In our continuing coverage from the LightBox Q4 Market Sentiment Survey, we delve into the leading concerns weighing heavily on the minds of the investor, broker, lender, appraiser, and environmental due diligence consultant respondents at year end—and how these concerns vary by industry segment.

- Chief Appraisers

- Field Appraisers

- Brokerage

- Investors

- Environmental due diligence consultants

- Lenders/Loan Officers

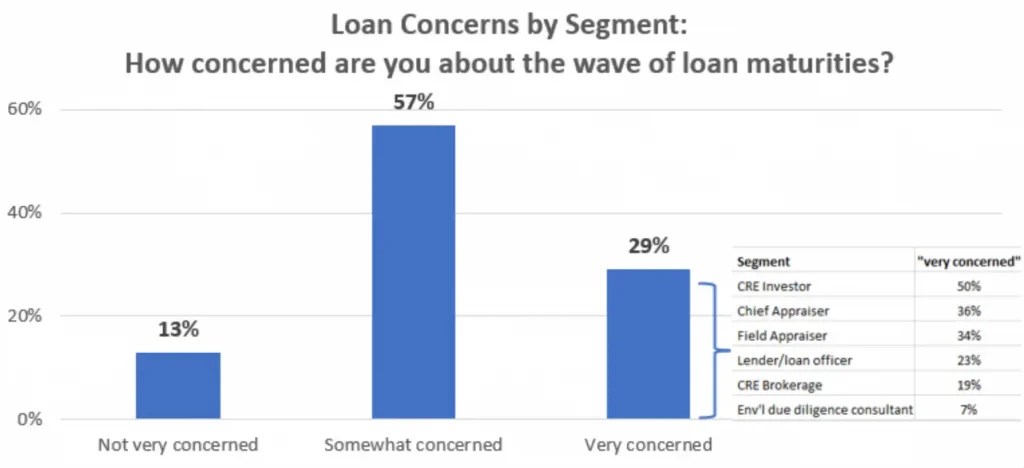

Asked how concerned they were about the upcoming wave of loan maturities, the majority (57%) are “somewhat concerned.” Nearly 30 percent of respondents are “very concerned,” but it is worth noting that the concern was more pronounced with CRE investors (50%), chief appraisers (36%) and field appraisers (34%).

In response to open-ended questions about market trends, concerns and predictions for the new year, respondents shared myriad opinions. The sections below summarize the three main concerns of each industry segment included in the Q4 survey:

Chief Appraisers: Lender Risk Management is Top of Mind

Top of mind for chief appraisers at financial institutions are concerns about the impact that higher rates and valuation uncertainty will have on assessing risk and refinancing loans under today’s challenging market conditions. In terms of the forecast, the consensus among chief appraisers was one of muted volumes in early 2024, then gradually picking up momentum only after the Fed begins to lower rates.

| TOP CONCERNS | IMPACT | RESPONDENTS’ VIEWPOINTS |

| Refi challenges under new market conditions | Borrowers will be challenged by higher rates, higher operating expenses, and requirements to need to bring more equity to renew loans. Could trigger defaults/foreclosures. | “If you have a $10M 20-year loan that originated at 4% and 1.25 DSCR, you’d have to pay down your loan 30% (or $3M) to renew at 8.5% with an 1.25 DCR if your net operating income stayed the same.” “I expect increase of maturity defaults through 2024, banks to increase portfolio monitoring likely leading towards a spike in appraisal work.” |

| Lack of clarity on property pricing | Low transaction volume challenges appraisals and updating LTVs for existing loans, as well as managing and monitoring CRE value risk across banks’ loan portfolios. | “Cap rate discovery is slow, but opportunity exists if we keep considering the cost of funds and buyer motivation.” “I expect cap rates to continue to increase for the next year, then leveling off towards the end of 2024.” |

| High interest rates | Higher cost of capital, negative impact on lending, competition among lenders | “Rates are too high to see much Q4 action. Borrowers will be searching out better rates than their new adjusted rates.” “Elevated interest rates will continue to create a squeeze on owners. I expect to see more stress in the system, and the “soft landing” will not be soft for the appraisal industry.” |

