For a long time, the narrative in the commercial real estate market has been that the best available use for older, obsolete shopping malls and offices would include a considerable percentage to single-family subdivisions and/or multifamily.

While there have been stories of offices in Central Business Districts being converted into apartments, the actual conversions have been rare. Outside the urban core, the story has been the same. While some suburban or exurban offices or corporate campuses have been converted, the more popular conversion has been to data center or industrial/warehouse/logistics properties.

In the mall space, conversions to pure residential have been atypical. Yes, there have been some moves to convert retail space to lifestyle communities (which include residential), but the pure residential play has been elusive. The LightBox CRE Predictions Report covered this topic (page 9) and some of the challenges.

Amazingly, even though the retail apocalypse started in 2017, an impressive percentage of older B and C class malls carries on. Some of this is a function of long-term owners extending loans multiple times in an effort to keep a property. In other cases, distressed asset buyers picked up malls at deep discounts and continued to operate the properties as malls.

Will these trends change anytime soon? Perhaps.

Two stories caught our eye recently.

In the office space, it was reported that Ryan Companies had acquired the old Thomson Reuters campus in Eagan, MN. The campus is enormous with 263-acres of land, nearly 180 of which are undeveloped. The space currently contains more than one-million square feet of office space along with more than 300,000 square feet of data center space.

The Eagan area and surrounding suburbs are awash in office sublease space availability, so it would not stand to reason that Ryan would use the space for more office space. Could this mean a sizable residential or lifestyle community is coming? While that is a possibility, some of Ryan’s recent projects have been for life science and industrial development.

Meanwhile, The Real Deal reports that Brookfield is offering the Neshaminy Mall outside of Philadelphia. The one-million square-foot property sits on 91-acres in Bensalem, PA. This seems like a better candidate for a flip to residential. The story notes that JLL is marketing the property with that potential in mind. The article notes that the property could trade for $25 million. If so, that would be par for the course for malls, which have seen many sell for fractions of the prices of 10 to 15 years ago.

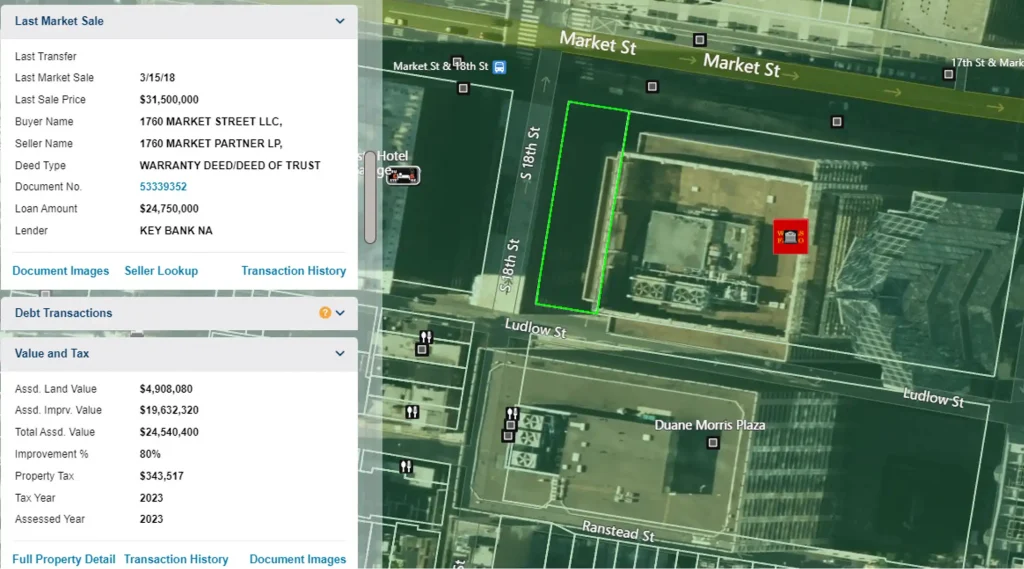

Lastly, also in the Philadelphia market, the Philadelphia Business Journal reports that 1760 Market Square in Philadelphia is being offered for sale with an expected sale price in the low $20 million range. A story from Bucks County Today notes that CBRE is offering the property which could be a candidate for residential conversion. (An aerial image of the property from LightBox Vision is below). A $20 million sales price for that asset would represent a disappointment. The property last sold for $31.5 million in 2018 and the property is encumbered with a loan of $24.75 million at the time. That Center City neighborhood has seen signs of stress over the last two years. Recently, the two-tower Center City property had its assessed value reduced by 30%, saving the owners of that property about $3 million for 2023 and 2024.

Interested in seeing more of the LightBox Vision data behind the story? Click here.