December’s CRE Transaction Flow Sets 2025’s High Water Mark

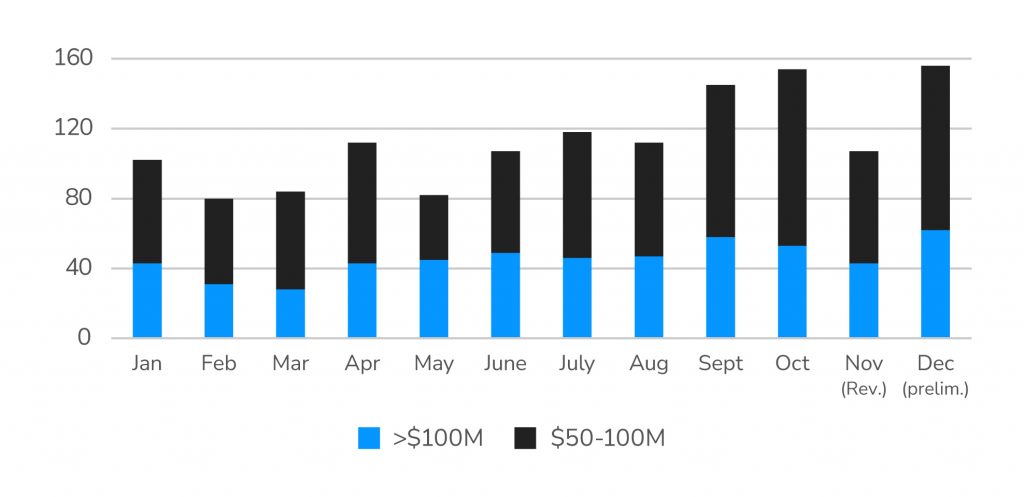

December dealmaking capped 2025 with a new high-water mark, reinforcing late-year momentum in CRE transactions even as macro uncertainty intensified. LightBox data shows 1,226 deals totaling $28.1 billion, surpassing October as the busiest month and rebounding from November’s holiday-shortened slowdown. Large transactions led the surge, with $100 million-plus deals up 44% month over month.

Signals inside the Transaction Tracker Report:

- Pricing divergence widened, separating quality assets from concentrated

distress. - Deal flow diversified, with activity spread evenly across major property types.

- Early-cycle indicators strengthened, suggesting improving transaction

readiness heading into 2026

Major Commercial Real Estate Deals (2025)

This strength persisted despite a softening labor market and growing geopolitical anxiety, underscoring investor conviction. As equity markets moved sideways and labor data continued to soften, CRE activity remained elevated through year-end, supported by deep buyer demand, disciplined capital deployment, and renewed lender participation, setting the stage for a strong start to 2026.

“I’m optimistic that ‘steady’ will be the operative word for the CRE market this year. While I don’t expect a melt-up in transaction velocity or pricing, I do see room for modest improvement on both fronts.”

– Manus Clancy, Head of Data Strategy, LightBox