The LightBox Phase I ESA Activity Index climbed to 98.0 in Q3 2025, up modestly from 96.9 in Q2 and 8% above last year, marking its highest level since late 2022, the latest sign of continued momentum across the environmental due diligence sector.

Insights covered in the Q3 Phase I ESA Snapshot Report include:

- The top 20 investors driving Phase I activity in 2025

- National and regional Phase I ESA volume trends across key sectors

- The fastest-growing markets and metros of the quarter

- Sentiment insights from the LightBox Environmental Due Diligence Market Advisory Council

- Emerging headwinds and opportunities shaping 2025 deal flow

Q3 was the third consecutive quarter of steady growth, underscoring broad-based expansion and improving confidence across key client segments. Encouragingly, Q3 earnings from major banks were largely positive, suggesting that CRE lending conditions have begun to stabilize. While capital remains selective and underwriting standards tight, debt capital availability has improved, sustaining demand for refinancing, M&A-driven due diligence, and deal activity across multiple asset classes and geographies

LightBox Phase I ESA Activity Index (base Q1 2021=100)

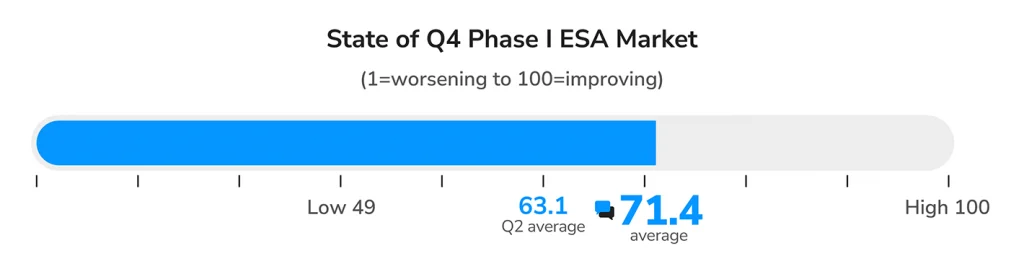

Phase I ESA Sentiment Reading Improves 8 Points to 71.4

The LightBox Environmental Due Diligence Market Advisory Council (‘Market Advisory Council’) members characterized Q3 as a period of measured optimism and selective opportunities, fueled by activity in data center, energy, and manufacturing sectors, as well as continued infrastructure investment and onshoring. This optimism translated into a noticeable uptick in confidence in Q3, assigning the Phase I ESA market an average score of 71.4, up from 63.1 in Q2. Individual responses showed wide dispersion, ranging from a low of 49 to a high of 100, reflecting varying regional and client conditions. Council members described overall market health as moderate to stable, with growth led by infrastructure and energy projects and investors cautiously re-entering select markets.

Uncertainty remains a defining theme, particularly around trade policy and economic direction, yet sentiment improved meaningfully as lenders, developers, and investors signaled greater confidence heading into year-end. While macro headwinds remain, the market’s tone has shifted from reactive to strategically forward-looking, marking a significant improvement over early 2025.

Looking Ahead: Where Phase I ESA Demand Is Headed Next

Despite persistent headwinds around interest rates, tariffs, and lending conditions, the Phase I ESA market continues to demonstrate resilience. Activity levels remain well above 2024 benchmarks, with analysts cautiously optimistic for continued momentum into year-end. The Q3 Phase I ESA Snapshot Report includes LightBox’s latest market forecast for Q4 and early 2026, highlighting where environmental due diligence activity is expected to accelerate next.

Download the full report to access the complete forecast and data analysis.

For more information about this report series or the data, email Insights@lightboxRE.com