After a strong start to 2022, rapid and diverse economic shifts at mid-year created a complex and unpredictable capital markets environment. Looking ahead to year-end 2022 and 2023, several key changes are shaping the market:

- Uncertainty and caution are the norm, as the battle between inflation and interest rates continues.

- Investment activity is cooling as higher borrowing costs drive some buyers from the market.

- Market volatility is causing investors, lenders, and owners to rethink strategies, reconsider assumptions, and prepare for possible disruption.

The shift in market dynamics is palpable, following a period of such strong economic growth and high capital allocations to U.S. commercial real estate, fueling triple-digit quarterly transaction growth rates. This new environment of persistent inflation and rising interest rates has injected uncertainty into an otherwise strong investment market. As investors and owners move toward what is typically a busy fall deal-making season, unprecedented volatility is creating early signs of a pullback in certain areas of the market. While there is still plenty of investment demand and dry powder to deploy, it is clearly a time to recalibrate and reforecast given recent market developments.

Here are key market indicators to watch heading into year-end and early 2023:

The Two I’s: Inflation and Interest Rates

Among the top factors driving instability in the market are the interplay of record high inflation — triggered by ongoing supply chain disruption and exacerbated by the war in Ukraine — and steadily rising interest rates.

Higher inflation is having a ripple effect throughout the economy, pushing up the costs of construction materials, energy, and consumer goods. Among the notable economic indicators showing stress at mid-year was GDP which fell for the second consecutive quarter, and the Consumer Price Index (CPI), which jumped 9.1% year-over-year in June, the highest increase in about four decades. In just-released data, the July CPI fell to 8.5%, a development that could suggest inflation is beginning to stabilize (although it is too early to tell).

The Fed is facing a delicate balancing act as it attempts to reduce inflation by raising interest rates without triggering a recession. The June increase of 75 basis points was the biggest single increase in rates in nearly three decades, and at its July meeting, the Fed matched that increase for the second time (its fourth increase this year). The higher costs of capital are forcing commercial real estate professionals to adjust to a new landscape and the need to reevaluate their market positions and adjust expectations.

Rising Capital Costs Puts Pressure on Underwriting

As the cost of capital rises with each interest rate hike and concerns of a recession intensify, many large U.S. financial institutions are pulling back on their loan originations for the rest of 2022 and into 2023. This change in tenor is a significant shift, given that 2021 was a record-breaking year for commercial real estate lending. Many lenders have already shifted to a more defensive underwriting position as they look to mitigate risks. Here are changes in property lending behavior that will characterize the near-term market:

- More intense underwriting scrutiny with a focus on assumptions about rent and cash flow growth

- Adjustments to rate locks as borrowers seek to lock in rates before further hikes

- Tighter standards for more risky, speculative loans

- Fewer bids on loans that previously had placed easily, such as 60% LTV multifamily loans

- Concerns about near-term maturities and the ability of borrowers to refinance

- Curtailing or halting loan origination activity

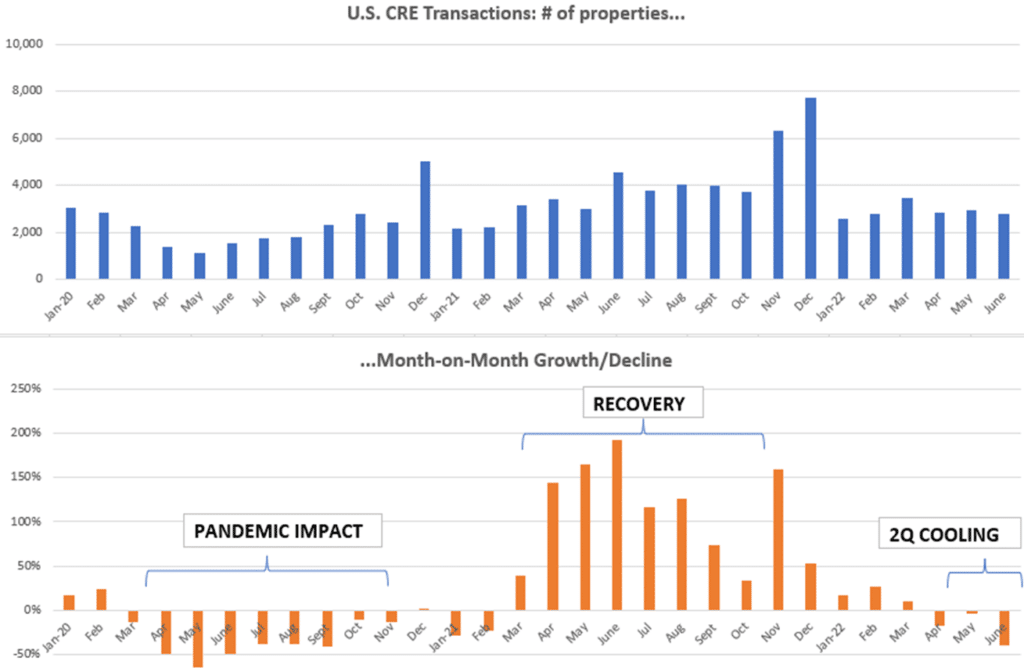

CRE Investment Levels Cooling

The higher costs of borrowed capital also had an adverse impact on mid-year commercial real estate dealmaking. Following a sustained growth and recovery period in 2021 coming out of the pandemic followed by a 17% Q1 2022 increase (relative to Q1 2021), the number of properties transacting in Q2 2022 fell by 29% year on year, according to MSCI Real Capital Analytics. The pullback is likely the result of a buyer pool that is thinning as higher rates impact access to debt capital. Recent transaction activity has also been weighted toward larger deals by buyers who have equity to deploy and are less sensitive to debt costs than smaller buyers. The quarterly decreases are also partly due to the market’s return to a more normalized growth rate after the post-pandemic recovery in 2021.

