CRE Market Index Reflects Continued Elevated Confidence, Tempered by Growing Concerns

Insights from the Market Confidence Report

Dianne Crocker, Principal Analyst at LightBox

The latest LightBox Market Confidence Index, while still elevated, reflects a slight moderation in the dramatic improvements of late 2020 and early 2021. Based on a broad-based survey of commercial real estate professionals across the U.S., the index now stands at 149.2, slightly lower than 154.4 in the second quarter, but still well above the Q2’20 low point of 114.1 (adjusted to an April 2020 baseline of 100). The index tracks overall confidence levels based on results from three key barometers: respondent’s views of the overall market, the pace of their own activity, and staffing plans. While the third quarter results reflect fewer respondents experiencing “significant increases” in their business as the pace of recovery slows, the percentage hiring employees now stands at its highest level since April 2020. Notably, most respondents are operating at full or near full capacity relative to pre-pandemic levels, a significant improvement over mid-2020 results.

LightBox’s early indications from the broker, valuation, lending, and environmental due diligence sectors indicate that a robust fourth quarter is well underway. The forecast of one of rational exuberance, a combination of optimism led by healthy investment and underwriting activity but tempered by concerns about the COVID variant’s effect on the market and inflation. If market fundamentals continue their positive trajectory, the 4Q21 index is expected to remain at high levels heading into the new year.

