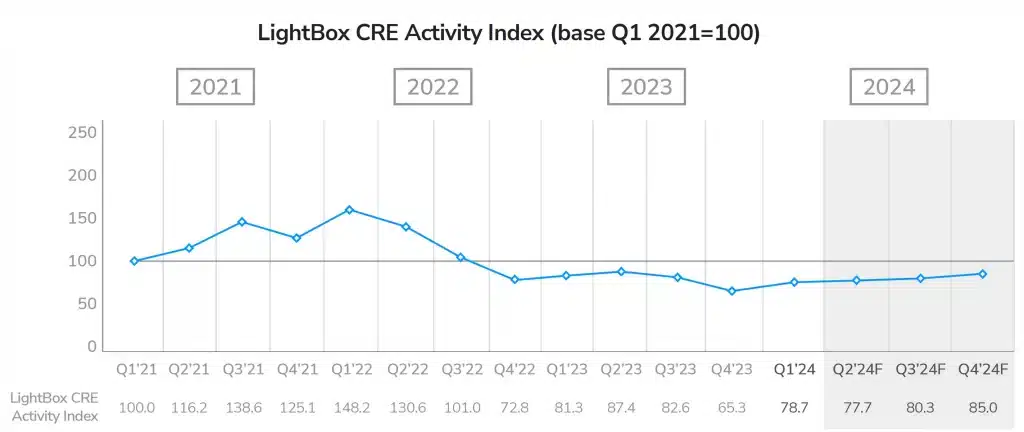

LightBox Activity Index Up Modestly in Q1 2024 from Q4 Low; Forecast Redrawn as Rate Cuts Stall

The first quarter of 2024 took the wind out of the sails of those hoping for the first round of interest rate cuts by midyear. Although there are emerging signs that investors are moving capital slowly back into play, it is now evident that the recovery will be more protracted than expected. At this time of significant market uncertainty, the quarterly LightBox CRE Activity Index presents an aggregate look at leading indicators that provide an early view into the pace of activities that support commercial property dealmaking.

Overall, the LightBox CRE Activity Index (anchored by a Q1 2021 baseline) rose 13.4 points from 65.3 in Q4 2023 to hit 78.7 in Q1 2024. While the latest quarter was an improvement over year-end activity, the Index is still slightly weaker than 81.3 one year ago. The biggest driver of the Index movement in this quarter was an increase in property listings.

At year-end 2023, the Index was at its lowest level in three years (a combination of a weak market and the seasonal slowness of a typical Q4), so these quarterly results reveal an early sign that sellers, who kept properties off the selling block for much of 2022 as rates rose, are growing more comfortable. For buyers and sellers, the necessary ingredient for optimism is that property prices will not fall much more, signaling that the time to move in early has arrived. The Q1 results suggest that sellers may be starting to test the waters. Given still-low transaction levels and constrained lending, demand for environmental due diligence and lender-driven appraisal activity are up only modestly from the previous quarter.

Intelligence from LightBox clients suggests guarded optimism for a thaw in property transactions although any significant increase is heavily dependent on the Federal Reserve moving away from its ‘higher-for-longer’ stance on interest rates. There is growing sense that the most dramatic price resets are in the rear-view mirror, which is also raising hope that the pricing gap between buyers and sellers could finally be narrowing. The wide pricing gap stalled deal activity last year – leading to what many called a ‘staring contest’ between buyers and sellers. This change is welcome news for brokers whose biggest challenge last year was the lack of inventory for buyers eager to place capital. Any increase in property transactions will come as welcome news to appraisers who struggled with limited comparable data in the past few years. Environmental due diligence consultants are supporting modest levels of loan originations by risk-averse lenders as well as some refinance activity and early investments, mostly by equity investors.

FORECAST: Higher Inflation Numbers Translate into Holding Pattern for Interest Rates

The biggest question facing the market is clearly the future path of interest rates, which in turn will be a key determinant influencing commercial real estate investment and lending decisions. After three consecutive months of stronger-than-expected inflation numbers, the forecast trajectory of lower rates this year has expanded from a matter of months to a matter of quarters. Fed Chairman Powell dampened any New Year optimism that rate cuts could come as early as April or May in his latest statement: “The recent inflation data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence.”

Given that the market expectation for interest rate cuts has moved from midyear to at least September, the forecast for the LightBox CRE Activity Index for the remainder of 2024 is likely to be on a slightly slower pace of recovery. It will be interesting to see whether the Q1 uptick in property listings is followed by the anticipated stronger activity in the environmental due diligence and appraisal components. With immediate rate cuts stalled, investment may be limited to opportunistic investors who are increasingly eager to deploy capital, focusing on distressed assets and refinancing activity as loans mature throughout the remainder of the year. When the first rate cut happens, it will likely deliver a long-awaited psychological impact, triggering a sense of optimism and spurring more investors to pounce on attractive opportunities for property acquisitions and development projects. Even absent imminent rate cuts, however, the bid-ask spread could narrow as investors are eager to put capital to work.

Market Sentiment Uneven Across Segments

The sentiment among LightBox CRE brokerage customers varies considerably given the disparities across property types and geographies. In general, those focused more on the office and industrial sectors are more cautious and subdued than those in multifamily and retail who are beginning to see conditions loosen. Uncertain market conditions across the board necessitate a cautious approach to underwriting and the importance of scrutinizing borrower creditworthiness and property fundamentals to mitigate risk exposure.

Based on the latest developments, the LightBox CRE Activity Index is unlikely to follow a V-shaped recovery, but rather, a more gradual path. Transactions in the second half of the year could rebound modestly as tighter risk spreads and seller capitulation deliver an uptick in market velocity that fuels an increase in the environmental due diligence and appraisals needed to support a new round of dealmaking.

The Q2 2024 LightBox CRE Activity Index forecast will be released in July, and adjusted for any market developments that warrant any change in assumptions.

About the LightBox CRE Activity Index

The LightBox CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. The Index report is part of a series of the LightBox Quarterly CRE Market Snapshot Series reports. To receive LightBox reports, subscribe to Insights.