Real-time data gives brokers a competitive edge in today’s uncertain commercial real estate (CRE) environment. As we reported with builder developers, brokers analyze numerous data points to help them identify sites for the acquisition and disposition of properties. With more than 20,000 brokers leveraging LightBox Vision to assist them with site selection, we spotlight four key datasets that CRE brokers can use to pinpoint sites for buyers or locate motivated property owners.

Points of Interest

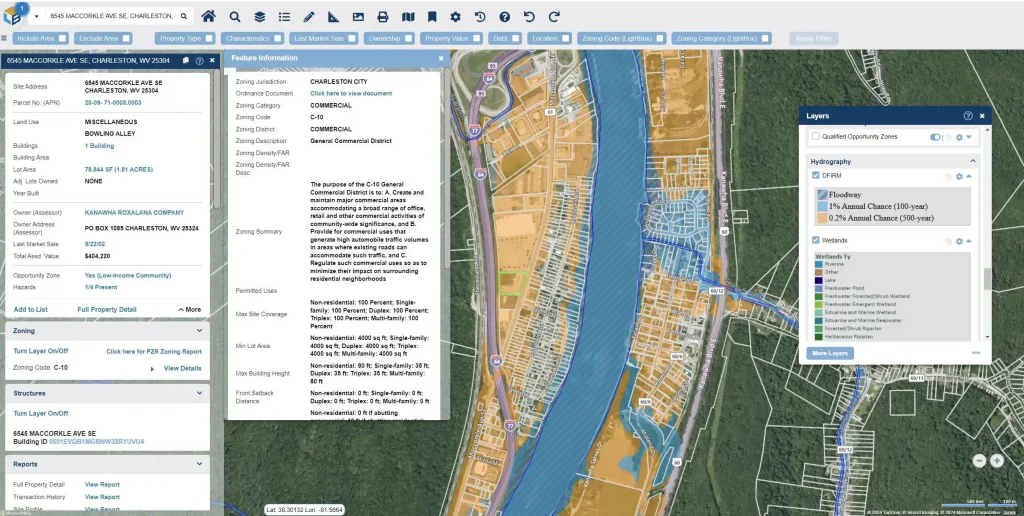

One of the most effective ways to assess various aspects of a property or land site is by searching for points of interest (POI) on the LightBox Vision map. Brokers can identify neighboring properties and evaluate if there are competitors or complementary businesses nearby that could impact demand or need. Performing a POI search enables brokers to determine the current usage and demand within specific industries or classifications, helping them locate areas of high activity and properties that match their clients’ requirements.

Let’s consider an example of reverse engineering a search for self-storage facilities, a rapidly growing sector valued at $54 billion in 2021, projected to reach $83.6 billion in 2027, according to Storeganise. As vacancy rates stay at low levels, brokers can identify opportunities for their self-storage clients seeking to expand their portfolio by conducting a market gap analysis. They can start by searching the word ‘storage’ under the LightBox points of interest filter, which will display any business with storage in their name on the map, along with the corresponding SIC code. Next, the broker can input the SIC code into the industry filter of the search to identify all self-storage facilities in the targeted market area and overlay the locations of vacant sites within a specified radius.

Loan Maturities

A total of $929 billion in loan balances, or 20% of outstanding commercial real estate debt, is due to mature this year, according to MBA’s latest loan maturity report. Brokers are vigilantly monitoring this looming wall of debt, recognizing it as both a challenge and an opportunity. Through analysis of loan maturity dates in LightBox Vision, brokers can gain deeper insights into the financial health and potential vulnerabilities of property owners.

Loans that were written at a low interest rate and are close to maturing may now face the prospect of refinancing at higher rates, impacting the property’s cash flow. With LightBox Vision, brokers can turn on the loan maturities layer to identify properties with loan maturities within two years, for example, empowering brokers to proactively contact owners to understand if owners will need fresh capital injection, intend to sell, or are in a strong financial position to weather the changes.

Risk/Hazard Mitigation

Brokers heavily rely on assessing environmental hazards when evaluating sites for acquisition or sale. By analyzing factors such as flood zones, wetlands, and brownfield sites, brokers gain invaluable insights into potential risks and opportunities. Utilizing LightBox data, brokers can layer critical hazard information on top of the point of interest and debt datasets. LightBox Vision data shows the general flood zone diagnosis of a particular site and includes precise measurements of site usability. This information arms brokers with valuable information when entering negotiations to get the best outcome for their clients.

Property Owner Profile

Understanding the broader context of portfolio ownership is equally essential for brokers seeking to navigate the intricacies of the market. By delving into owner profiles and scrutinizing factors such as portfolio composition, recent market sales, and ownership types, brokers gain unique insights into the value of the site. Leveraging LightBox Vision’s property ownership dataset, brokers can access a list of other properties the owner has in their portfolio, filter sites by a particular type of owner (e.g. a corporate owner with countless assets vs. a small business owner with only a few sites), gives telling property adjacency ownership data as well as intel on a given site’s ownership history—enabling targeted outreach and informed negotiations.

Looking Ahead:

These LightBox Vision datasets represent only the top criteria brokers are currently using for site selection. Zoning, sales comps, demographic data and more are all part of the data sets made available for deeper analysis. With just a few clicks, brokers can perform in-depth analyses, uncovering qualified sites and identify motivated owners quickly.