Moving forward, continued softness in transaction volume is likely to continue as rates and valuations establish a new equilibrium. If property prices begin to level out, there will be more pressure on buyers to consider how to improve a property in order to get their return on investment. Cash flow growth from tenants could be challenging in a prolonged economic slowdown and will vary greatly by property type and market. In light of recent changes, it is logical that investors are pausing to re-evaluate their strategies and that fewer buyers are responding to listings—a trend evident in LightBox’s RCM® investor platform. Today’s investors need to work harder to navigate the uncertainty and risk, and it is more imperative to differentiate by property and market, and consider whether a property’s investment makes sense even in a potential slower-growth/slower-appreciation scenario.

2022 Forecasts are Being Redrawn

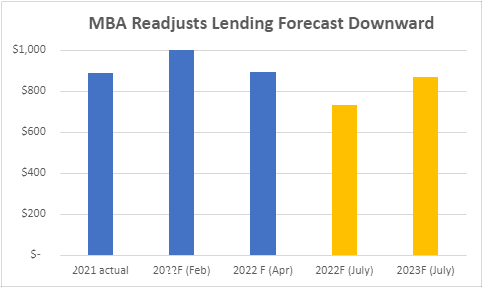

After a record start to the year, the shifting economy, marked by high inflation and rising interest rates, is prompting many investors and lenders to redraw their forecasts for 2022. The Mortgage Bankers Association (MBA), for example, has downgraded its lending forecast twice since February. These downgrades came after the MBA had originally predicted that commercial loan originations would break the $1 trillion mark in 2022 for the first time in history, By April, the MBA dialed back the optimism, instead predicting flat growth in 2022. In its latest reforecast from mid-July, the MBA is forecasting:

- A slower second half of the year for commercial property loan originations

- An 18% decline in financing for CY2022 from $891 billion in 2021 to $733 billion in 2022

- A rebound by 2023, reaching $872 billion (close to 2021’s high).

The forecast revisions reflect how sensitive the market is to the Fed’s rate hikes so it is reasonable to expect that future hikes this year could trigger additional adjustments to expectations about lending activity.

Climate Risk/ESG Takes Center Stage

Another factor that will define commercial real estate, not just in the final quarter of 2022 but for years to come is climate change risk. Looking back, 2022 will likely be viewed as a pivotal year when ESG issues became an important consideration for commercial real estate investors and lenders. A recent Cushman & Wakefield study found that 84% to 93% of industry respondents expect energy efficiency, carbon emission reduction and climate mitigation efforts to increase significantly over the next three to five years.

The market is beginning to see the impact that the adoption of new standards has on giving investors a way to codify sustainability and climate risk in quantitative terms like other types of property risks. As more agencies and organizations (e.g., ASTM, CREFC, SEC, etc.) focus on climate risk—and as new tools and data emerge, it becomes more critical for commercial real estate professionals to measure the climate risk for underwriting asset risk correctly.

On the investment side, valuations are being adjusted to account for ESG-focused construction measures, green building premiums, net zero emission targets and other areas that support ESG initiatives. As that happens, it is important that climate risk and sustainability are priced into property deals, and access to capital will become dependent on assessing a property’s exposure to future risks and having sustainability plans in place.

ESG/Climate risk impacts CRE in many ways, including:

- Tenants want healthier space, particularly as they contemplate a return to the office.

- A strong ESG profile can boost a borrower’s access to capital

- Owners are impacted by more cities and states adopting ESG requirements

- Transparent data for investors means better informed decision-making

As this trend gains momentum, it will drive demand for services from many commercial real professionals qualified to help property investors, lenders and owners understand a property’s vulnerability to climate risk and respond to new requirements to report greenhouse gas emissions.

Assets in Demand: Industrial and Multifamily Continue to Lead

Industrial and multifamily assets are expected to continue to top the list for investors heading into 2023, given their ties to e-commerce/supply chain modernization and the strong demand for housing, respectively. On the industrial side, vacancy rates are at low levels in many markets. The sector had a record 551 million square feet absorbed in the 12 months ending in April and rent growth is exceeding inflation.

Demand for multifamily is expected to continue on a strong trajectory, as rising housing costs put ownership out of reach for many new buyers. Growth in the apartment sector is also being fueled by huge population shifts that are bringing new renters into the market and by housing shortages, especially in new migration markets. These factors helped push up national rents by about 17% over the past 12 months, according to Moody’s.

Assets in Flux: Outlook for office and retail still being written

Office and retail assets, however, face a more uncertain future. With work-from-home policies still driving down demand for office space, office leasing and investment activity is expected to remain notably lower than before the pandemic. Retail continues to adjust to new consumer behaviors that were exacerbated during the pandemic, including those that influence warehouse-to-store inventory changes. The sector is a mixed bag of subtypes and geographies, with high-end and low-end properties performing well, but middle tier stores continuing to struggle.

Looking Ahead to 2023

As the market digests rapid changes in market dynamics, all eyes are on efforts to tame high inflation and manage the impact of rising interest rates. As the cost of capital rises, rent and cash flow are more critical for successful investment. With a shrinking buyer pool putting pressure on sellers to make concessions, valuations are being reduced in some asset classes and investors are rethinking their short and long-term strategies.

In today’s volatile environment, it is more important than ever to verify older assumptions about tenant demand, rent growth and other fundamentals. In short, the numbers and assumptions have to make sense. Investors and owners are looking at all avenues for opportunities, efficiencies and ways to maneuver around headwinds. It’s an important time to rethink positions. And, it’s critical to forecast, reforecast and recalibrate as new market developments take shape in the coming quarters.