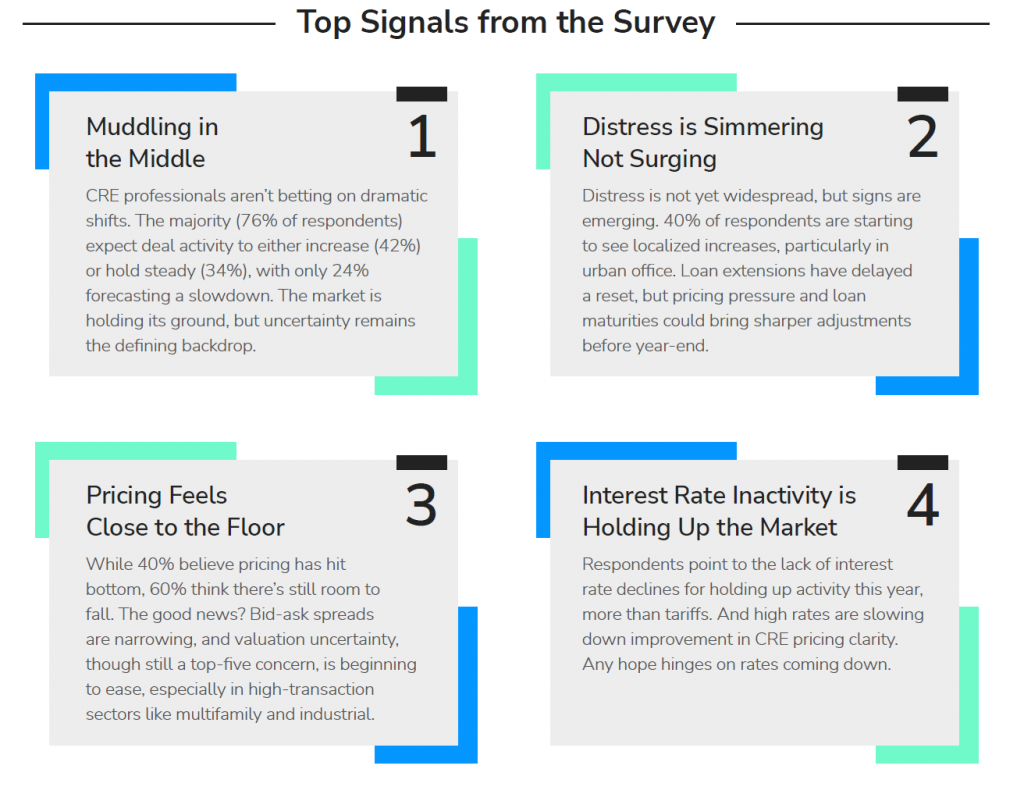

According to the LightBox Mid-Year 2025 CRE Market Sentiment Survey, conducted mid-July, the industry is preparing for a busier second half with uncertainty around interest rates and tariff policy weighing heavily on decision-making. Based on responses from 237 professionals across investment, brokerage, appraisal, and environmental due diligence, the survey found that 76% expect deal activity to either increase (42%) or hold steady (34%) through the remainder of the year. Interest rates remain the top concern, followed by economic volatility and emerging tariff risks.

Despite ongoing volatility, the results reveal a common thread of guarded optimism. Many professionals are anticipating long-awaited interest rate relief, growing opportunities in the distressed asset space, and improved pricing clarity, all of which could stimulate deal activity. The majority of respondents expect deal volume to remain steady or increase over the next two quarters, a sign that the market is poised to soldier on through lingering economic headwinds.

“Despite a first half that didn’t quite play out as expected with growing uncertainty around interest rates and tariffs, our survey shows that the CRE market is gearing up for a more active second half,” said Dianne Crocker, research director at LightBox.

While CRE capital is still constrained, expectations for modest rate cuts and improving pricing clarity could support increased lending and investment activity heading into Q4. The survey showed that 69% of respondents agreed with a statement that the CRE market will continue to advance “soldier on” through the second half of the year, as long as deals pencil out. This is a strong sign from an industry bracing for ongoing uncertainty but still hopeful about pricing clarity, modest rate relief, and renewed lending momentum.