For the last several years, Dallas has emerged as a strong commercial real estate (CRE) market showing incredible resilience throughout the pandemic shutdown and its aftermath with an economy that has continued to attract business and individuals. For the LightBox Prism 2024 conference, Dallas was chosen as the host city for LightBox customers, partners, and industry experts to meet and discuss market trends and opportunities. The LightBox analyst team collected some of the most recent statistics that highlight why Dallas continues to be a CRE market to watch.

Booming Economy

Dallas, with over 8.1 million people (the fifth largest MSA in the country), is ranked the #3 U.S. market to watch for overall real estate prospects in 2024, boasting impressive numbers for job growth, environmental due diligence, and yes even office construction. It is #1 in the country in net jobs added with 139,700 jobs, and #1 in population growth. For three consecutive years, the city has maintained its top spot as the leader in CRE investment across the U.S., with $13.2 billion in the first nine months of 2023.

Thriving Construction Across Multiple Sectors

One of the key drivers of Dallas’ CRE success lies in its thriving construction market. As the top metro for office construction according to 2023 CBRE and Cushman & Wakefield data, it is also ranked the #6 market for home building prospects. Data center construction is another booming segment of CRE, which Dallas holds more than 1.42 million square feet of projects under construction, according to Cushman & Wakefield. In fact, 2,500 acres of high electrical capacity industrial data center land just went up for sale and QTS Realty Trust is reported to be adding a two-story data center spanning 210,755 to its 55-acre campus in Irving, according to the Dallas Business Journal.

Environmental Due Diligence Wins Top Market Spot

Dallas was ranked #4 in environmental due diligence for 2023, according to the LightBox EDR ScoreKeeper model, with 5,400 properties assessed. In the first quarter of 2024, Dallas unseated top-ranked Las Vegas with 28% growth in Phase I ESAs, outperforming well above the 5% decline across the 25 primary metros in the country.

Multifamily: Top Sector in Property Listings

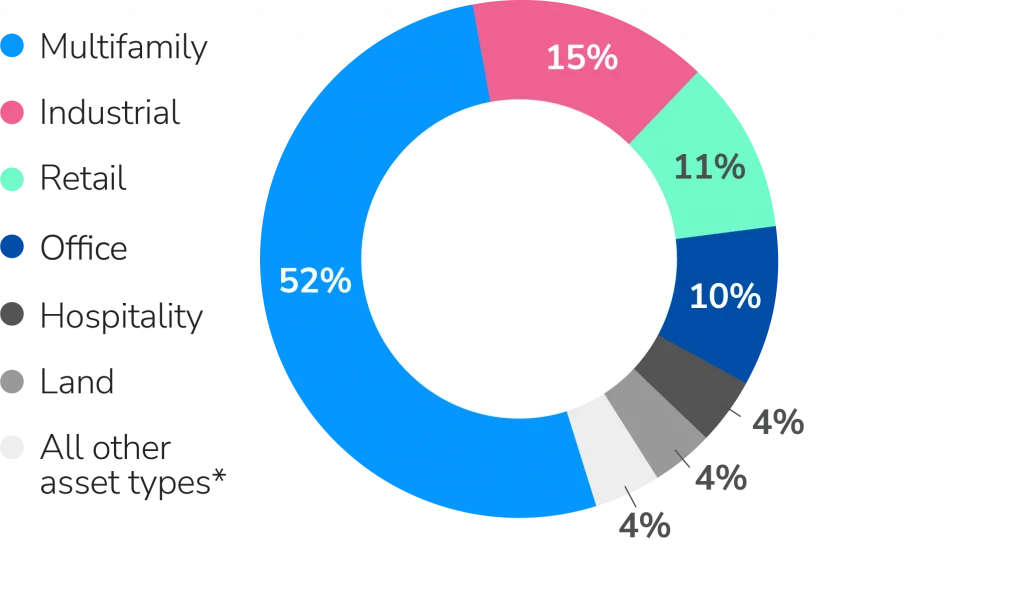

Multifamily stands out as a gleaming light in Dallas’ real estate sector, leading in appraisal awards, capturing 21%, with office (18%), industrial (15%), and retail (14%) following close behind. Additionally, Dallas holds the 3rd position in the nation for property listings, with multifamily significantly outnumbering other property types, with 52%.

LightBox RCM Property Listings by Asset Type in Dallas MSA (2022-2023)

Did You Know?

The city’s CRE landscape is also significantly influenced by prominent sports team owners, like those of the Dallas Cowboys and the Mavericks, who own substantial real estate holdings.

Jerry Jones, the owner of the Dallas Cowboys since 2019, is affiliated with owning over 190+ real estate assets. (includes Omni Frisco Hotel since 2017)

Mark Cuban, owner of the Mavericks since 2000, is affiliated with owning over 40+ real estate assets. He sold his majority stake ($3.5B) to casino mogul Miriam Adelson and her son-in-law Patrick Dumont.

Some Headwinds Approaching

As the city continues to evolve, a few challenges are on the horizon. The office sector continues to be challenged, with an overall office vacancy rate at 26.2% in the first quarter. Vacancies in the Dallas office sector remain high as companies continue to downsize and supply outpaces demand. Just last week, 1201 Main was put up for sale as a value-add investment opportunity, which features 650,000 square feet of office space. The the office space is only 36% occupied, according to JLL, who is marketing the listing. Due to the city’s rapid expansion in energy usage, climate risk is a growing business concern, with CO2 emissions potentially doubling by 2100, according to one climate forecast model using LightBox data. Moreover, as construction costs rise and office vacancies increase, coupled with a growing negative absorption, the metro area faces some challenges ahead.

This brief market overview just scratches the surface of Dallas’ thriving CRE scene. Stay tuned for highlights from the LightBox PRISM 2024 event, where our team will provide insights from some of the key sessions and panels from the subject matter experts in CRE environmental due diligence, lending, and valuation.