As the end of the first quarter nears, commercial real estate professionals are watching for signs of a market in transition while awaiting word from the Fed on the timing of the first round of interest rate cuts. Below is a look at the developments shaping up so far this quarter and an early look at LightBox market metrics across key commercial real estate segments.

Early Look at LightBox Metrics Barometer

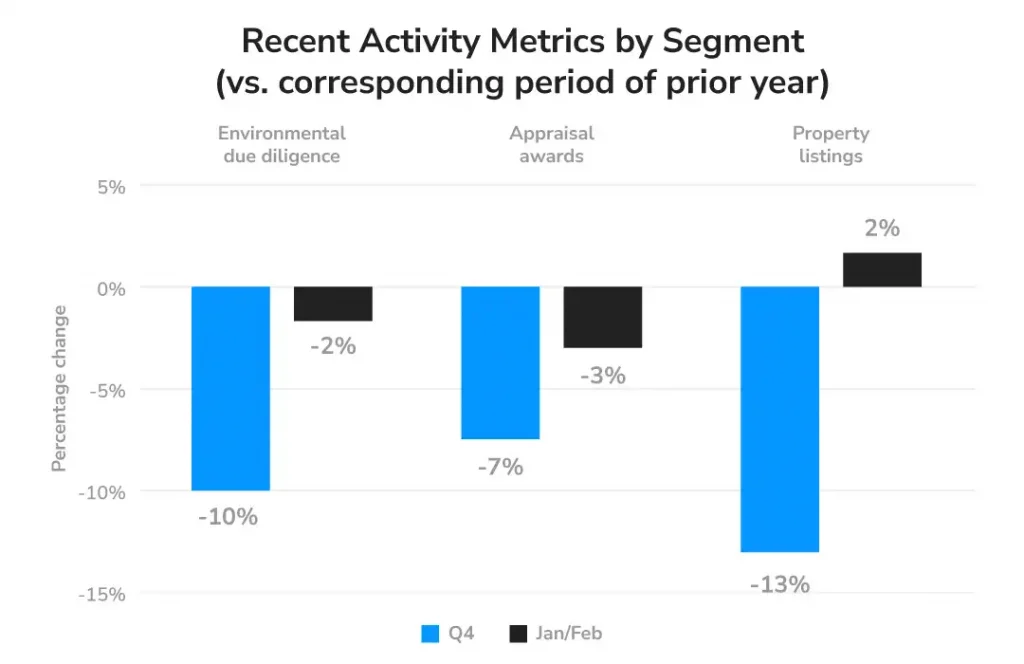

January and February volume across LightBox platforms provides an early view into how Q1 2024 could end up in terms of three key CRE market barometers:

Property listings: a measure of sellers’ willingness to put assets on the block

Environmental due diligence: an early indicator of lender origination/refinance volume

Lender-driven appraisals: an early indicator of lender origination/refinance volume

The good news is that 2024 activity as of the end of February across all three segments reflects an improving trend year over year (YOY) with less severe declines than we saw in Q4 2023. The total volume of property listings brought to the LightBox RCM platform showed promise with a 2% increase in the January-February timeframe compared to last year, when interest rates were still on an increasing trajectory.

Headline Makers So Far in ‘24

- Those eager for interest rate cuts will need to be patient. At the Fed’s January and March meetings, the committee voted to hold rates steady for the 4th and 5th consecutive times. In its March FOMC statement, the Fed cited recent market indicators of an expanding economy, such as strong job gains and the still-low unemployment rate. The hesitation to cut rates is that, although inflation, while easing, remains elevated. The Fed is in ‘wait-and-see’ mode and does not expect to reduce rates until there is “greater confidence that inflation is moving sustainably toward the 2% goal.”

- Assuming rates begin to retreat (likely by mid-year), CRE transactions are expected to pivot into growth territory in the 2nd half of 2024 for the first time in 2 years with forecasts in the range of a 10-20% increase for the year.

- The Mortgage Bankers Association released its latest forecast in February, predicting that originations this year will rise 29% above 2023’s low point, noting that 20% of the $4.7 trillion in outstanding commercial mortgages will also mature this year, a 28% increase from 2023 maturities.

- In retail, sands are shifting while some major retailers like Family Dollar, Dollar Tree and Macy’s shutter stores and others like Aldi’s and Target announce aggressive expansions.

- NY Community Bank closed a $1 billion capital infusion deal, putting the spotlight back on banks’ risk exposure due to underperforming commercial real estate loans.

- TX Board of Education just divested $8.5 billion in assets from BlackRock, citing an ESG strategy that promotes a transition toward green energy investments that is at odds with state law prohibiting state investment in companies that “boycott the oil and gas industry.”

- Major investors including Goldman Sachs, Blackstone and others announced plans this month to actively invest in U.S. commercial real estate again, fueled by a sense that prices may be bottoming out. Other major players are likely to follow suit as investors grow impatient and go into hunting mode for opportunities that present the best ROI early in the market turnaround.

Quotes from the Field

The major conferences LightBox attended already this year were: CREFC, NMHC’s Annual Meeting, NAI Global Convention, MBA CREF, NAIOP I.CON West and the RMA Chief Appraiser Roundtable. In general, there was a mix of guarded optimism that 2024 would finally deliver a gradual improvement in commercial real estate lending and investment, as well as a fair amount of concern surrounding the specter of rising distress as more loans approach their maturity dates.

Andrew Phillips, Head of Sales and Strategic Partnerships for Capital Markets at LightBox said, “I was on a panel session in early 2023 where I stated that I expected the market to show signs of recovery beginning in September 2024, and it seems from the clients I’ve been talking to during this year’s conference season that many CRE executive now expect that timing to be more and more likely.”

Furthering the cautiously optimistic narrative, Dianne Crocker, LightBox Principal Analyst shared, “I sensed a palpable shift in sentiment at the EBA winter conference compared to what I saw at the summer conference. Environmental due diligence consultants and lenders are readying staff to handle an expected uptick in work this year related both to loan maturities and distress as well as opportunistic capital moving back into play.”

Notably sentiments can vary widely by focus area. Greg Kaiser, Director, Strategic Accounts for Capital Markets at Lightbox said, “So far this year, attendees at the conferences I’ve attended have had a varied sentiment based on asset types of focus. At NMHC, I felt cautious but excited optimism, but at the NAIOP conference and in conversations with my contacts who typically attend SIOR, the mindset is more subdued given the challenges in the office and industrial sectors. Overall, I’m sensing that multifamily and retail brokers are more upbeat in their outlook for the year and have already begun to see things shake loose. In all, I think most are hopeful for some movement toward the end of Q3.”

Q1 2024 CRE Market Snapshot Report Series

For a complete analysis of market trends and quarterly benchmarks, watch for the release of the Q1 2024 LightBox CRE Market Snapshot Series:

- Part 1 Lender-Driven Appraisals

- Part 2 Phase I Environmental Site Assessments

- Part 3 Capital Markets and CRE Investment Trends

Keep an eye out for the Q1 2024 Market Snapshot Series and CRE Activity Index that tracks trends across all three sectors of commercial real estate and forecasts expectations for the rest of 2024.