LightBox used commercial real estate data to profile Atlanta, Georgia as the host city of CREW’s Network Convention.

Atlanta, Georgia, long known as the hub of the South, is a transportation, distribution, and cultural center, which may account for one of its nicknames “the New York of the South.” The city houses the world’s busiest airport Hartsfield-Jackson, which has retained that title for 23 of the last 24 years. With nearly 93.7 million passengers, it’s no surprise the city is host to a wide range of entertainment and sporting events. Taylor Swift’s highly publicized “The Eras Tour” stopped in Atlanta at the Mercedes Benz Stadium for three nights in April 2023.

In the commercial real estate (CRE) industry, Atlanta is set to host several leading organizational meetings and conventions this fall including NAR (National Association of REALTORS®), CCIM Institute (Certified Commercial Investment Member) and CREW (Commercial Real Estate Women) Network. The week of September 20-22, more than 1,400 industry professionals from around the world are headed to the CREW Network Convention at the Hyatt Regency in downtown Atlanta for its annual event.

As the 2023 Technology Program Partner for CREW Network, LightBox profiled Atlanta from a location and data lens across its brokerage, investment, lending, appraisal, and environmental due diligence sectors.

By the numbers, Atlanta continues to be a healthy, vibrant market for commercial real estate investment and development.

Atlanta — a city positioned for growth

Atlanta is on the radar for commercial real estate investors and is widely viewed as an attractive metro area to place capital for long-term growth.

- 3rd in the U.S. for overall real estate prospects – jumping five spots since last year

- The 5th largest market for CRE in H1 2023 – totaling $4.96B in deal volume (MSCI)

- One of the 10 hottest data center markets in North America

- A top hub for emerging life sciences development

- The 7th most active market for Phase I ESAs (environmental site assessments) in H1 2023 – over 2,200 properties assessed

Commercial Real Estate data to watch in Atlanta

Despite Atlanta’s top market advantages, CRE market participants will be watching data trends resulting from economic headwinds. LightBox took a bird’s eye view within a 5-mile radius of downtown Atlanta and examined key data points from LightBox VisionSM, LightBox’s comprehensive mapping and research platform, to highlight how the metro may be impacted by upcoming loan maturities, as well as recent commercial sales activity.

- Over 400 commercial real estate loans are coming due in the next 12 months

- More than 375 commercial properties totaling 6.2 million square feet sold in last 12 months

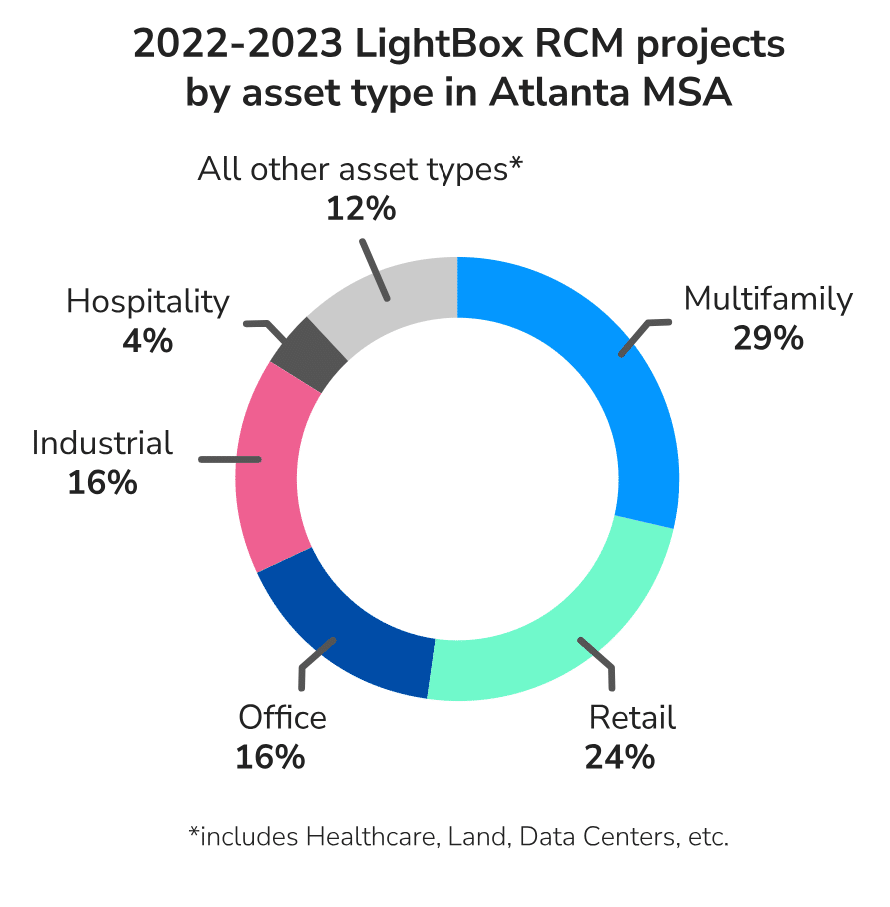

From the LightBox RCM, a commercial real estate marketplace-platform, the Atlanta MSA (metropolitan statistical area) is one of the top 10 markets in the U.S. based on the number of property listings, ranking ninth. While transactions are down compared to last year, LightBox data identifies potential market opportunities across different property types.

Top 5 asset types listed in RCM®

- Multifamily

- Retail

- Office

- Industrial

- Hospitality

Top 5 asset types based on

investor criteria:

- Land

- Multifamily

- Office

- Industrial

- Retail

CRE participants: Looking for the right opportunities

Strong market fundamentals in Atlanta are drawing attention from lenders and investors, particularly notable given the current market slowdown. Collectively in 2022-2023, interest in the Atlanta MSA has remained strong with more than 35,000 NDAs (Non-Disclosure Agreements) executed with the RCM platform. This is a key indicator that buyers are conducting preliminary due diligence as they consider acquiring CRE properties. RCM’s proprietary investor database consists of 84,000 qualified and targeted buyers; based on acquisition criteria, there are over 20,000 buyers interested in the Atlanta MSA.

| CRE Lender-Driven Appraisal trends | % Change |

|---|---|

| $ Appraisal fees awarded | -44% |

| # of Awards | -30% |

Commercial real estate lenders are tightening the reins on debt capital, asking more questions, and shying away from loans with high-risk profiles, according to Dianne Crocker, principal analyst, LightBox. The 30% YTD decline in lender-driven appraisals in metro-Atlanta is consistent with the industry’s overall slowdown and significantly below the Mortgage Bankers Association’s (MBA) latest data showing a 53% year-over-year decline in commercial property lending in the U.S.

CRE market participants are navigating a great deal of uncertainty right now and investors are looking for the most compelling opportunities for ROI as they move capital back into play. Atlanta will continue to rank high on the list of strongest investment prospects for asset types such as data centers and life sciences given its strong population growth, research centers/universities, and access to a growing workforce of tech talent.

For a deeper dive on Atlanta, its market advantage and top concerns – download the LightBox Atlanta Location Data Sheet.