At the close of each quarter, LightBox’s Environmental Due Diligence Market Advisory Council, a broad-based cross section of leaders from consulting firms across the U.S., share their insights from the field on key market developments, business challenges, client sentiment, and expectations. In the first of this two-part series, we share where council members are seeing growing demand for Phase I environmental site assessments (ESA) and what it means for the near-term forecast. In part two, council members share their top business challenges as the market slowly emerges from the downturn of the past few years.

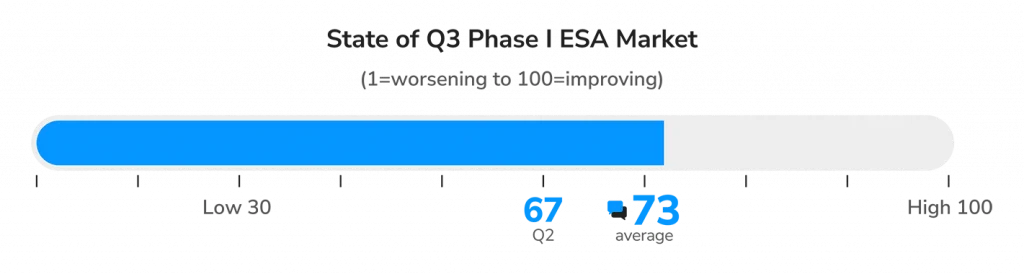

In the latest quarterly survey, Market Advisory Council members assessed Phase I ESA market conditions at an average score of 73 on a scale from 1 (worsening) to 100 (improving)—a 6-point improvement over 67 in the previous survey. It is worth noting that there was a wide range in responses from a low of 30 to a high of 100. This disparity reflects how different client sectors are performing at this early stage of the CRE market’s recovery as well as varied sensitivities to interest rates.

Strong-Growth Sectors for Phase I ESAs

Asked where they are seeing emerging opportunities, council members’ responses reflect the wide disparity across markets for Phase I ESAs.

- Agency lending (Fannie, Freddie, HUD)

- Slowly increasing refinance work as lenders address loan maturities

- Private equity investment

- Lending from non-bank lenders, insurance companies, and credit unions

- Portfolio work related to refinancing

- Mezzanine and bridge lenders

- Strong growth on M&A projects

- Infrastructure investment

- Federally-funded brownfield projects

- Renewable energy projects

- Dramatic increase in work to support data centers due to rapid AI adoption

Private Investors Fuel Demand for Phase I ESA Work

With many large lending institutions curbing originations out of concerns about elevated CRE risk concentrations, consultants are seeing smaller lenders and well-capitalized buyers pick up the slack. Institutional investors like Blackstone, Investcorp, Nuveen, and others made recent headlines by closing deals of more than $100 million. At the other end of the spectrum, smaller property deals that appeal to private investors and real estate funds are surfacing that create opportunities for Phase I ESA work with a growing swell of opportunistic investors deploying capital as the market gradually improves. As the bid-ask gap narrows, new property investment from clients who were previously on the sidelines is beginning to pick up momentum. Several council members observed a dramatic increase in Q3 work from lenders and developers compared to previous quarters as they capitalized on new opportunities driven by new financing options or improved market conditions.

M&A Driving Q3 Demand

Other areas of growth in the past quarter include the continued strong momentum in environmental due diligence to support M&A activity, which is up year over year as companies look to grow market share and position themselves for long-term growth. From a strategy perspective, consultants are also reconnecting with clients who are gradually reinvigorating projects after the slow market period.

“We’ve been actively re-engaging with our existing clients, including those we have not heard from as much during the market’s more difficult periods. Many are now exploring ways to move forward, and this re-engagement has been key to opening new doors for growth. In addition to capitalizing on the strong momentum in M&A over the past two quarters, we’ve seen continuing opportunities in the renewable energy sector. Unlike other parts of the market, renewables have remained resilient amid volatility, providing a steady pipeline of projects throughout the year. This sector’s stability makes it an attractive area for continued development moving into the near term.”

– Brian Wilson, Managing Principal, August Mack

Data Centers and Small-Box Retail Outpacing Many Sectors

In terms of specific asset classes, council members mentioned data centers and small box retail as sectors with strong drivers, as well as demand for solar/renewable energy projects. Geographically, council members report strong demand in the Sunbelt and secondary urban centers more than large metropolitan markets.

“The demand for data centers to accommodate data storage associated with the proliferation of AI has increased dramatically and I think it will continue to do so. Developing data centers is complicated and nuanced from an environmental, permitting, energy and structural perspective. The need for a full-service experienced consultant that understands these complexities will be paramount.”

– Kathryn Peacock, Principal, Partner Engineering & Science, Inc.

Guarded Optimism for a Strong Year-End

The first interest rate cut had a noticeable impact on overall CRE market sentiment with the latest round of surveys conducted by organizations like NAIOP, CREFC, and SIOR all pointing to renewed optimism. September’s strong transactions volume continued through October, so it’s not surprising that a significant 58% of CRE Market Advisory Council members expect to see higher Phase I ESA demand in Q4 compared to Q3, driven by capital market tailwinds boosting stronger CRE and M&A transactions. Another 42% expect stable volume, and notably, no member is expecting a decline.

Members report clients that are notably less cautious with the beginning of the Fed easing cycle and demonstrating renewed interest in expansion and development projects, as well as an urgency to close deals by the end of the year.

Expectations for Phase I ESA Demand in Q4 2024

As the market adjusts to the new declining interest rate environment, recovery across Phase I ESA markets will not be uniform and will vary by client type, geographic region, and sector. Phase I ESA professionals can take solace in the fact that market is more optimistic than it has been in years and that Q3 set the stage for the pool of investors to expand with stronger transaction and lending velocity to follow along with greater access to capital as the widespread transfer of CRE assets and property redevelopment gets underway.

LightBox 2024-2025 Environmental Due Diligence Market Advisory Council

Chuck Merritt

President/LEED AP

Merritt Environmental

Consulting Corp

Steven McNeil

Chief Strategy Officer

Blew & Associates Inc.

Kathryn Peacock

Principal

Partner Engineering

& Science, Inc.

Brad Wolf

Executive Director of

Environmental Services

Principal, BL Companies

Ben Bremer

President, LCS

Dana J. Wagner

Vice President/National

Director | Due Diligence

Services, Terracon

Adam Bennett

Senior Vice President

AEI Consultants

Kevin Karr

National Practice Leader

Environmental Site

Assessment, CBRE

Brian Wilson

Managing Principal

August Mack

Nolan Previte

President and CEO

EBI Consulting

Adam R. Meurer

Senior VP, Director of

Environmental Services,

ECS Mid-Atlantic, LLC

Jennifer Ewing

Senior Project Manager

Civil & Environmental

Consultants, Inc.