Field Appraisers: Positioned to Support Refi, Distressed Loans

For appraisers working in the field for lenders and investors, top concerns center around low lending volumes, competitive pressures, and the impact of higher rates on the market. The sentiment toward 2024 volume is that field appraisers will likely see an uptick in demand in the early quarters to support banks being forced to re-evaluate existing loans and their risk exposure under new market conditions, and that additional opportunities will surface throughout 2024 as distressed assets increase and price discovery comes into focus.

| TOP CONCERNS | IMPACT | RESPONDENTS’ VIEWPOINTS |

| High interest rates | Lower lending and transaction volume; challenges for properties acquired at market high that will struggle under higher rates, lower valuations | “Lots of distressed assets ahead as loans reset to current interest rates. Many loans not being able to be refinanced without equity and many borrowers don’t have equity to put in.” “Many current buyers are expecting to refinance in 24 months or so at rates significantly lower than today. The only opportunity is with cash buyers as others sit and wait.” |

| Liquidity crisis | Low lending levels | “Borrowers want to do deals, but banks do not want to lend.” “My lender clients are not making new loans, only focused on renewals. They are also beginning to request liquidation and similar values.” |

| Competitive challenges | Pressure on fee and turnaround time | “I expect continued low volume for opportunities with competitive bids on fees and turn time. I have been reading all year about loans maturing but we have not seen any related work.” “I am seeing stable demand for commercial appraisal work, but down 30% from record 2022 levels. I would the same levels next year unless unemployment goes over 5%.” |

Brokerage: Challenged by Lack of Inventory

Respondents from the commercial real estate brokerage segment, on the front lines of investment, are concerned about the impact of high rates on investors who are cautious and limited by higher cost of capital, the lack of property listings and distressed asset uncertainty.

Expectations seem to largely be for more of the same in the first half of 2024, with a possible uptick if interest rates begin to decline in late 2024 or early 2025. There is some guarded optimism by brokerage respondents who are bullish about opportunities that will surface as distress ramps up and properties with maturing debt that cannot stabilize at current interest rates come onto the selling block.

| TOP CONCERNS | IMPACT | RESPONDENTS’ VIEWPOINTS |

| High interest rates | Tighter lending, higher equity expectations, challenging leasing, limits opportunities to cash buyers | “This year has been very slow in sales. I expect it to be worse next year.” “The market will continue to decline through next year and into 2025 if the current or higher levels of financing rates continue.” “My team is focused on structuring sale leasebacks; an alternative liquidity solution for corporate occupiers. With that, we are bullish on our space given the expected increase in interest rates.” |

| Lack of inventory | Sellers reluctant to list properties in uncertain environment, lack of price discovery | “The office sector is dragging our overall market sentiment down.” “I want to see more properties available as I have buyers but nothing available on the market at this time.” |

| Distressed asset uncertainty | Forecasts have yet to materialize as borrowers/lender extend loans | “Our volume is down 35% year over year, and we don’t expect distressed opportunities to blossom for another 12 months.” “Floating rate owners will start to feel the pressure in Q1 and mitigate risk by selling property.” “Downturn will create incredible buying opportunities for value- add investors.” |

Investors: Waiting for Their Moment to Pounce

Among investor respondents, concern stemmed from an extremely cautious deal making environment. While early 2024 is expected to bring more caution due to market uncertainty and the upcoming election, investor respondents also expressed the hope that next year will bring a turning point as investors and lenders come to terms with the new reality of higher interest rates and the impact on lower property values. There was also a perceptible note of optimism as distressed assets are expected to move the needle and increase potential value-add investment opportunities.

| TOP CONCERNS | IMPACT | RESPONDENTS’ VIEWPOINTS |

| Market uncertainty | Disincentivizes investment | “Investors are playing the waiting game due to expected price reductions in many property types.” “Too much change too quickly has put many sectors of the market into a holding pattern.” “Current cap rates cannot be justified. The only transactions taking place are core (all cash) or buyers willing to absorb seller losses. Underwriting still includes exit caps that are way too low.” |

| Distress | Mix of concern about financial impact on owners/lenders, emerging opportunity after low-volume 2023 | “We expect to see lots of opportunity for assumable mortgages next year.” “Cap rates must expand significantly for markets to normalize. This will cause a wave of distress and defaults over the next 36 months.” “In 2024, lenders will become impatient and finally start pushing non-performing loans/properties off their books.” |

| Price uncertainty | Low transactions contributed to a lack of clarity, high bid ask gap | “In 2024, pricing on assets will finally start to reset to reflect the high interest rates, high construction costs, and the increased operating costs.” “As prices find a new equilibrium, investors who have been patiently waiting on the sidelines will finally get their moment to pounce.” |

