2023 sets the record for weather disasters costing $1 billion or more.

- 2023 has set a record for the number of weather disasters in the U.S. costing $1 billion or more, with 24 confirmed events as of mid-October. This surge in extreme weather events is bringing climate risk into sharper focus.

- Climate risk is gaining more attention in the real estate industry due to the increase in extreme weather events.

- Types of environmental risks are assessed to understand a property’s susceptibility to various climate-related challenges.

The impact of climate risk on real estate is gaining more attention as extreme weather events rise. With a few months remaining in 2023, the U.S. has set a record for the number of weather disasters in a year that cost $1 billion or more. As of mid-October, the National Oceanic and Atmospheric Administration (NOAA) reported that 24 confirmed weather/climate disaster events with losses exceeding $1 billion have affected the U.S. this year, including two flooding events and 18 severe storm events. That’s well above the eight-event annual average between 2008 and 2020.

The rapid increase in extreme weather/climate-related events elevates the importance of climate risk exposure of commercial properties, particularly those built in flood-prone areas. In our continuing series on LightBox EDR’s 2023 Benchmark Survey of Environmental Consultants, we explore emerging best practices on how environmental professionals respond to the growing demand for assessing climate risk during Phase I environmental site assessments.

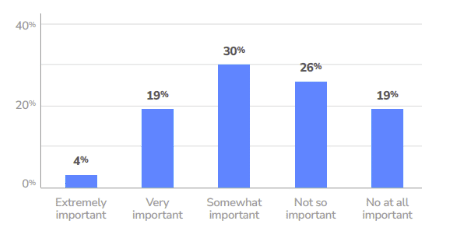

Our team asked how environmental specialists would characterize the importance of climate risk assessments in today’s commercial real estate deals and loan originations, 30% selected “somewhat important,” and another 23% selected “extremely important” or “very important.”

Many respondents noted that property location is an essential factor, with flood risk considerations being given more significance on Phase I ESAs on properties in coastal areas where sea level risk is often included in the assessment.

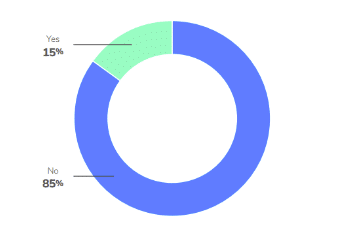

Another key finding is that clients specifically ask 15% of environmental professionals to conduct a climate risk screen. The U.S. Department of Housing and Urban Development, the Federal Aviation Administration, federally-funded projects requiring NEPA review, and lenders’ requirements are key drivers.

When asked what types of environmental risks they look at when conducting a climate risk screen, 137 survey respondents gave various answers. In order of frequency (highest to lowest), the most common types were flood risk/floodplain/sea level rise, wildfire, wind, extreme heat/cold temperatures, and seismic risk. As noted by one respondent, “We always consider flood risks as potential business environmental risks in our Phase I reports.” Another commented, “If we were conducting a climate risk assessment, it would address the property’s likelihood of being affected by inland flooding, sea-level rise, wind impacts, wildfire and mudslides.”

The tools and property-level data available for assessing a commercial property’s exposure to risks like floods, wildfires, and other extreme weather events will improve as demand for climate risk assessments grows. Remarkably, given the rapid rise in insurance rates for buildings in flood-prone areas, the need for asset-level analysis is becoming a critical factor in investment and lending decisions. Thus, environmental due diligence is relied upon to support those decisions. When the following LightBox EDR benchmark survey is conducted, it will be interesting to see how much the 15% of EPs being asked to address climate risk as part of environmental due diligence has increased. As AEI Consultants’ CEO Holly Neber observed at the recent GreenBuild conference, “Traditional environmental due diligence is evolving. Risk management, due diligence and sustainability are all aligned to support assets that retain and grow their value for the long-term by being informed, prepared, and operating efficiently.”

ABOUT THE 2023 BENCHMARK SURVEY

LightBox EDR is dedicated to tracking and understanding trends in the property due diligence market and responding to our client’s requests for current industry benchmarks. In 2023, LightBox EDR invited a sample of environmental consultants and engineers across the United States to complete a survey with questions on market performance, Phase I ESA pricing and turnaround time, clients’ risk tolerance, the near-term outlook and top business challenges. More than 300 environmental professionals responded to the survey over three weeks, representing almost every US state and a broad cross-section of firm sizes and types.

Click here to view the complete summary of survey results.

The following blog will look at Phase I ESA industry technology trends.