NOTE TO READERS: this article was written in collaboration with The Commercial Observer

CRE market uncertainty is chiefly blamed on one key factor: interest rate volatility. Market participants have faced the ramifications of 11 rate hikes since March 2022 with the possibility that there could be one or two more hikes before the Federal Reserve is done. We’ve seen the chilling effect in deal activity. Our own LightBox CRE Activity Index shows a marked drop in transaction activity year over year.

Lenders haven’t emerged unscathed, but they have fared better than some thought after four banks failed earlier in 2023. The failures of Silicon Valley Bank, Signature, First Republic, and Heartland Tri-State – the first bank failures since 2020 — represent over $548B combined in displaced assets.

For the rest of the banks, higher deposit costs and additional provisions for credit losses are putting downward pressure on bank profits.

Given all this, there is increased competition among lenders for deals that are in the pipeline now and a deliberate positioning for the wave of $1 trillion in loan maturities that are expected in the next 12 months, according to Morgan Stanley. Lenders we talk to aren’t waiting idly on the sidelines. They are using this time to strengthen and secure existing relationships, invest in processes to increase, or improve their efficiency ratios, and maintain the capability to perform thorough due diligence and analysis on a variety of opportunities and scenarios regarding maturing loans and other aspects of the current CRE environment. The upshot is they are focusing on positioning for reengagement once interest rates stabilize and more ‘normal’ market activity resumes.

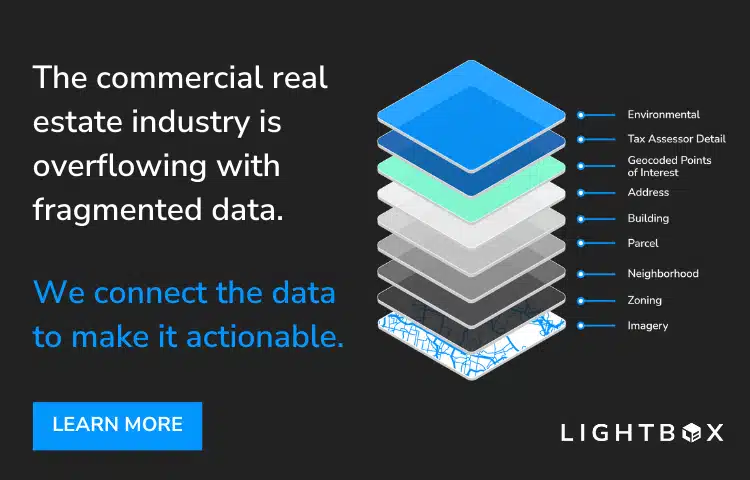

In order to accomplish all this, lenders are looking for ways to synchronize disparate data sets to produce analytics to arrive at conclusions faster and drive better business and policy decisions. Essentially, lenders are looking to de-risk their portfolios and uncover hidden opportunities for upside.

Connecting ‘Siloed’ Lender Data

Producing actionable data in time to pivot or simply act – that’s where many lenders run into trouble and reach out for help from our team at LightBox.

LightBox technology delivers commercial, geographic, spatial, and environmental building data on a single platform, enabling clients to make smart, data-driven decisions. And the key is the LightBox Identifier (LID) that connects the various layers of commercial real estate data to provide a complete and comprehensive picture of every property and all its attributes.

For lenders, this is a game changer in managing their portfolios. Extraction and analysis of data from numerous operational data stores typically requires weeks of work. That’s not a sustainable model in an uncertain market. Once implemented, LightBox enables integration of data from various sources including in-house and third-party providers for faster data analysis to derive insights and impact strategy.

More banks recognize that an environment with fragmented data leaves the business open to numerous risks that could otherwise be managed. But the solution is not to throw more resources at the problem. There’s already a lot of investment in the lender space. Approximately 80 percent of a lender’s IT budget, according to the ABA Journal, is simply on preserving and maintaining their technology environment. The real solution is to focus on cost-effective tools for connecting both existing data and adding necessary data to eliminate blind spots and gain insights without rebuilding information for the use cases that matter most.

