Mid-Cap CRE Deals Surge to Highest Level of 2025

October continued the healthy stream of CRE deals with $34.6 billion in transactions, up 28% from September’s $27 billion in a signal of a strong start to Q4.

Inside the Transaction Tracker Report:

- Capital deployment picked up in October, pointing to renewed deal momentum as year-end approaches.

- 68% of repeat sales closed above prior values, with medical office emerging as the month’s surprise leader.

- October’s activity hints at how investor strategy is evolving heading into 2026.

LightBox’s Transaction Tracker logged nearly 1,100 U.S. closings, highlighting the breadth of deal activity across sectors and investor types.

Activity was broad-based, spanning multifamily, retail, and office, which together accounted for 65% of monthly volume. Institutional capital remained active across healthcare, data centers, and prime office assets, while mid-cap deals added to the month’s strong momentum.

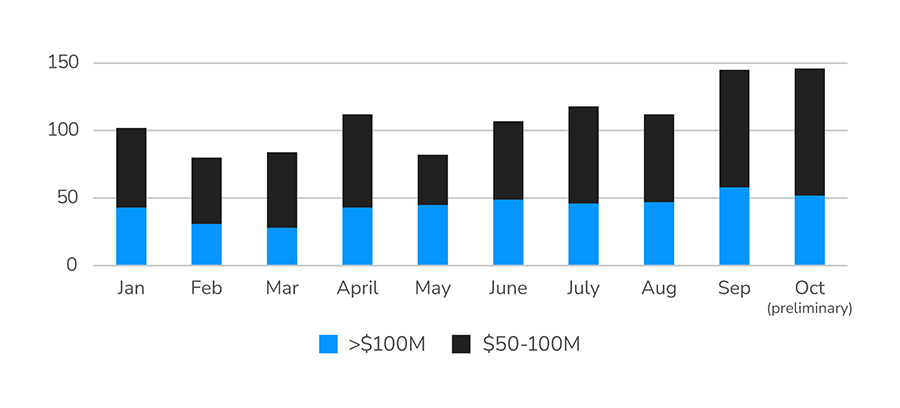

Major Commercial Real Estate Deals (YTD 2025)

“October’s widespread range of transactions gains point to a more balanced market environment. With activity picking up across multiple sectors, confidence among lenders and investors continues to build as the year winds down.”

– Manus Clancy, Head of Data Strategy, LightBox