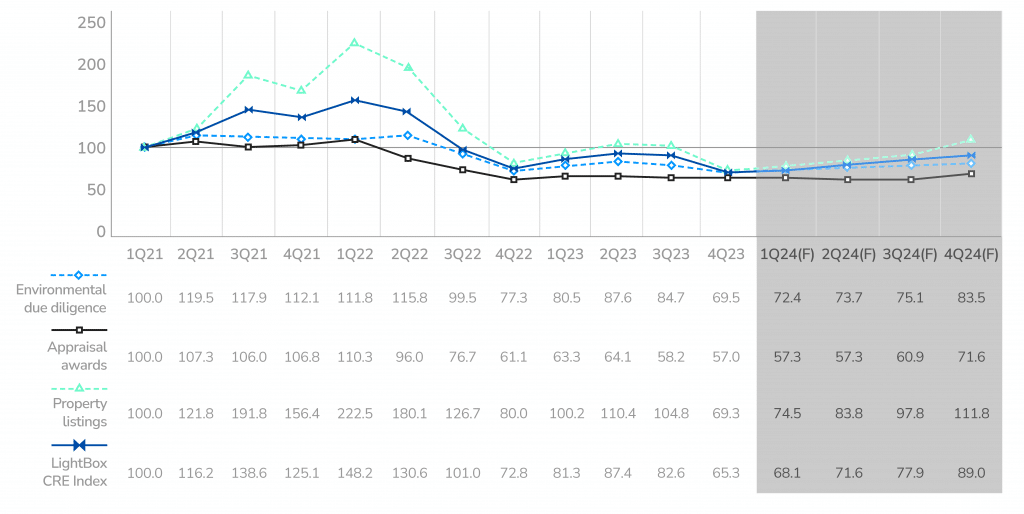

LightBox Activity Index Shows Momentum in H2 2024 After Drop in Q4 2023

The quarterly LightBox CRE Activity Index presents a unique look into today’s uncertain market with a focus on three leading barometers across the industry. Collectively, the Index tracks activity on three elements that support commercial property dealmaking:

- property listings on the LightBox RCM platform used by brokers and investors;

- environmental due diligence activity from the LightBox EDR ScoreKeeper model; and

- appraisal volume from the C360/RIMS platform used by financial institutions and credit unions.

After reaching a high-water mark in Q1 2022 on the heels of the historic levels of lending and investment in 2021, the index (anchored by a Q1 2021 baseline) tracks the dramatic impact that the first round of rising interest rates had on the market. Sellers took to the sidelines for much of 2022, reluctant to list properties for sale as the Fed implemented the first round of rate hikes. With transactions falling and lenders pulling in the reins on loan originations, demand for environmental due diligence and appraisal services fell.

LightBox CRE Activity Index (base Q1 2021=100)

Early 2023 brought less aggressive interest rate hikes, but the market remained on pause due to a wide pricing gap that developed between buyers and sellers, the challenges of securing debt capital and widespread uncertainty about where interest rates would land. The forecasts calling for a busier second half of 2023 failed to pan out and the Fed’s policy of keeping interest rates higher for longer kept any significant rebound in lending and investment at bay. By year-end, the Index was at its lowest level in three years, consistent with dealmaking volume that was 30 to 40% below 2022. (It is worth noting that Q4 listings activity reflects the seasonal slowness that typically characterizes the last quarter of the year).

CRE Challenges: Inventory, Pricing, Reuse

The main challenge of LightBox’s broker clients is the lack of inventory, as evidenced by the index’s declines in the last two quarters of 2023. Investor clients are waiting for their time to pounce as pricing resets are still ongoing, although the pace of decline is moderating in many asset classes. For appraisers, the main challenge is the difficulty in accurately pricing properties in a low-transaction market with limited comps data. Environmental due diligence consultants are positioning themselves to support any rebound in lending this year, as well as adaptive reuse projects as the commercial real estate industry adjusts to shifts in demand for property use post-pandemic, particularly in the office and retail sectors. Top of mind across all sectors is the reality that the commercial real estate industry will be forced to deal with the challenges of the significant loan maturities coming due this year at markedly higher interest rates.

Impact of Fed Rate Policy

Although the Fed’s December statement opening the door to interest rate cuts this year came as welcome news across the board, those hoping for cuts to begin after the next meeting in March could be disappointed based on comments Chairman Powell just made after their January meeting: “I don’t think it’s likely the committee will reach a level of confidence by the time of the March meeting to start cutting rates.” The good news is that the latest data indicates that inflation continues to ease but remains elevated, so the Fed is going to be circumspect about cutting rates too early.

FORECAST: Busier H2 2024 As Capital Prepares to Pounce When Fed Cuts Rates

Based on the latest market data and other intelligence from the field, momentum is starting to build. Several rate cuts by the Fed between late April and July would add to the building momentum for a rebound in the second half of 2024. The near-term forecast will likely deliver early signs of a moderate uptick in property listings leading into the second half of the year, and the capital that has mobilized to take advantage of the expected new wave of investment opportunities will move into play. Demand for environmental due diligence and appraisals will follow in support of new transactions. The forecast scenario, which assumes no significant market upsets like an escalation in geopolitical risk, is not without its tailwinds. For instance, the forecast accounts for a possible, short- lived Q3 pause as typically happens in advance of a presidential election.

It is also worth noting a few recent market developments impacting the near-term forecast:

- Yields on Treasury bonds have fallen sharply over the last 90 days with the yield on the 10-year down more than 100 basis points since early November. The impact on the dealmaking climate is that it should allow more acquisitions to “pencil out” thanks to lower rates. It should make refinancing less daunting to borrowers than it was three months ago.

- Risk premiums have compressed considerably during that same period. Lending spreads up and down the credit curve have tightened sharply since the fall, putting additional downward pressure on lending rates. This, too, will allow more deals and refinancings to pencil out.

- The war chest of cash available to deploy has continued to increase, and the pressure to put that cash to work on buying performing assets or distressed assets is building.

- In some of the most distressed markets (i.e., San Francisco, Chicago, and Baltimore office markets), sales have started to trickle through. These sales – albeit at extremely disappointing levels – are important benchmarks for the markets. Once distressed market sales begin and price discovery takes place, the markets become positioned for another wave of transactions. Bottoms are forming in many markets which should lend optimism to a forecast of higher transactions in H2 2024.

The Q1 2024 LightBox CRE Activity Index forecast will be released in April, and adjusted for any market developments that warrant any change in assumptions.

About the LightBox CRE Activity Index

The LightBox CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. The Index report is part of a series of quarterly LightBox market snapshot reports. To receive LightBox reports, subscribe to Insights.