HELPING THE REAL ESTATE INDUSTRY MANAGE CLIMATE CHANGE RISK THROUGH DATA AND MODELING: A LIGHTBOX PERSPECTIVE

1. The adverse effects of climate change are driving the development of new climate data, risk modeling, and analysis tools.

2. Banks and other firms understand the need for climate modeling but have been slow to embrace it for a variety of reasons.

3. Regulations from the SEC and other government agencies will likely spur change.

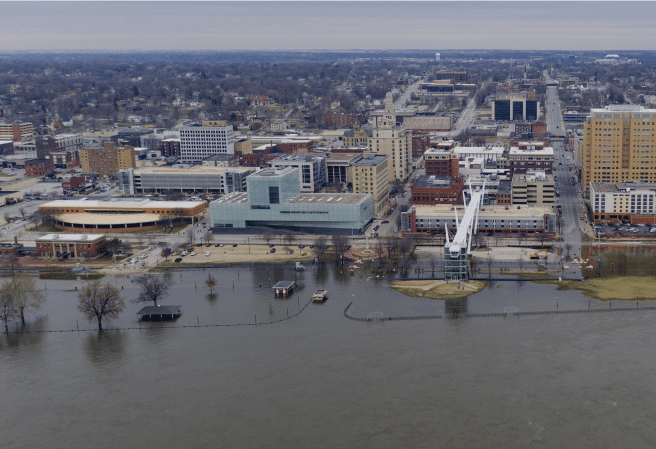

The annual damage that natural events inflict on commercial and residential real estate continues to rise significantly—and much of it is directly related to climate change. Market participants, including equity investors, lenders, regulators, and other stakeholders, are increasingly focused on this issue for two reasons: the potential impact their activities have on the environment—the “E” in environmental, social, and governance (ESG) investing—and to prepare for the effects of climate change on property and infrastructure by developing resiliency schemes (ESG+R).

Climate modeling and climate data as services and products aren’t new. The insurance and re-insurance industries have used catastrophe modeling for decades, and public data for flood and seismic zones and other hazards has long been collected and disseminated. The expansion beyond insurance is tied to the growing global push to address the effects of climate change, which has led to a rise in the number of climate-modeling companies.

The market for physical hazard data is transforming rapidly, especially when it comes to climate change. LightBox has been a data partner to several of the research companies building forward-looking models to project the probability and scale of events over an extended time period. We provide these companies with core property characteristics, building footprint coordinates, and other critical metrics such as elevation and soil type, as well as the tools to help them spatially join that data with their own. These companies are beginning to turn their attention to calculating dollar amounts associated with these losses. LightBox supported FirstStreet Foundation’s efforts to quantify residential flood risk (https://firststreet.org/press/aal_launch/) and has an agreement to distribute its output. We are also helping FirstStreet scale wildfire risk projections.

LightBox provides clients physical hazard data via public data sets that we have gathered directly or via partners. Much of this data—such as FEMA flood and seismic zones—reflects current risks. LightBox has also mapped the individual components of the new FEMA Risk Index to the properties in our database and makes that available via our core API products.

Climate model predictions of various types, asset vulnerability and adaptation modeling, real-time event tracking, benchmarking, current hazard characterization, and the measurement and benchmarking of energy consumption and greenhouse gas emissions are among the current solutions on the market. LightBox has connected with most of the firms developing them. In the future, we believe new uses for our data will emerge as businesses and government agencies seek broader solutions for understanding and managing climate change risk.

Market Demand for Climate Models: Where Things Stand Now

The insurance industry’s need for climate modeling data is well established, but broader adoption has been slower to take hold. The private sector has been reluctant to lead in adopting climate models. While some firms want to understand their exposure to hazards, acting as an early adopter by limiting proceeds or requiring additional insurance could put them at a competitive disadvantage.

Several large asset managers have spoken about the topic. In a recent presentation, AEW discussed greenhouse gas targets and how the company manages its portfolios to reach them. The Federal Reserve expects large banks to lead the creation of policy and to build internal models. Shareholders of most major banks are calling on the firms to play a more active role. Bank of America says climate risk is both a safety and soundness issue and a source of reputational risk. While there is significant interest in understanding climate exposure and resiliency, an unwillingness to pay for climate models and the belief that little action can be taken based on them has limited their market growth thus far.

In the U.S., government agencies such as the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Federal Housing Finance Agency, and the Securities and Exchange Commission have recently issued requests for information—LightBox responded to the FHFA RFI—but no regulations have yet been enacted. The SEC recently published a proposal that, if enacted, would require certain public companies to make disclosures, largely related to greenhouse gases, beginning in 2023. It will require lenders to potentially understand their role in the entire supply chain. For example, if they have funded the acquisition of a property and one of the tenants is a polluter, the bank will be assigned a portion of those “Scope 3” emissions.

FEMA’s zone designations can have a dramatic impact on the obligation to acquire flood insurance and on the rates property owners pay. The new Risk Factor 2.0 model is an attempt to improve upon this. However, because of the substantial changes in flood risks and the potential impact on consumer insurance rates, it is being phased in gradually. FEMA’s Risk Index provides numeric risk scores at the census-tract level and scoring of communities’ ability to pay for adaptation projects.

The American Society for Testing and Materials (ASTM) has established an initiative with climate modeling firms, investors, and environmental professionals to create a guide and a standard for property resiliency assessments. It focuses on screening and hazard identification, site specific vulnerability evaluation, and custom resilience or adaption measures. LightBox is engaged in support of this effort.

Finally, several environmental consulting firms have businesses dedicated to resiliency analysis and mitigation. An initial assessment report identifies potential hazards and ranks them by potential damage and probability, after which specific mitigation projects are proposed to clients. One recently indicated a further need to benchmark utility consumption.

Government Regulations Will Eventually Move Climate Modeling Forward

Given the market’s relatively slow adoption of climate models, it may take strong, clear regulatory action to spark demand. It’s too early to tell how the recently released SEC proposal will play out. In the meantime, we’re preparing for the future. Climate change isn’t going away, and neither will the need for accurate, timely data to help manage the wide range of risks that come with it.