At mid-year, market barometers on commercial property sales and lending showed the early impacts of the rapid rise in interest rates by the Fed. Within a few short months, the bullish forecasts at the start of 2022 became obsolete. The suddenness of this market shift has surprised just about everyone. In response, many commercial real estate lenders are tapping the breaks to process what the growing market uncertainty and possibility of a recession mean for their business. Based on a presentation at the CUBG conference in Portland, OR August 10th below is a list of 10 factors impacting the market in the second half of 2022—and the implications of each for commercial real estate lenders.

- The Two I’s: Inflation and Interest Rates

Inflation is running at more than a 40-year high and in response, the Fed has responded aggressively with four interest rate hikes (the latest two of which were the largest hikes in three decades). The more rates rise, and the longer inflation stays elevated, the higher the fear of a recession.

- Higher Costs of Capital Pressure Lender Underwriting

In response to higher interest rates and growing market uncertainty, lending in the second half will take a hit as some lenders respond by curtailing (or even halting) commercial real estate lending. Others are still lending but exercising caution by requiring borrowers to put more cash into deals or avoiding riskier loans that would not have raised eyebrows just a few quarters ago. Lenders are also increasingly concerned about maturing loans and whether borrowers can afford to refi at higher rates.

- CRE Investment Climate Shows Early Signs of Cooling

As higher costs of capital shut some borrowers out of the market, it is not surprising that commercial real estate dealmaking at midyear reflected a decline of 29% (in terms of number of properties) compared to the first half of 2021, according to MSCI. Transactions in the second half are likely to continue the cooling trend as buyers pull out of deals either because of higher borrowing costs or to hold off in case property prices fall as valuations catch up with changing market dynamics.

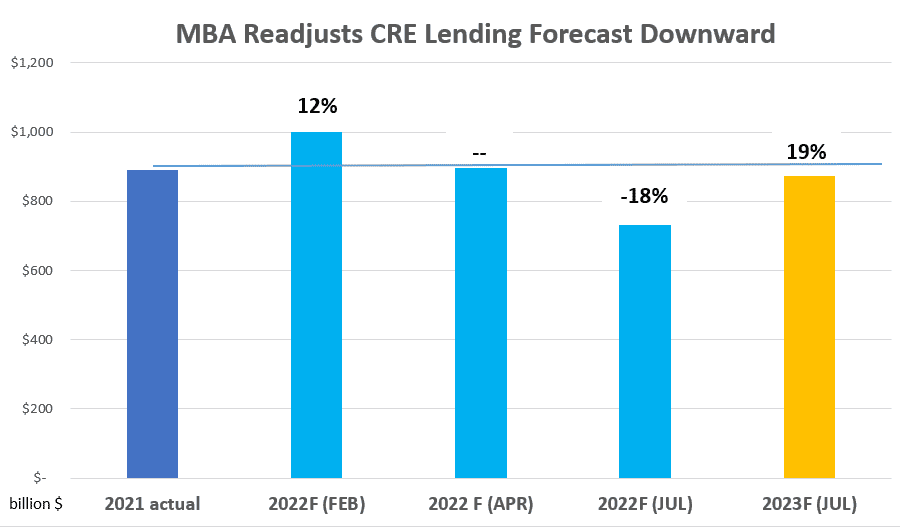

- Lines Being Redrawn on 2022 Forecasts

In response to recent market developments, forecasters like the Mortgage Bankers Association backed away from their original 2022 lending forecasts. Twice (so far). In April, the MBA backed off of its forecast that commercial property originations would grow 12% this year in favor of levels that would run parallel to 2021’s record year. By July, after three rate increases, the MBA pulled back further expecting an 18% decline followed by a 19% increase for 2023.

- Industrial and Multifamily Still Lead Investment

Multifamily and industrial still dominate investment activity, accounting for 61% of all new investment in the first half of 2022. As lenders adopt a more conservative stance, these two asset classes will continue to be viewed as relatively low risk given the healthy fundamentals, like strong demand, low vacancy rates, and rent growth in many markets.

- Office and Retail Lending Opportunities More Nuanced

The future of the office sector is still being written as companies renegotiate rents and consider the redesign of their office footprint with a post-pandemic workforce. The retail sector is a mixed bag of subtypes and geographies with varying risk profiles. The strongest lending opportunities are on retail conversions as obsolete properties are either renovated to meet the demands of today’s consumer or repurposed into entirely new uses.

- Secondary Metros Driving Growth

One trend established in the 2021 recovery period post-COVID that continued through mid-year is the strength of smaller, secondary markets. Based on output from the LightBox ScoreKeeper model, six of the ten fastest growing metros for environmental due diligence in the U.S. are smaller metros like San Antonio, Pittsburgh, and Nashville, as well as in Texas and Florida metros experiencing large population bursts as a result of the pandemic.

- Underwriting is a Numbers Game

In a lending environment characterized by rising interest rates, rents in some asset classes or geographies weakening, and upward pressure on cap rates, the numbers matter more. Assumptions about rent growth, cash flow, and vacancy rates can vary greatly by property type and market and may be adversely impacted by a prolonged economic slowdown.

- Climate Risk/ESG Take Center Stage

2022 will likely be viewed as a pivotal year when climate risk and ESG became critical lending considerations. In response to new rules, standards, and guides on conducting climate risk assessments—and as new tools and data emerge, it will become more critical to measure climate risk for underwriting asset risks correctly and access to capital will become dependent on assessing a property’s exposure to future risks.

- Pressures on Efficiency Intensifying

There is intense pressure on lenders to collect, process, and analyze property data quickly and accurately in an uncertain market. Technology adoption is now a competitive issue to meet the market’s increasing pressure on efficiency and accuracy to close loans quickly and new best practices are emerging in underwriting as well as performance metrics.

In response to rapid market changes and rising concerns, commercial real estate lenders are recalibrating and proceeding with caution. The second half of 2022 will likely be choppy especially with the expectation of several more interest rate hikes. This new phase of the real estate cycle demands extra vigilance related to the impact that downward pressure on rents or reduced cash flow could have on underwriting decisions and a lender’s overall risk exposure. As the market resets on property pricing and borrowing costs, property fundamentals are still largely favorable and the longer-term vision for commercial real estate will likely be focused on the changing needs of properties to meet post-pandemic demand and the new ways technology enables smarter, more efficient decision making.