LightBox released its Fall 2022 Investor Sentiment Report, which takes stock of how respondents in six commercial real estate segments—Brokerage, Investment, Lending, Property Due Diligence, Valuation, and Other—are adjusting to the recent shift in market conditions.

According to the report, “Significant market headwinds, including a slowdown in economic momentum, rising interest rates, ongoing supply chain disruption, labor shortages and the threat of a recession are adversely impacting investor sentiment heading into the year-end. As financial markets react to the Fed’s ongoing efforts to tame inflation, many commercial real estate investors and lenders are recalibrating, stepping back or taking a more cautionary approach to investment activity. This sentiment strikes a notable contrast to the optimistic forecasts voiced at the beginning of 2022, when many industry experts expressed confidence in a strong growth trajectory for the year. Those optimistic projections became obsolete by mid-year, however, as rapidly changing economic conditions ushered in a wave of uncertainty.”

Survey responses from the environmental due diligence sector indicate that, in addition to a potential recession, three areas are of particular concern: A decline in business activity, uncertainty about hiring, and rising construction and materials costs.

Business activity is down as a potential recession looms

As the Fed continues its efforts to raise interest rates to control inflation, there is growing concern about a recession. Ninety percent of survey respondents are concerned about a potential recession, of which 35% were “very concerned.”

The forecast for the remainder of 2022 is trending more toward “stable/optimistic” than represented by the full survey sample—38% among environmental professionals versus 27% in the broader market. Yet, many commercial real estate professionals also note that real estate continues to provide a strong hedge against inflation. This is particularly true for sectors experiencing the strongest demand, such as industrial and multifamily.

Nearly half (49%) of environmental professionals reported experiencing a decline in their recent business activity based on market changes—13% “a significant decline” and 36% “moderate”—a notable shift in sentiment and activity after a very bullish first quarter. Sixty-seven percent of EPs with lender clients have seen no change in activity, while 28% reported that lenders have reduced or halted commercial property loan originations.

Hiring is in flux as companies grapple with worsening economic conditions

Hiring plans are directly related to confidence levels, and the survey results in this area are telling. Fifty-three percent of environmental firms are hiring only for high-priority needs, while 26% are still aggressively hiring across the board. Both percentages are larger than the broader industry samples of 40% and 20%, respectively. Environmental consultants at LightBox’s recent PRISM event revealed they are also focusing on staff retention strategies and initiatives to ensure that companies don’t lose employees during today’s talent war.

Industrial demand is high—but so are construction and borrowing costs

Commercial real estate is also struggling with higher construction costs and delays in the building materials supply chain, a trend exacerbated by rising interest rates—though firms anticipating further hikes may increase their business activity now as clients try to lock in rates before they increase further.

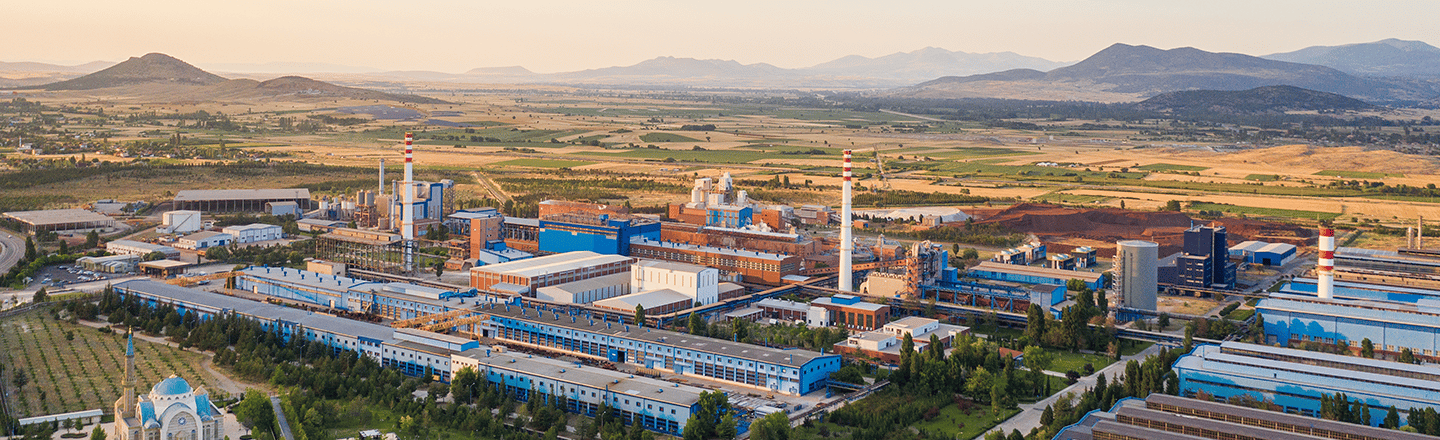

The industrial sector continues to lead investment activity with low vacancy rates and strong rent growth, while the office sector is still struggling with high vacancies, given the new hybrid work environment. Higher borrowing costs, increased operating costs—the result of inflation—and weak rent growth will likely limit the capital supply and hinder investments in office.

In addition, notes the Investor Sentiment Report, “Demand for industrial space is far outpacing supply, even with a projected softening of consumer spending due to recessionary factors. According to global logistics firm Prologis, the U.S. market is experiencing more than 800 million square feet of pent-up incremental demand, yet there is only 375 million square feet coming online.”

As 2022 draws to a close, interest rates—and their impact on transaction volume and taming inflation—remain the key variable affecting the outlook for commercial real estate. Given the uncertainty around future increases and whether fiscal policy succeeds in controlling inflation without a recession, many investors, brokers, and lenders expect pricing to adjust, eventually leading to renewed momentum. But until then, environmental consultants are carefully watching market barometers and adjusting forecasts as necessary.