Editor’s note: LightBox recently held an invitational event in San Diego, California where Candi Coleman, Head of Lender Strategy, presented information regarding data digitization initiatives in the lending and appraisal industries. Here are some of the key takeaways from her conversation and the role that structured data will play in the industry.

Against the backdrop of significant data availability, AI, and market volatility, lenders and appraisers are at the precipice of an untapped technology opportunity. Here’s what lenders need to know to streamline their processes and access actionable data from appraisal reports.

Commercial Appraisals: The Current State

In the past 20 years, appraisers have made marginal technological progress in report delivery, transitioning from hard copies to digital PDF reports. Lenders will hire a third-party licensed appraiser and the process for procuring those appraisals has been automated using either the bank’s own proprietary system or specialized appraisal ordering applications like Collateral360 or RIMS.

Given that backdrop, the industry has ample opportunity for improvement. There is no standard data capture mechanism for commercial appraisals, and there is no automated process to extract the data from a PDF report; the data typically must be re-keyed to be delivered and ingested into various business systems. Valuable salient facts and conclusions from appraisal reports and other collateral due diligence reports remain locked in document formats that cannot be easily leveraged for analysis, benchmarking, and forecasting.

The upshot of having to re-key data is process redundancy, or lack of efficiency and errors. In addition, updates to datasets are manual and difficult to track. Only the largest lenders have begun to solve for structured data capture, as they typically have the resources and infrastructure to support the necessary technology.

Moving Toward a Standardized Dataset for Commercial Appraisals

The commercial appraisal sector has made an effort to move toward a standardized dataset, but progress so far has been slow. By contrast, in the residential real estate sector, government-sponsored entities Fannie Mae and Freddie Mac developed the Uniform Appraisal Dataset (UAD), a standardized industry dataset for appraisal information that is communicated digitally through the Uniform Collateral Data Portal® (UCDP®). The UAD standardization, developed under the direction of the Federal Housing Finance Agency, includes formats for fields, allowable values from a list of choices, abbreviations to enable more information on printed appraisal forms, and ratings and definitions for condition and quality.

On the commercial side, MISMO, the standards development body for the mortgage industry, is one of the organizations advancing the creation and adoption of standardized appraisal data for multifamily, retail, office, and industrial sectors. What could accelerate commercial adoption? GSEs regained market share in multifamily lending in 2023, which could tip the balance if the GSEs pursue a path that parallels the residential sector. But the desire for market participants to tap salient data with emerging technology may also accelerate adoption.

Structured Data is the Answer

Structuring data from multiple inputs for risk rating, stress testing, covenants, credit analysis and more will enable appraisers to better describe a property and deliver a holistic and consistent view of property characteristics. For mortgage lenders, structured datasets will make it easier to verify property eligibility and determine overall collateral risk. Despite mutual benefits, the CRE industry has moved at a slow and steady pace toward standardization, structure, and digitization. Of the banks LightBox surveyed at the event, fewer than 20 percent reported that data digitization is a current bank initiative. Still, it was unanimous among all attendees that extracted or digitized data has valuable application.

Adopting technology such as AI and large language models (LLM) offers a pathway toward streamlined collection, analysis, and reporting, fostering a more automated process to enhance decision-making across institutions.

Three Key Steps to Progress

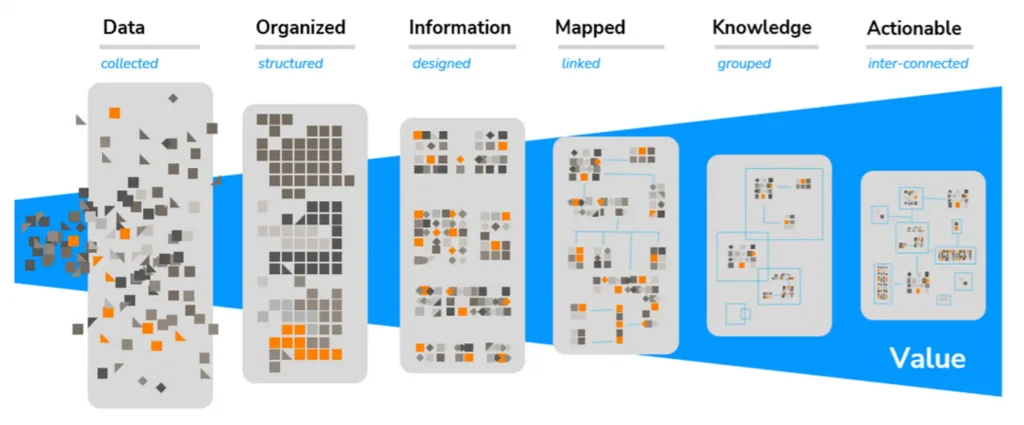

In response to the pressing need for structured data within the banking industry’s appraisal sector, LightBox is working to facilitate the transformative digitization efforts. Ms. Coleman outlined key steps where lenders are seeking assistance: first is transforming unstructured datasets and then integrating them into a mapped system of actionable datasets. The challenge is navigating the complexities of appraisal data with efficiency while also keeping data privacy a top priority. The three key steps are establishing:

- A standardized dataset to allow for structured schema that can be adopted by the commercial real estate industry to allow for enhanced analysis and reporting.

- A standardized transport mechanism. The JSON transfer mechanism allows for delivery of structured data in a format that can be ingested into any analysis toolset.

- Digitization of data (extracted data) for application in key use cases.

Join the Conversation

Want to learn more about what industry participants are doing to tap emerging technology? Join us at the 2024 LightBox PRISM Conference in Dallas, TX from May 13-15, where we’ll explore the industry’s timeliest topics, including the session: Using AI to Unlock Data in Commercial Real Estate Appraisals. Learn more about PRISM 2024 >

About Candi Coleman, MAI

With over 27 years of experience in the appraisal and financial industries, Candi Coleman, MAI is an adept real estate, regulatory compliance, and technology professional. As the Head of Lender Strategy for LightBox, Ms. Coleman works on behalf of our Lender and Appraisal communities by acting as a conduit to influence products, data usage, reporting and compliance management. Acting as a consultant for both our internal and external business partners, Ms. Coleman helps to share her knowledge through best practice guidance using real world experience with key stakeholders.