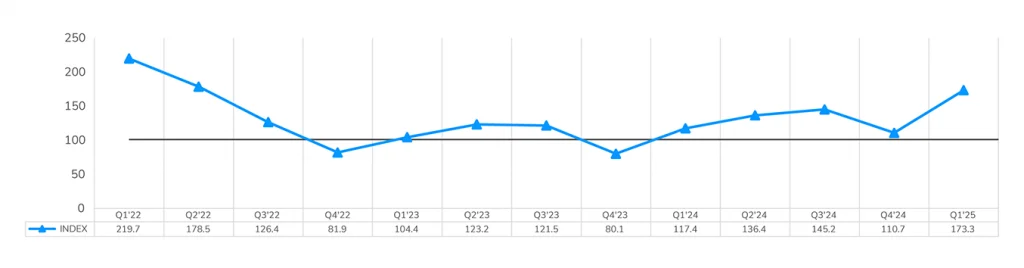

Q1 2025 opened with a surge in property listings—jumping to a three-year high—signaling renewed activity across the U.S. commercial real estate market. The LightBox Property Listings Index closed the quarter at 173.3, its highest level since Q2 2022 and a significant jump from 110.7 in Q4 2024. The early months of the year showed a clear acceleration: Listings in January more than doubled those in December, followed by month-over-month gains of 8% and 7% in February and March, respectively. Multifamily assets led the charge, accounting for a full one-third of all listings, with volume surging 132% from Q4. Retail properties made up 20% of listings, followed by industrial at 12%, indicating broad-based activity across asset classes. The robust listing activity reflected not only seller motivation but also buyer engagement across a diverse capital base, with major CRE transactions occurring nationwide.

Key Q1 2025 Developments:

- The LightBox Commercial Property Listings Index hit 173.3 in Q1, up 57% from a seasonally slow Q4 and 48% year-over-year, as seller confidence strengthened.

- Listings surged early in the quarter, more than doubling from December to January, with additional monthly gains of 8% in February and 7% in March.

- Year-over-year gains were significant: healthcare listings tripled, retail doubled, and land rose 77%.

- Listings for private capital deals (<$20M) have been steadily increasing over the past year, reaching 72% in Q1, up from 68% last quarter, with retail and multifamily making up 54% of that activity.

- On a scale from 1 to 100 (improving), the LightBox CRE Market Advisory Council scored Q1 market conditions at 60, down from 63 in Q4 and 67 in Q3, reflecting increased volatility and tariff-driven uncertainty.

LightBox Commercial Property Listings Index (base Q1 2021=100)

“In Q1, we saw steady improvement and an increasing appetite to transact. That momentum will certainly be tested as we head into Q2.”

– Bryan Doyle, Managing Director, Capital Markets, CBRE

Steady Momentum Meets Headwinds of Federal Policy Unknowns

Looking ahead, Q2 will be pivotal. Will the current momentum hold, or are we seeing the early signs of a deeper market slowdown? As the past few months have shown, the market can shift very quickly. While the CRE market continues to move forward, future policies can impact the forecast. Until more clarity emerges, CRE lending will be more selective, investment decisions more strategic, and tenant performance under closer scrutiny. The good news is that, despite growing uncertainty and signs of economic cooling, the CRE market continues to show resilience—and in some sectors, strength. Deals are getting done, loans are being underwritten, and refinancings are moving forward. CMBS issuance is gaining momentum, lenders are not retreating to the sidelines, and big-ticket deals across asset classes and geographies are still closing coast to coast.

What makes forecasting so challenging is not knowing the extent, scope, or duration of future tariffs which makes their economic impacts difficult to predict. There are countless ways that tariff policy could play out, and the impact across specific asset classes will be varied. Retail, for instance, relies on healthy consumer spending and low prices, so if tariffs increase the cost of goods like apparel, appliances and electronics and others, retail tenants could be adversely impacted. Owners of existing commercial property in some sectors like multifamily could benefit from higher tariffs that drive up construction costs and limit new supply. If sentiment grows more nervous and uncertain, competition for CRE assets could decrease and give well-capitalized opportunistic investors the upper hand. The next few months will be pivotal in confirming whether this is a temporary breather or the start of a more sustained slowdown. For now, the fundamentals suggest a CRE market that continues to advance but at a slower pace, not necessarily from a lack of interest but due to growing caution.

This analysis is part of the LightBox Quarterly CRE Market Snapshot Series, which provides insight into activities that support commercial property dealmaking. The data presented in the Focus on Capital Markets and Investments are derived from the activities of the LightBox RCM platform and used to calculate the LightBox Commercial Property Listings Index. LightBox RCM is the industry’s leading go-to-market listing platform that powers investment sales, as well as debt and equity deals. As a trusted CRE technology solution, LightBox RCM offers a global marketplace for buying and selling CRE and increases the speed, exposure, and security of deals through one streamlined online platform. Brokers can leverage integrated property marketing tools, transaction management and business intelligence.

For more information about this report series or the data, email Insights@LightBoxRE.com