Environmental due diligence consultants: More of the same in 2024

The collective sentiment on the near-term forecast among environmental professionals who responded to the survey is for slow and steady business volume in the first half of 2024 with the possibility of higher volumes later in the year if market uncertainty dissipates. Environmental due diligence consultants are positioning themselves to support adaptive reuse projects as the commercial real estate industry adjusts to shifts in demand for property use. The uncertainty of the upcoming presidential election was raised by respondents in this segment of the industry more than the others who participated in the Q4 survey.

| TOP CONCERNS | IMPACT | RESPONDENTS’ VIEWPOINTS |

| Market uncertainty | Low lending and investment volume compared to high-volume 2021 and 2022 | “Concerns include the ever-present possibility of unpredictability negatively affecting the market.” “We are investing heavily in business development and marketing.” “With high rates, CRE investments need to be significantly more attractive to be worthwhile than they did 2 years ago. With an ever-growing population and finite amount of land, I see multifamily development as a growing necessity, especially in major coastal MSAs.” “I’m not optimistic. It appears that hardly any transactions are happening, even with cash buyers. On top of that, we’re facing pricing pressure on due diligence projects even though everything related to travel costs more.” “Expectation is that early to mid-2024 to pick up due to loan maturities.” |

| Distressed assets | Challenges lenders’ balance sheets, raises likelihood of foreclosures and bank losses | “Office property loan maturities are a huge concern as the ROI is still significantly down, and banks are not going to be able to work out deals on dealing with distressed assets. I expect to see more small and mid-size banks go under that are overextended on office property loans. This will likely result in work through FDIC once those institutions go under.” “I am concerned that we’ll see more foreclosures as the recession continues and/or deepens.” |

| Presidential election | Added uncertainty of a major election could negatively impact an already sluggish market | “In an election year, it is typical that some activity will take place in Q1 and Q2 and then significantly slow until the results of the election are determined.” “Election years are notoriously flat. I expect things to turn around in the commercial real estate market drastically in 2025.” “Election signals to me that folks will be holding the eggs in their basket a bit closer. That…and the two wars going on right now.” |

Lenders/Loan Officers:

Not surprisingly, lender respondents are concerned about the impact that higher interest rates will have on borrowers’ ability to refinance maturing loans, property values and ultimately, banks’ risk exposure from commercial real estate lending. Most respondents are not expecting 2024 to be dramatically different from this year with one noting: “I expect things to remain as they are – not as strong as prior years but not disastrous.”

| TOP CONCERNS | IMPACT | RESPONDENTS’ VIEWPOINTS |

| High interest rates | Downward pressure on property values, DSCRs and demand for CRE | “My guess is that this will take a few years to work itself out. I don’t see a soft landing.” “High rates are keeping investors on the sidelines for at least the next 12+ months.” “Rates will hold steady where they are currently through most if not all of 2024.” |

| Distressed/non-performing loans | Loans originated at lower interest rates will struggle to refi | “Bridge loans from 2021/2022 that had no rate caps anticipated are worrisome.” “The increase in rates with loans maturing or having rate adjustments will increase distressed loans.” “There’s going to be a ton of fortunes made over the next 3-5 years, but they will come on the backs of massive loss.” |

| Market uncertainty | Lack of clarity impacts lenders’ ability to assess borrowers’ cash flow, assess at-risk loan exposure assessments | “As a banker, I have significant concerns regarding properties meeting cash flow expectations once loans are repriced in this higher rate environment. I anticipate the market value of some CRE sectors will decrease due to present cap rates.” “My hope is that we will see the beginning of a basis reset across most asset types. Investors must come to terms with the fact that they have lost a very meaningful amount of their equity and we need to see transactions at new pricing really pick up.” |

**

Across all segments, respondents expect continued headwinds as the market digests higher interest rates, loan maturities and more clarity on property pricing. Also top of mind is the impact of the upcoming election and geopolitical conflicts. The timing of how 2024 plays out will depend largely on when the Fed stabilizes, then starts to lower, interest rates.

Subscribe to LightBox Insights to receive reports and analysis.