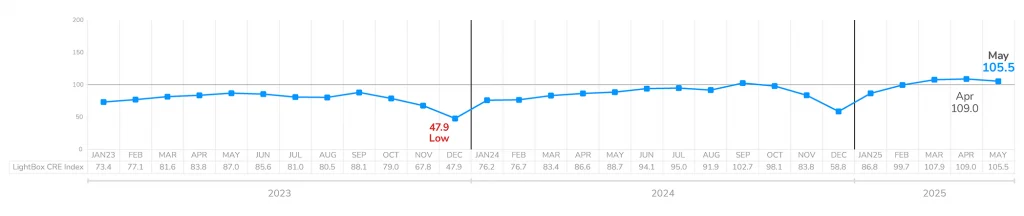

The LightBox CRE Activity Index declined slightly in May to 105.5 from 109 in April, which is the first monthly drop in 2025 and a clear signal that the commercial real estate market’s strong early-year momentum may be losing steam. While the Index remains historically elevated—still 22% higher than one year ago—the retreat from April’s reading marks a gradual deceleration.

May’s modest pullback follows several months of strong activity and may represent the first tangible impact of newly announced tariffs, which are injecting a fresh wave of uncertainty into CRE dealmaking.

Index Still Over 100, But Declines for First Time This Year

The CRE Activity Index is based on May’s average daily volume in each of the three functions that support CRE lending and investment:

- Lender-driven commercial appraisal awards fell by a significant 19% below April levels—the first month-on-month decline since December and 12% below one year ago, reflective of lenders pulling back from the strong momentum of the first four months of the year.

- The average daily flow of commercial property listings increased 1% compared to April but a more significant 47% from last May when sellers were reluctant to bring commercial properties to the selling block until prices stabilized.

- The volume of Phase I environmental site assessments, an early indicator of CRE lending and investment volume, was flat in May for the second consecutive month but 7% higher than last May.

Monthly LightBox CRE Activity Index (January 2021 – Present)

Manus Clancy

Head of Data Strategy

LightBox

“After a fast start to the year, May’s Index confirms that the market is starting to tap the brakes. The investment community isn’t retreating, but it is recalibrating. Lenders are becoming more selective, and underwriting timelines are stretching out as everyone reassesses risk.”

FORECAST: Was May an Emerging Trend or a Short-Lived Pause?

The key question now is whether May’s modest pullback marks the start of a broader downward trend or merely a temporary pause in an otherwise resilient recovery. While still in the triple digits, the LightBox CRE Activity Index’s modest month-over-month dip reveals how tariff-driven uncertainty is beginning to weigh on dealmaking. Encouragingly, May saw a steady influx of new listings and continued interest from a diverse pool of buyers pursuing solid investment opportunities across asset types and regions. Underwriting activity remains steady, though market feedback points to more conservative strategies amid mounting macroeconomic risks. The market is still advancing, just not at the brisk pace seen earlier this year.

As midyear approaches, the trajectory of the Index will depend on how investors and lenders respond to a widening field of unknowns. In the meantime, underwriting assumptions must grapple with persistent uncertainty around interest rates, construction costs, asset pricing, tenant demand, and operating expenses.

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.