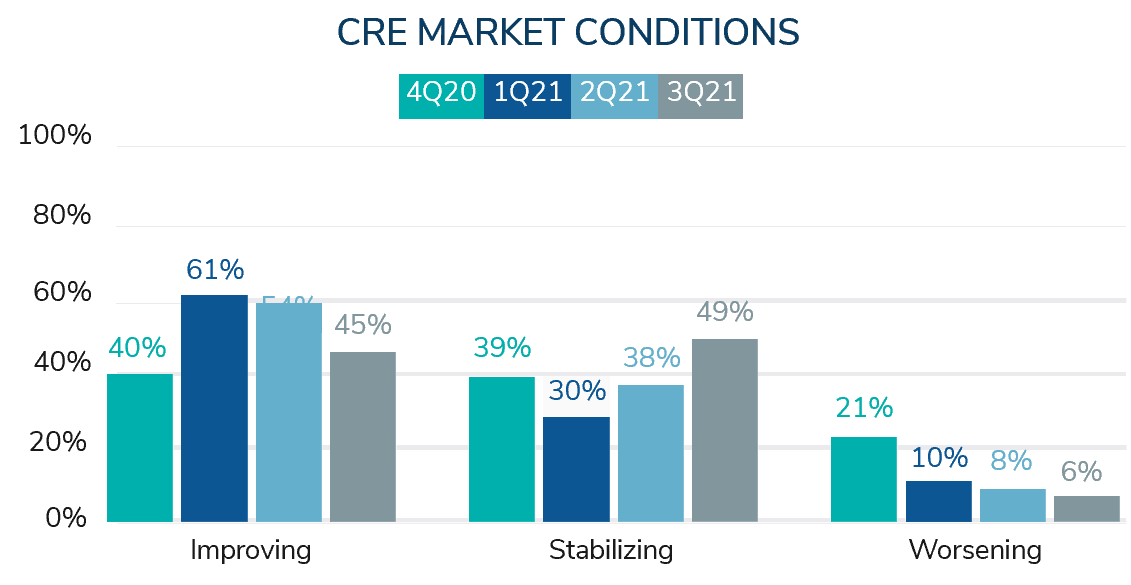

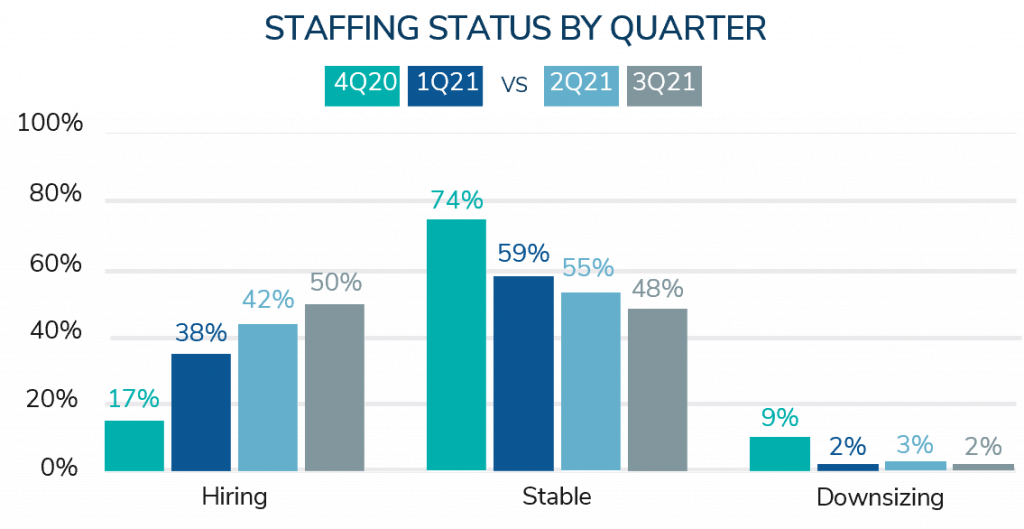

Overall Market Conditions

The third quarter results reflect a slight shift from those respondents who view the overall market as “improving” to “stabilizing.” This transition is a notable change from the results of 1Q21 when the market was experiencing double- digit growth in transactions as the market recovered from the depths of the downturn. At the other end of the spectrum, the percentage who view the market as “worsening” declined to a record-low of 6%. By region, differences are minimal. Respondents were slightly more likely to report improving market conditions in the Southwest (46%), Southeast (44%), and MidAtlantic (40%) regions than respondents in the Northeast (37%) and West (35%) regions.

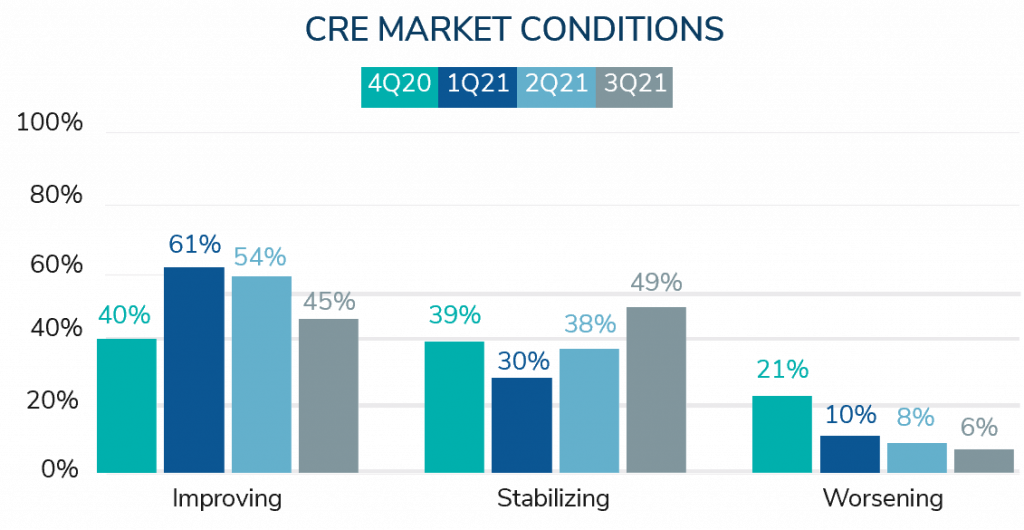

Respondents’ CRE Activity

The latest results also reflect a moderation in respondents’ own business activity in 3Q21 relative to earlier this year. A still-solid 56% experienced a “slight” or “substantial” increase in the latest quarter versus 60% in 2Q21 and 71% in 1Q21. Only 9% experienced a third quarter decline, a negligible change from 10% in the previous quarter. Asked to forecast how they expect their 2021 annual volume to compare to 2020, nearly one-third (30%) expect a “substantial increase” over last year, and another 49% expect a “slight increase,” not surprising considering the abrupt decline in activity after the pandemic hit in 2Q20.

