As commercial real estate (CRE) investors attempt to make sense of unprecedented economic upheaval, all eyes are on debt and equity financing. With rising interest rates pushing up the cost of capital, lenders are tightening their requirements or retreating from commercial real estate entirely. This volatile environment is in sharp contrast to the first half of 2022 and the typical fourth quarter frenzy of commercial deal-making.

“Investors are navigating a challenging environment where lending requirements, property valuations and debt service coverage are under more intense scrutiny,” says Tina Lichens, Senior Vice President of Broker Operations for LightBox. “As buyers and sellers reevaluate their positions heading into 2023, we expect to see a rebalancing of pricing expectations that will ultimately lead to renewed growth in investment activity.”

Following a strong first half of the year for CRE investment, higher interest rates pushed cap rates higher and caused a significant retraction in commercial real estate deal volume. In the third quarter, major money center banks announced a retreat from CRE lending. The CBRE Lending Momentum Index, which tracks the pace of CBRE-originated commercial loan closings in the U.S., declined by 11% in the third quarter compared to the second quarter—and was nearly 5% below the level recorded in the third quarter of last year.

While regional and local lending sources remain active, deals that move forward are facing a more risk-averse environment and tighter lending requirements. The higher cost of capital has shut some buyers out of the market, and, as a result, third-quarter investment was down 18% compared to the corresponding quarter of 2021, and 16% below the second quarter according to the latest quarterly CRE transaction data from MSCI Real Captial Analytics.

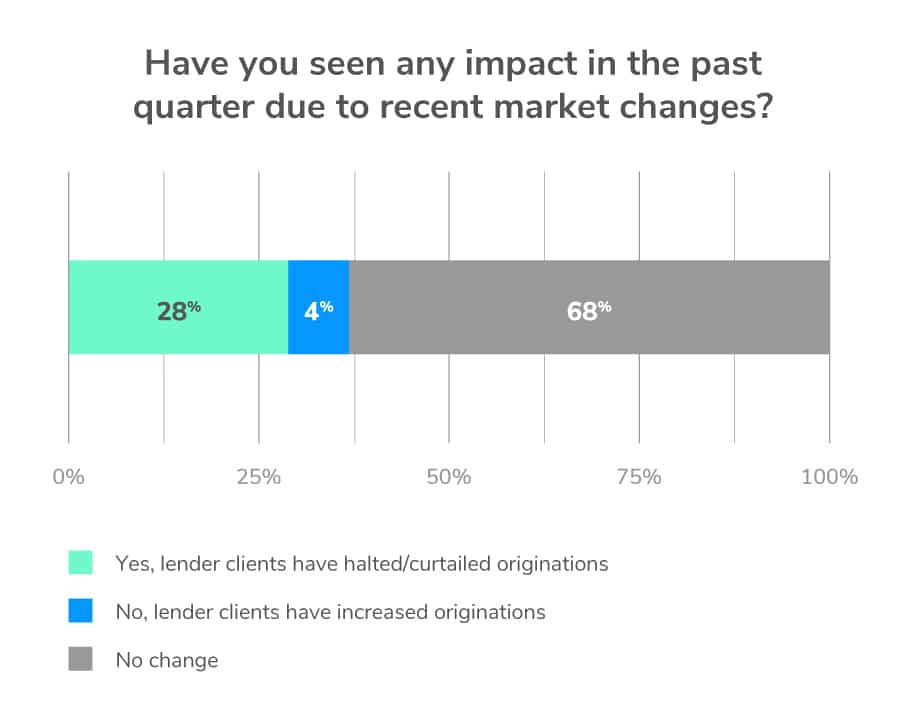

CRE lending drove strong growth at many banks last year and in the first half of this year, as investors took advantage of low interest rates. In response to changing conditions, however, LightBox’s latest survey data revealed that 28% of survey respondents in due diligence have lender clients who halted or curtailed originations in the third quarter. “For loans that are proceeding, lenders are exercising far more scrutiny on assumptions about occupancy, rents, and property values. In today’s uncertain environment,” according to Dianne Crocker, LightBox’s principal analyst, “the numbers have to make sense.”

Larger banks have been more prudent in anticipating potential credit losses, but the credit losses and delinquencies haven’t been seen yet, says Jon Winick, CEO of Clark Street Capital. “Time will tell if they were ahead of the curve enough, anticipated problems that never occur, or had their heads in the sand.”

Given the backdrop of rising rates and the potential recession, credit risk and having a good handle on property values will be top of mind for lenders, says Raj Aidasani, Senior Director, CREFC. “Our market has yet to fully absorb the dramatic changes over the last year and, in addition, the standoff between buyers and sellers is expected to continue. Lower transaction activity translates to lower market price transparency, making the credit work lenders perform even more critical.”

This is an unprecedented market cycle and one that offers many challenges to underwriting transactions. On the positive side, many companies and properties have experienced strong years given the momentum in 2021 and the start of 2022. Underlying property performance remains strong for many asset classes, especially those that can raise rents to account for higher costs.

