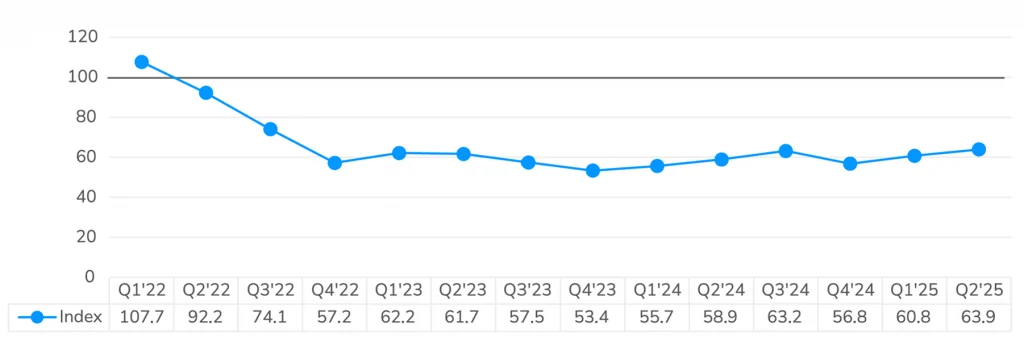

At the midpoint of 2025, the commercial real estate (CRE) appraisal landscape remains remarkably resilient even as market participants navigate volatile macroeconomic terrain, tighter underwriting, and global policy headwinds. The LightBox Appraisal Index rose for the second straight quarter to reach 63.9 in Q2, its highest level since Q3 2022, signaling continued strength in lender-driven activity even amid rising caution.

Key Q2 2025 Developments from the Appraisal Snapshot Report:

- Appraisal volume hit $62.2M, a 6% increase over Q1 and up 14% year-over-year, driven by modest growth in new CRE loan originations and refinancing activity.

- Average appraisal fee per project climbed to $3,437—up 1% QoQ and 7% YoY, marking the third consecutive quarterly increase.

- Turnaround time improved slightly to 14.1 business days from 14.4 in Q1, continuing a downward trend from the 18-day peak in early 2022.

- Retail and industrial properties made up the largest share of appraisal volume at 42.1%, followed by office (15.8%) and multifamily (15.6%).

- Market sentiment remains mixed: 39% of appraisers say they are “somewhat more optimistic” about the outlook, while 29% are “slightly more pessimistic”.

Appraisal Activity Index and Volume Trends

The LightBox Appraisal Activity Index continues its upward trajectory, rising 5% quarter-over-quarter and 9% year-over-year. The index now sits at 63.9, its highest since late 2022, and a sign that CRE underwriting pipelines remain active.

Q2 began with strength and appraisal volume surging 11% in April versus March. April stood out as the busiest month, highlighting how quickly volume can react to shifting economic signals.

With lender focus tightening and rates still elevated, it remains to be seen if the early Q2 momentum will hold through H2 2025. Activity has already softened in May and June, falling 3% and 12% respectively. This uneven pattern reflects lenders’ increasing caution in response to a new trade war, fluctuating Treasury yields, and macro uncertainty.

The fundamentals, however, remain intact. CRE loan balances are still growing, and lenders, particularly banks, CMBS shops, and debt funds, are staying in the game, albeit with tighter standards and longer deal cycles.

LightBox Appraisals Index (Base Q1 2021=100)

Market Outlook: Is CRE Pricing at an Inflection Point?

A striking 55% of appraisers surveyed by LightBox disagreed that CRE prices have bottomed or that the bid-ask gap has narrowed. The price discovery process continues, especially in transitional asset types like office and retail.

Meanwhile, the LightBox June CRE Activity Index reading of 113.9 marked the highest level since May 2022, suggesting that deal flow remains steady despite broader hesitance.

The Q2 data paints a picture of a CRE market that is cautiously pressing ahead. Appraisal activity continues, but lenders are applying more rigorous filters. The standout theme of 2025 so far: resilient capital but increasingly selective deployment.

According to survey responses, the most anticipated trigger for market acceleration is a potential Fed rate cut. If it materializes, possibly as early as Q3, it could open the floodgates for sidelined capital and boost valuation pipelines heading into 2026.

As one appraiser succinctly noted, “It is so hard to act with certainty under conditions of such uncertainty.” That sentiment captures the tightrope that lenders, appraisers, and investors are walking in today’s CRE landscape.

The LightBox CRE Market Snapshot Series, Q2 2025—Focus on Lender-Driven Appraisal Trends—presents data from more than 1,200 banks and credit unions across the United States and reflects industry benchmarks specific to lender-driven commercial property appraisal activity. The data are derived from LightBox applications Collateral360 and RIMS, which are used by financial institutions to manage and procure appraisals in support of property lending activity. The LightBox CRE Activity Index combines appraisal activity with environmental site assessments from LightBox EDR and property listings in LightBox RCM to create a composite of CRE transaction activity.

For more information about this report series or the data, email Insights@LightBoxRE.com