Getting zoning conformance right is crucial to keeping deals on track.

- Zoning regulations allow local governments to control growth and development and establish what can or cannot be built or rebuilt on a parcel of land.

- Conformance problems may affect the loan process and can be time-consuming and costly to resolve.

- A detailed zoning report can help real estate professionals anticipate problems with building, rebuilding, or selling a property.

A recent LightBox webinar, “PZR Reports® to Close Deals and Make Smarter Business Decisions“, looked at the role of zoning in commercial real estate property transactions, the impact of zoning conformance on the property loan process, the importance of zoning endorsement law, and how ordinance insurance coverage can mitigate risk in a transaction.

PZR reports help real estate professionals understand these issues and more. The reports review complex zoning regulations and property conditions to find the information title companies, underwriters, lenders, brokers, attorneys, and real estate developers need to close deals.

Six key areas to consider when dealing with Property Zoning

No. 1: Legally non-conforming sites typically benefit from rebuildability provisions

Three key terms relate to zoning conformance status: Legal conforming, which is an existing development lawfully constructed that meets the current code standards; legally non-conforming, which is an existing development lawfully constructed of which some aspect does not conform to code standards; and non-conforming or non-complying, which is an existing development that has deficiencies that aren’t legally permitted.

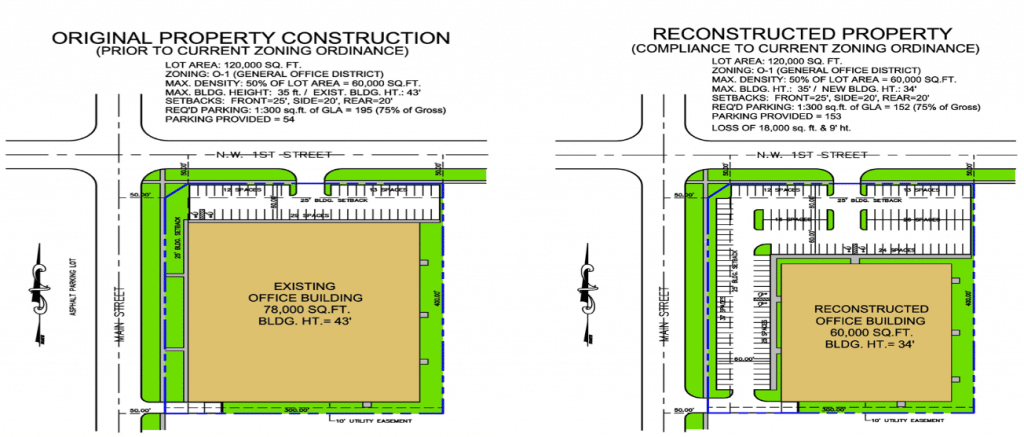

How these zoning provisions affect a property can significantly change its outlook. In this example, a 43-foot-tall, 78,000-square-foot office building on a 120,000-square-foot parcel was initially required to provide 54 parking spaces. However, because of new zoning ordinances and code requirements, a developer couldn’t rebuild the property the same way. Under current code standards, the structure would be much smaller, with floor area reduced by about 18,000 square feet. The building height would be nine feet less than initially constructed, and the property would require 99 more parking spaces. This would impact the necessary zoning endorsements, and the amount of law and ordinance coverage needed might affect the loan terms.

No. 2: Parking issues may classify a property as non-conforming and kill a deal

In this instance, a Michigan resort hotel property has a nonconforming, noncomplying parking issue. The resort was approved with parking to be constructed on an adjoining lot owned by the hotel. However, it never built the spaces, and the city never noticed. The property received the correct certificate of occupancy, and the subsequent owner later sold the land, including what was supposed to be available for parking. This is a possible deal killer. There’s no simple solution if the property is damaged or destroyed, and there’s no way to provide the missing parking. Situations like this can delay the closing of almost any type of loan.

No. 3: Unpermitted changes in entitlements that require approvals from the city will delay a loan closing

This assisted living center in Arizona is an example of a nonconforming, noncomplying property. It was originally approved for 85 beds, and the city issued the certificate of occupancy accordingly. However, today, the property operates 95 beds. The conversion of extra space was never approved, and there was no evidence of entitlements or variances permitting the additional beds. This would pose a problem should the property ever need to be rebuilt because there would be no simple way to replace the ten additional beds. Obtaining property permits from the city would be costly and time-consuming and could delay the closure of a loan.

