Our annual Sentiment Survey, conducted at a time of considerable market uncertainty, provides a unique opportunity to explore today’s complex market conditions through the lens of LightBox’s broad client base across the commercial real estate (CRE) lending, brokerage, investment, appraisal, and environmental due diligence sectors. The findings, analyzed and expanded upon through interviews with industry experts, point to the many challenges – and opportunities – across the LightBox ecosystem.

Our goal in sharing these findings is to report on what our CRE clients are experiencing across the U.S. and highlight key commercial real estate trends in the rapidly changing market landscape, the critical role of technology in addressing the industry’s top business challenges, the growing importance of climate risk in dealmaking, and valuable perspectives on emerging opportunities and the near-term forecast.

The findings, analyzed and expanded upon through interviews with experts in the commercial real estate industry, point to the many challenges — and opportunities — across the LightBox ecosystem.

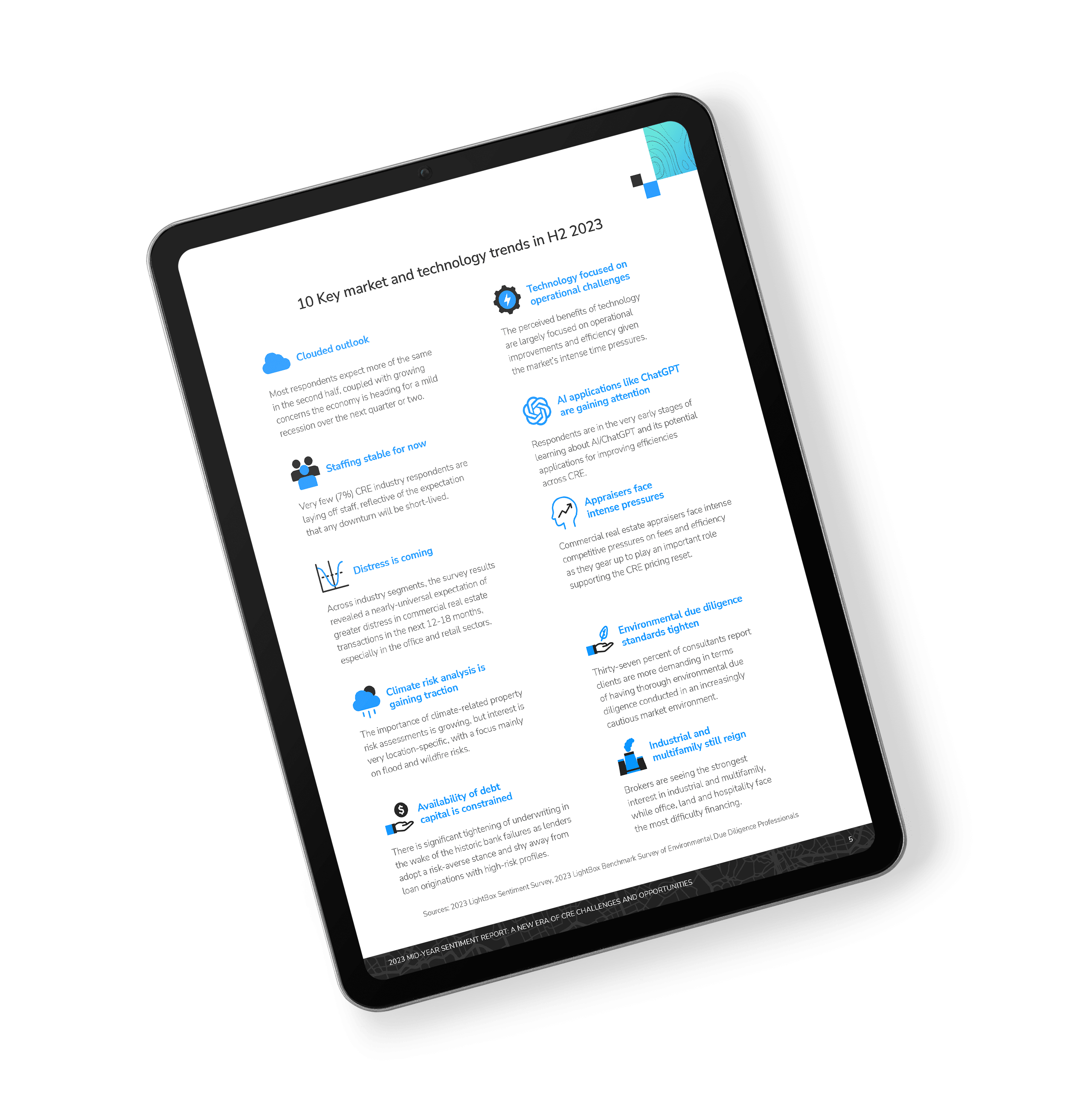

Key findings of the 2023 Mid-Year Sentiment Report: A new era of CRE challenges and opportunities

- Staffing Plans: Active hiring across the board fell by 15% over Fall 2022

- #1 Market Concern: Potential for economic recession

- Appraisal: Slightly better than a slow Q4 2022 but operating in a “pens down” mode

- Climate Risk: Somewhat important/Very important responses at 54%

- Distress: 89% of brokers and field appraisers expect to see it over the next 12-18 months

- CRE market expectations for second half of 2023: 48% see no change