After a Modest October Dip Amid Shutdown, CRE Activity Remains on Track for a Solid Finish to 2025

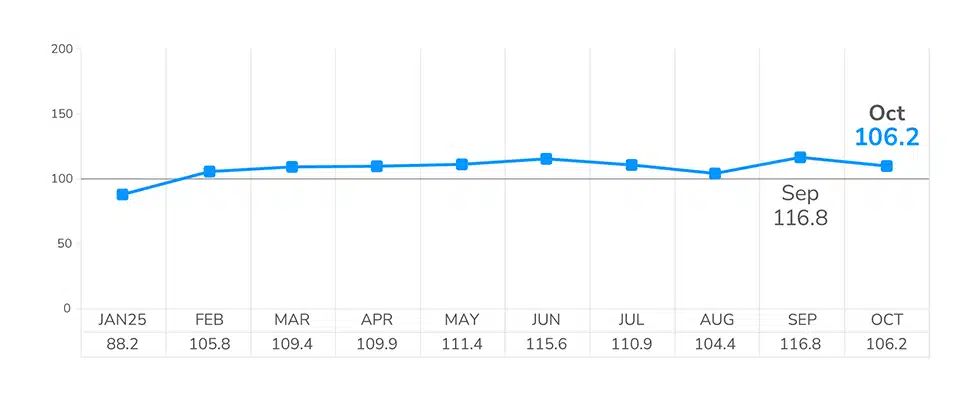

After a strong September surge, commercial real estate activity eased slightly in October. The LightBox CRE Activity Index dipped from 116.8 to 106.2, a modest, expected pullback driven in part by the prolonged federal government shutdown. Still, the Index held firm in triple-digit territory—its ninth consecutive month above 100, signaling that CRE momentum remains intact heading into year-end.

The latest LightBox CRE Activity Index reveals:

- Where property listings adjusted after September’s surge and what that means for Q4 deal flow.

- Which asset classes are driving strong environmental due diligence activity.

- How lender-driven appraisals and rate relief are supporting steady financing pipelines.

Built from more than 30,000 real-time market signals across listings, lender appraisals, and environmental due diligence, the LightBox CRE Activity Index provides one of the earliest and most comprehensive reads on commercial real estate momentum. It helps industry professionals anticipate shifts in lending, investment, and transaction activity before they appear in official market data.

LightBox CRE Activity Index

After climbing to its 2025 peak in September, the Index’s October reading of 106.2 reflects expected normalization following last month’s 25% surge in property listings. Historically, activity tends to soften between October and November as year-end seasonality sets in, but 2025’s elevated baseline shows that the market is performing well above last year’s levels.

While macro headwinds—including layoffs, softer consumer confidence, and the shutdown—created friction in October, underlying fundamentals remain steady. Lending and due diligence activity held near record highs, supported by stronger balance sheets and two Federal Reserve rate cuts this year.

The October Index underscores what many CRE professionals are seeing firsthand: a market that’s cautious but far from stalled and that is resilient, recalibrating, and positioned for a disciplined close to 2025.