No. 4: It’s essential to understand the impact zoning compliance has on a property

Zoning compliance is related to genuine property reviews and establishing and obtaining proper zoning endorsements. But it’s crucial when closing a deal to understand the impact zoning compliance has on property. Jurisdiction code provisions also come into play for properties in the event of a partial and or total loss due to a natural disaster. Extended ordinance coverage, which is a rider to the casualty policy, can help mitigate the cost of reconstruction and bring the site into compliance with current standards. Understanding compliance and the permitted rebuild language will help determine whether single coverage is sufficient or whether expanded coverage is necessary.

No. 5: Conditions pre-dating current zoning code requirements usually do not require an owner to take any action

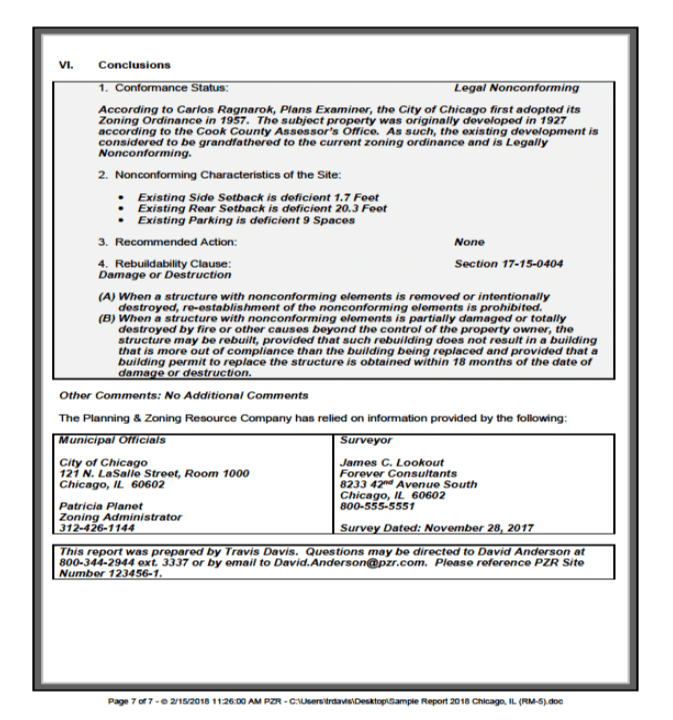

Nonconforming characteristics may not appear to be as problematic as they seem. A PZR Report® summary of zoning and site requirements for an apartment complex in Chicago indicates the existing side setback, rear setback, and parking are deficient to current code requirements. However, the owner doesn’t need to take any action to bring the site into compliance with current codes because the site was approved and constructed according to previous code requirements and the deficiencies to current code were not a result of actions taken by the owner. The city recognizes that all this predates the code, and the owner has the right to rebuild were the property to be damaged or destroyed. It’s essentially a pre-existing condition. In cases such as this, cities will typically establish a damage threshold which requires compliance with current code requirements during rebuild when the threshold is exceeded.

No. 6: It’s common to see rebuild provisions that require compliance to current codes when a property is damaged beyond the 50 percent threshold

Often, we’ll see rebuild provisions that indicate if a property is damaged beyond the fifty percent threshold of replacement value. It can only be rebuilt to current code, which could significantly impact the property’s value and the loan. The owner may need new endorsements and insurance policies to cover new risks.

LightBox PZR is the oldest zoning company and advisory firm in the U.S. and has been established as the gold standard in the zoning due diligence industry. Our only business is providing reliable site zoning analysis and compliance reviews, so we are uniquely positioned to help you navigate the challenges of zoning conformance and due diligence.

PZR® has deep ties to 99 percent of municipalities in the U.S. and can quickly provide information needed by title companies that is consistent and reliable in format and facilitates the issuance of zoning endorsements. Watch our latest webinar for more information about how PZR can help you close deals and make smarter business decisions or contact your representative to learn more.