Managing Environmental Risk

Connecting comprehensive data for analysis can help banks burrow deeper into essential due diligence on projects for a host of scenarios, such as the growing demands surrounding environmental risk.

LightBox serves as an industry leader in environmental property due diligence, with thousands of federal, state, local, and tribal databases of environmental contamination, the complete US Geological Survey (USGS) historical map collection, and the largest private collection of aerial photography, with 3.1B images going back to the 1930s.

This data is essential for evaluating projects for Phase I environmental site assessments (ESA) – a key step in assessing risk for commercial properties. Years of historical environmental data can inform lenders and developers about hazards that might be (or have been) adjacent to a property. Additionally, more lenders are also requiring a climate risk screen to assess risk from natural disasters. The most common types are risks from flood, wildfire, wind, extreme heat/cold temperatures, and seismic events. This means lenders need data on flood zones, climate events, and Sanborn maps as part of their due diligence process.

But today’s lenders need to consider more, such as ensuring a borrower’s compliance with an emerging patchwork of environmental regulations — such as New York’s Local Law 97 or SB 253 in California — that require certain buildings (by type and square footage) to follow carbon emissions standards or be subject to fines. LightBox has detailed property statistics that can help lenders conduct carbon emissions due diligence as part of their underwriting and loan documentation process.

Identifying Asset-Type Risks and Opportunities

LightBox’s ability to connect fragmented data and create a holistic picture of assets or properties assists lenders in evaluating the relational possibilities between properties in different asset categories.

This is especially relevant today, given the need to proactively identify underperforming assets before they are completely underwater.

In the office sector, this has been playing out since the pandemic as US employees now work in offices only about 3 days a week. As a result, firms continue to report that they are downsizing office footprints. The potential impact? Terminated or underperforming leases, delinquent loans, and an increase in defaults. One high profile example of what can go wrong: WeWork, once valued at $47B, filed for Chapter 11 bankruptcy protection in November under the weight of spiraling losses, as reported in the Wall Street Journal.

Calculating the scope of risk of any particular asset class or market is only part of the answer. In some cases, clients are investigating adapting an asset’s use, for example, repurposing aging office space for multifamily redevelopment. In fact, federal agencies are providing support and guidance to encourage developers to engage in conversion projects, according to AXIOS Multifamily Dive Brief. Some cities are already offering tax incentives and streamlining approvals for these conversion projects. But, flipping an office property to a residential one is not without complications. Knowing the zoning limitations or requirements for asset conversions can prevent potential problems that could be costly or delay the closure of a loan. LightBox zoning data provides market participants the detailed information they need to ensure the proposed redevelopment will meet zoning regulation codes.

Connecting data together for a comprehensive property analysis can also help identify assets and markets that are promising refinancing or investment opportunities. The industrial sector, the top performer of the past several years, has receded from its peak, even as rents have held up. But some analysts predict that manufacturing sites for electric vehicles and data centers that support AI technology will be key sector drivers and offer CRE investment opportunities in coming years.

These considerations require an in-depth, cross-asset-class analysis, which can provide lenders a complete view of their portfolio including the property characteristics, spatial relationships, zoning data, loan information, and valuations all tied to the address.

Connected CRE Data in Action

LightBox connected data also helps lenders in their due diligence regarding breaking news events that could impact their portfolios.

In these use cases, LightBox’s comprehensive data sets and analytics capability have high-value implications. Using the example of Bed Bath & Beyond’s recent store closures, LightBox data can make sorting through the plethora of related data a much quicker and easier task.

When Bed Bath & Beyond declared bankruptcy in April, lenders looked across their entire retail book to assess the magnitude of their risk. With unstructured data sets that are not connected, that’s normally a lengthy process. Because the LightBox data is connected across multiple layers, lenders can quickly see the scope of their exposure connecting at-risk properties to other attributes.

The possible use cases for this could just as easily assist in untangling the recent bankruptcies of Rite Aid or WeWork.

The bottom line for CRE lenders is to manage portfolios to avoid the downward pull of troubled loans as stress in this market persists. And as market activity returns, lenders who have remained strong across their portfolios will be in a competitive position when opportunities materialize. We know it’s just a matter of time — and being armed with the right data.