The recent news that the U.S. Environmental Protection Agency (USEPA) designated two PFAS chemicals (per- and polyfluoroalkyl substances) as hazardous substances under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) is a significant development for environmental due diligence professionals in the commercial real estate (CRE) industry. Notably, the USEPA’s rule requires additional PFAS considerations be included in the scope of work for any CERCLA-driven Phase I Environmental Site Assessments (ESAs).

The rule is the latest federal response to the health risks associated with PFAS exposure and as scientific evidence expands, so does the potential for property liability exposure. A recent New York Times article quoted an attorney who predicted that upcoming litigation could “dwarf anything related to asbestos.” The USEPA designation essentially shifts responsibility for PFAS cleanup at contaminated sites to polluters—like any other Superfund cleanups—and President Biden’s 2021 infrastructure law provides $9 billion for communities to address PFAS contamination.

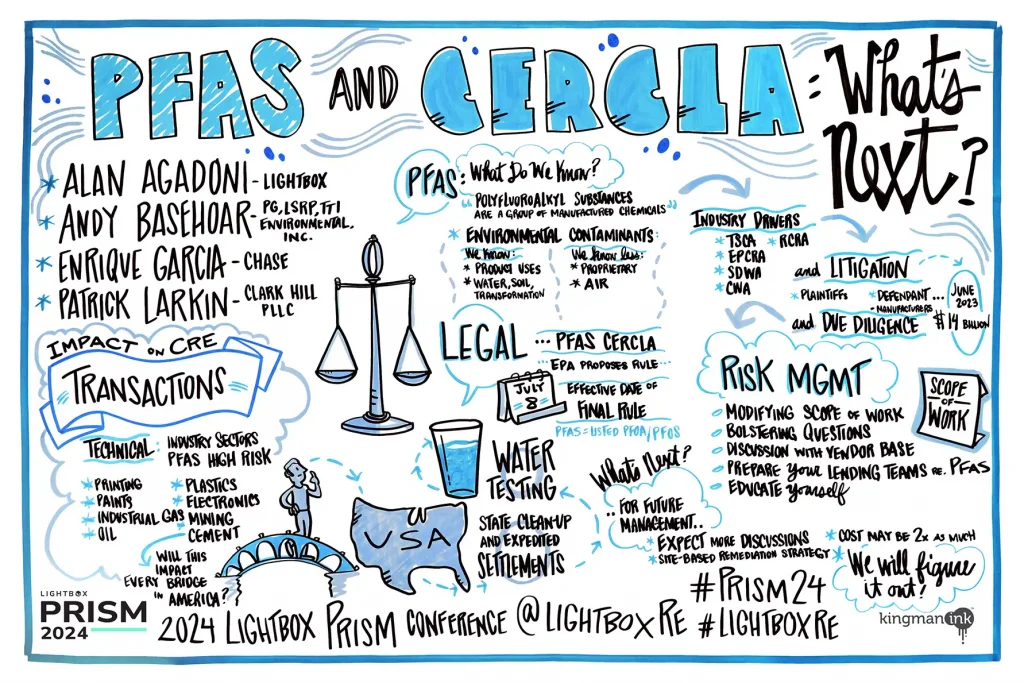

That leaves the environmental due diligence industry, CRE lenders and other stakeholders to grapple with how best to assess properties for PFAS risk before the new rule’s effective date of July 8, 2024. At the recent LightBox PRISM conference, which gathers leading environmental consulting firms, financial institutions, and appraisers from around the country, a track titled “PFAS and CERCLA: What’s Next?” tackled this complex issue. A panel of leading experts discussed the technical impacts of the new designation from three unique perspectives: attorney, lender risk manager, and environmental property consultant. The panel was moderated by Alan Agadoni of LightBox and featured attorney, Pat Larkin of Clark Hill Public Strategies, risk manager Enrique Garcia of JP Morgan Chase, and environmental professional Andy Basehoar of TTI Environmental, Inc.

The Attorney’s Perspective: Legal Implications and Strategies

Pat Larkin, Senior Director at Clark Hill Public Strategies, highlighted the substantial legal implications of the new PFAS rule, noting that “Regulators like the USEPA are now enforcing PFAS-related liabilities more stringently, and this is likely to result in a significant uptick in legal disputes.” As such, Larkin emphasized the critical importance of environmental professionals, appraisers, and risk managers to consult with legal experts during PFAS due diligence to navigate the complexities of the new regulations. “Engaging with an attorney early in the due diligence process can help identify and manage potential legal challenges, ensuring compliance and minimizing liability,” Larkin explained.

The Risk Manager’s Perspective: Incorporating PFAS Into Standard Processes

Enrique Garcia, Executive Director at JP Morgan Chase, underscored the concerns from the perspective of risk managers at lending institutions, noting that “the lending sector is particularly focused on the risk management aspects of this new rule.” He pointed out that with PFAS now under the CERCLA umbrella, banks and other financial institutions must now incorporate considerations about this class of chemicals into their risk assessment frameworks.

Garcia raised several critical questions that lenders are grappling with:

- How will this impact Phase I ESA reports?

- Are we looking at more extensive and expensive Phase II investigations?

- What are the risks to lending decisions and foreclosure processes?

While he noted that some risk managers have begun to accept background concentrations of certain contaminants like arsenic, PFAS presents a unique challenge due to its widespread presence and persistent nature. “Ultimately, lenders will likely need to adopt a multi-pronged approach, balancing the need for thorough due diligence with practical considerations of cost and feasibility.” He suggested that lenders need to prioritize properties based on specific risk factors and ensure that their due diligence processes are robust enough to withstand scrutiny from regulators and stakeholders alike.

The Consultant’s Perspective: Technical Challenges and Solutions

Andy Basehoar, Site Remediation Program Manager at TTI Environmental, Inc., provided insights into the myriad technical challenges posed by the new PFAS rule. “For environmental professionals, the transition from Phase I ESAs to Phase II investigations under this new rule is complex,” Basehoar observed. He highlighted the need for environmental professionals (EPs) to adapt quickly to the changing regulatory landscape, emphasizing the importance of understanding the sources and transport mechanisms of PFAS.

“Consultants must be prepared to conduct more detailed assessments, including soil and groundwater testing, to identify and quantify PFAS contamination,” Basehoar explained. He also noted the potential for increased remediation efforts, which could significantly impact project timelines and costs. “The circular life cycle of PFAS means that remediation strategies must be comprehensive and forward-looking.”

Basehoar also emphasized the importance of staying current with evolving industry standards and best practices. “The ASTM E 1527-21 Phase I ESA standard is a valuable tool for ensuring consistency and transparency in addressing PFAS risks,” he remarked. He advises consultants to leverage such standards to enhance the reliability and credibility of their assessments.

Navigating the New Era of PFAS Due Diligence

The designation of PFAS as a hazardous substance under CERCLA represents a significant milestone with implications for environmental due diligence and risk management decisions during commercial property transactions. From legal complexities and financial risk management to technical assessment and remediation challenges, the impacts of this new rule are far-reaching as the industry adjusts to the new regulatory landscape. One thing the panelists agreed on was the critical importance of technical expertise in assessing PFAS risk and developing robust strategies for minimizing liability exposure. By proactively addressing the legal, financial, and environmental considerations of PFAS risk, the CRE industry can better manage liabilities, protect investments, and ensure compliance with emerging regulatory requirements in this rapidly changing environment.