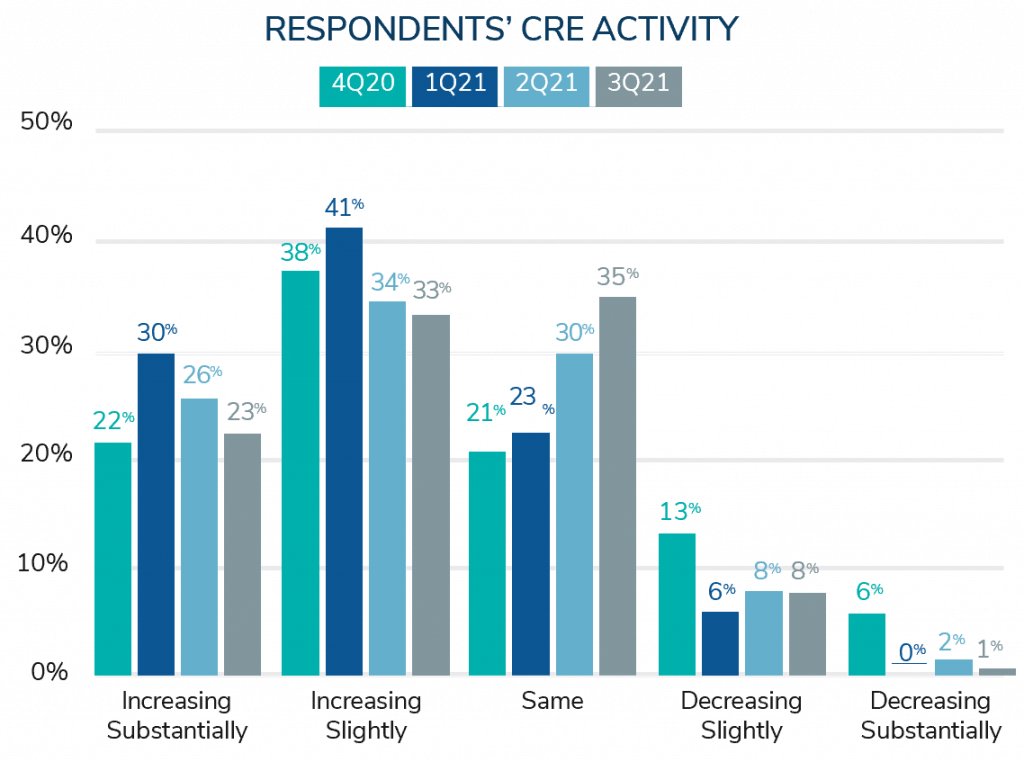

Staffing

In anticipation of future market growth and business opportunities, most respondents are looking to expand staff, and very few are downsizing. At 50%, this is the highest level since the 2Q20 launch of the LightBox Confidence Index survey and nearly three times hiring levels at year-end 2020. With most companies now operating at full of near- full capacity (versus only 70% one year ago), demand to fill positions to accommodate heavy workloads is high, although many respondents aired their frustration at an inability to find qualified candidates given today’s labor shortage.

Additional Observations

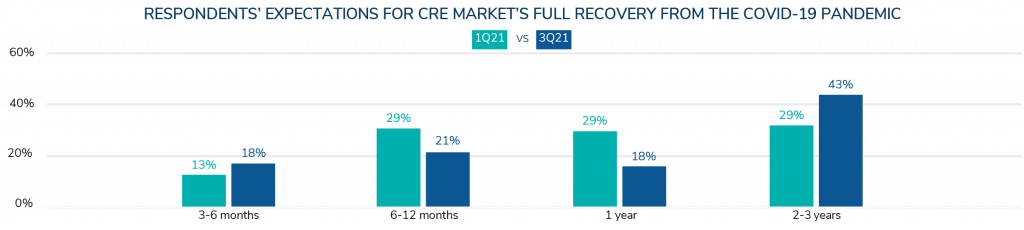

At the start of 2021, promising news of the vaccine pointed to light at the end of the tunnel, but the latest quarter’s results reflect a slightly more cautious yet still optimistic view of the market. Several new concerns have emerged or intensified since our 2Q21 survey: rising inflation, the lingering impacts of the pandemic, higher interest rates, fiscal policy uncertainty and political unrest. These concerns took a toll on the forecast, and respondents have shifted to a longer-term expectation for the market’s full recovery from the pandemic. Forty-three percent now believe it will be two to three years before the market recovers fully from the pandemic, up from only 29% at the start of 2021. Sixty percent of respondents have yet to see distressed assets surface in their area, another 37% have seen distress, albeit “only to a small degree.” Looking ahead, 34% expect to see higher volumes of distressed properties, but not until the second half of 2022.

Asked what types of properties or deals are seeing the most activity, industrial/warehouse tops the list (54% of respondents), followed by multifamily (47%). Industrial properties near commercial hubs remain in high demand, along with apartment buildings in growing metros. As one respondent observed, “Office, hospitality, and retail have a long way to go for full recovery, while industrial has grown significantly and may be in for a correction at some point.” Notably, one big accelerant in the market is an expansion in investor focus to smaller metros and alternative asset classes. Opportunities are growing in areas that benefitted from pandemic-led relocations as well as in the development of vacant land for housing/multifamily construction, and value-add projects in office and retail. The market is poised for a strong finish to 2021, and the results of the next Confidence Index Survey will be very telling as clients begin to think about their 2022 forecast given growing market concerns.

About the Market Confidence Index

The goal of the LightBox Market Confidence Index is to gauge quarterly shifts in prevailing business conditions across the commercial real estate ecosystem, and insights that shape the near-term outlook. The index is calculated based on responses in three key areas: how respondents perceive the overall commercial real estate market, changes in their own business activity, and staffing plans. The weighted score is then normalized to an April 2020 baseline of 100, the first month of data collection. The 3Q21 survey closed October 10, 2021. The results reflect the views of an invited group of LightBox clients from the following sectors: environmental due diligence consultants/engineers (74%), appraisers (12%), commercial real estate lender (4%) and other commercial real estate professionals (10%). The next survey will be conducted in early January 2022 to collect sentiments on 4Q21 activity and expectations for the new year.