Among the property sectors to watch are multifamily, which has seen record rent growth, and industrial, due to questions about whether demand drivers will remain as strong long-term. Given the recent shifts in lending, debt capital is more difficult to find for office, hotel and retail, as lenders reduce their exposure to asset categories with higher risk. Also, the office sector continues to struggle with lower occupancy levels given return-to-work policies. Recent layoffs in the tech sector could add another layer of stress to some office properties.

While long-term real estate market forecasts remain positive across many property types, particularly multifamily and industrial, the short-term outlook has dimmed. In the 2022 ULI Real Estate Economic Forecast, real estate economists downgraded their forecast for the near-term U.S. real estate and economic environment compared with six months ago, noting more pessimism for 23 of the 27 variables reviewed.

Lenders search for liquidity

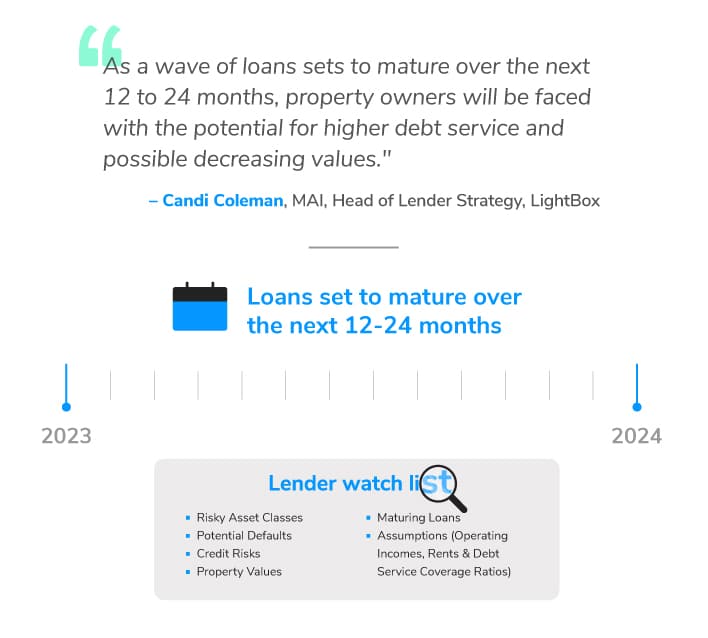

Growing economic weakness has also prompted lenders to reassess their loan allocations as they try to balance out portfolios that are now seen as too top heavy on real estate. “We’ve seen a dramatic slowdown in appraisal activity this year, which provides an early indicator for loan activity,” says Candi Coleman, MAI, Head of Lender Strategy with LightBox. “The appraisal industry has been very busy for the past 18 months and now we’re in a holding pattern.”

The slowdown in lending also puts the spotlight on maturing loans and a potential risk crisis as cap rates and interest rates rise, says Coleman. “As a wave of loans sets to mature over the next 12 to 24 months, property owners will be faced with the potential for higher debt service and possible decreasing values. That puts borrowers in a tight spot when looking to refinance their loans.”

According to Moody’s Analytics, the squeeze on loan rates and cap rates is ushering in the prospects of negative leverage, a sign that the impact of rising rates is starting to take hold. There is an estimated $5.5 billion (28%) of new CMBS issuance that reflected negative leverage in the third quarter, according to Moody’s. This was a sharp uptick from the second quarter when only 8% of properties had negative leverage and from the third quarter of 2021 when the figure was just 2%.

A look at delinquency levels shows a modest uptick, that could be an early sign of things to come. In October 2022, the Trepp CMBS Delinquency Rate was 2.96%, an increase of four basis points from September and only the third increase in the last 28 months. The percentage of loans in the 30-day delinquency category was 0.09%, a decrease of five basis points for the month. “Whether this is the beginning of a turning point as a result of higher interest rates and a slowing U.S. economy or just a momentary bump remains to be seen,” the report notes.

Market experts point to delinquencies being at near record lows, partly due to strong macro-economic factors and the record stimulus given out during the pandemic. There is a mindset that consumers and businesses can withstand higher rates for a while, but at some point, cracks will begin to emerge. “One important indicator that banks will consider moving forward is debt service coverage ratios, as they capture the true ability of a property to repay mortgage loans,” says Coleman.

If inflation continues to decrease, the Fed might transition to a less aggressive stance on future interest rate hikes. Until there is more clarity, however, investors can expect to see a continuation of the current cautionary lending environment, particularly if recessionary conditions strengthen heading into 2023.

“Lenders are looking for volatility to subside, and we’re likely not going to see that happening anytime soon,” says Aidasani. “As a result, lending activity in 2023 will be restrained, with demand bouncing back in late 2023 and 2024. Higher-quality properties in better locations will fare better, and we will see a further divide between the “haves” and “have-nots.'”

For a deeper dive into the market, check out the Fall 2022 LightBox Investor Sentiment Report, featuring insights into hot button topics such as the top threats to the industry, how inflation is impacting investment and whether respondents think a recession is on the horizon.