Manus Clancy is head of data strategy at LightBox

Positive headlines for the US office market have been as elusive as a Niners fan in a Travis Kelce jersey lately.

Investors have been reminded day in, day out of the problems with the sector by dismal sales comps and news of banks taking big losses on their CRE books. Some offices have sold for 60% or more below prices from the last 10 years. Meanwhile, shares of New York Community Bank tumbled after the firm cut its dividend follow problems with its CRE portfolio.

One, rare, positive headline last month came from the Philadelphia Business Journal.

The piece by Paul Schwedelson notes that the owners of Centre Square in Philadelphia had negotiated a reduction in the assessed value that will save the owners a few million dollars in each of the next few years.

The specifics are that the assessed value was cut from $362.6 million to $275 million for 2023 and $250 million for 2024. That will reduce the property tax tab from $5.1 million to $3.5 million in 2024.

To be sure, the savings – almost $2.8 million – is small compared to normal costs for re-tenanting a property, for capital improvements, and for the impact of falling rents at major US offices. But considering the current, ahem, challenging environment, any good news is welcome.

(The property is a 1.76-million square-foot office at 1500 Market Street. The complex is made up of two buildings and is owned by Nightingale Properties and Wafra Capital).

One of the big questions nationwide has been how willing assessors would be in granting relief to office owners at a time when the office segment is under siege. In this case at least, the City of Philadelphia chose to play ball.

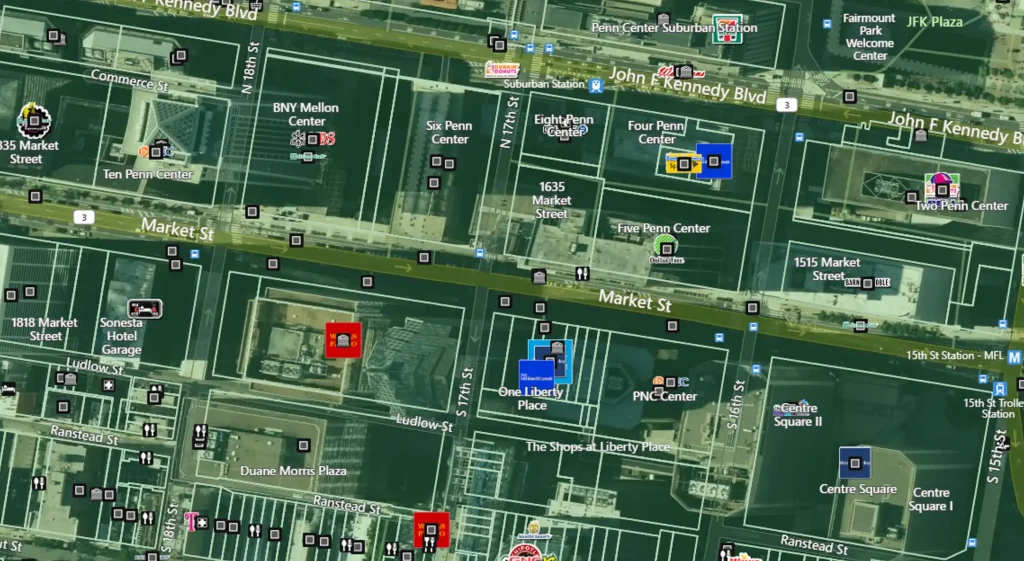

That stands in stark contrast to New York City which bumped up tax assessments on Big Apple Class B office by 2.6%. (Story from GlobeSt here.) The area in Philadelphia adjacent to Center City includes trophy offices, as our LightBox Vision map below shows. It might be time for some of those owners to drop a dime on the city’s tax assessor office.

Interested in seeing more of the LightBox Vision data behind the story? Click here.