class A 500,000-square-foot industrial campus completed in 2023, was acquired by EQT Exeter for $87 million. The 34-acre site, located less than a mile from Interstate 75, offers direct access to Tampa and Southeast Florida. EQT Exeter previously paid $92 million for a neighboring industrial park, signaling a growing footprint in the region.

- Commerce, CA: Garfield Business Center, a five-building, 544,705-square-foot industrial complex at 3300–3430 Garfield Avenue, was sold by Terreno Realty after more than a decade of ownership. Terreno originally acquired the fully leased property in 2012 for $52.4 million, according to property records. The buyer was LaSalle Investment Management. Built in 1986, the complex is located in the warehouse-dense City of Commerce, about 10 miles southeast of Downtown Los Angeles. Despite its age, the property remains competitive due to its infill location and a mix of bulk and shallow bay configurations suited to a variety of tenants.

The current state of the industrial market is rewarding new construction with premium pricing, but older, well-positioned properties are seeing renewed attention as investors balance yield, functionality, and location. As the development pipeline continues to contract, competition for both modern assets and prime infill real estate is likely to intensify in the second half of 2025.

Hotel: Luxury Bets Continue in Resilient Markets

The U.S. hotel sector is navigating a complex economic environment marked by elevated operating costs, persistent labor shortages, and the drag of new tariffs on construction and renovation materials. International inbound travel remains below pre-pandemic levels, putting pressure on gateway markets that traditionally rely on foreign tourism. Additionally, inflationary insurance premiums and a higher cost of capital continue to weigh on margins, prompting more cautious underwriting.

Yet despite these headwinds, investor interest remains focused on high-performing segments—particularly luxury resorts, convention-friendly properties, and well-branded urban hotels.

Recent transactions reflect this bifurcated dynamic:

- Phoenix, AZ: Ryman Hospitality Properties’ $865 million acquisition of the 950-key JW Marriott Phoenix Desert Ridge Resort was the standout hospitality transaction in May. Following nearly $100 million in renovations in 2023, the asset sold for significantly more than its prior $602 million valuation. The deal signals sustained confidence in Phoenix as a dual-threat leisure and convention market.

- San Francisco, CA: The Hyatt Centric Fisherman’s Wharf at 555 North Point Street sold for $80 million, or roughly $253,000 per key. The 316-room hotel was acquired by an undisclosed buyer as part of Park Hotels & Resorts’ strategy to divest “non-core” assets. The sale price represents 64 times the property’s projected 2024 EBITDA, according to Park. While San Francisco’s commercial real estate market continues to face headwinds, a new JLL report points to a “robust recovery” underway in the city’s hospitality sector. RevPAR is expected to rise alongside improving travel demand and business fundamentals, positioning San Francisco hotels for renewed investor interest after years of lagging post-COVID performance.

- Boston, MA: The Courtyard Boston Copley Square, an 81-key historic select-service hotel at 88 Exeter St., was included in a larger acquisition deal valued at $50 million. Situated in the heart of Back Bay, the boutique property continues to draw steady demand from both business and leisure travelers, highlighting investor confidence in well-located, branded assets within top-tier urban markets.

Retail: Experiential & Mixed-Use Hold Up

Retail continues to defy broad-brush narratives of decline. In May, Plano’s Legacy West sold for $785 million, demonstrating the enduring appeal of well-executed, high-traffic mixed-use developments. Combining retail, office, and multifamily on a walkable, amenity-rich campus, the project shows how multifaceted revenue streams and experiential design continue to draw both shoppers and investors.

That said, the sector remains highly bifurcated. While open-air centers, grocery-anchored assets, and experiential formats are attracting capital, traditional inline apparel retail continues to struggle. In May, Torrid announced it would shutter 180 stores, adding to a string of brand-scale contractions in brick-and-mortar apparel. These closures reflect ongoing challenges from e-commerce competition, rising occupancy costs, and shifting consumer preferences.

Notable Transactions:

- Davie, FL: Edens acquired the 108,623-square-foot Weston Road Shopping Center for $51.25 million, despite the recent departure of anchor tenant Office Depot. The property’s location in Southwest Broward County, where Q1 2025 vacancy rates were just 1.6%, underscores investor confidence in high-demand submarkets.

- Denver, CO: Quebec Square, a 207,611-square-foot power center shadow-anchored by Walmart, The Home Depot, and Sam’s Club, sold for $56.7 million. The property’s strong national tenant mix and strategic location near Interstate 70 highlight the continued appeal of strategically positioned power centers.

Conviction Over Optimism

What’s ahead in June? Watch for signs on office distress which is likely to continue to be a slow burn rather than an intensifying crisis. Keep an eye on whether industrial tightens as the pipeline contracts further.

“With Wednesday’s double (positive) whammy of a benign CPI number and the likelihood of a U.S.-China trade deal, we expect some of the recent uncertainty to retreat and for a rebound in activity to pick up in the second half of 2025,” noted Clancy. “This isn’t a market for optimism—it’s a market for precision, meaning that capital is still moving, but it’s only chasing conviction.”

We’ll be tracking the signals. To get this analysis every month—complete with exclusive data and commentary—subscribe to Insights and get the next edition delivered directly to your inbox.