Learn key takeaways from the recent LightBox 2023 Mid-Year Sentiment Report.

- Three trends—concerns over a recession, pricing uncertainty, and a growing number of loan maturities—continue to gain ground

- Market uncertainty, bank failures, climate change, and a drop in hiring are top concerns and challenges among real estate professionals

- New technologies are helping firms across the commercial real estate industry streamline their workflows, but it remains to be seen how disruptive artificial intelligence will be

The LightBox 2023 Mid-Year Sentiment Report, conducted at a time of considerable market uncertainty, looks at today’s complex CRE market conditions through the lens of our broad client base across the commercial real estate lending, broker, investment, appraisal, and environmental due diligence sectors. The findings, analyzed and expanded upon through interviews with industry experts in the commercial real estate sector, point to challenges and opportunities across the ecosystem. The report highlights key trends such as the critical role of technology in solving business challenges and the growing importance of climate risk in dealmaking, looks at emerging opportunities, and offers a near-term forecast.

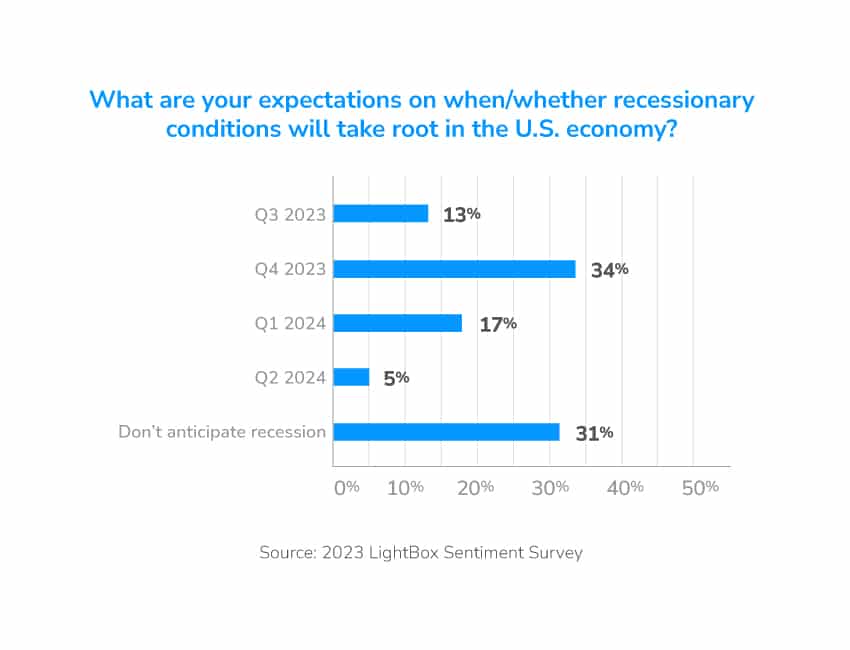

Three trends—recessionary concerns, pricing uncertainty, and the wave of loan maturities over the next 18 months—were gaining ground when the LightBox Fall 2022 Sentiment Report was released and continue to affect the commercial real estate market. Nearly half of the survey respondents (47%) expect a recession sooner rather than later (22% in 2024), while about one in three (31%) do not expect one at all. The CRE industry is struggling with a wide range of business pressures. The top three for investors, brokers, environmental consultants, and field appraisers are finding new business, maintaining profitability, and responding to competitive pressures.

What follows are the 10 key takeaways from the report, which can be read in full here.

- Market uncertainty continues. Deals are difficult to complete, capital flows are subdued, and property valuations are in flux. The CRE market is bracing for a wave of nearly $900 billion in loan maturities over the next two years for which refinancing may prove difficult, especially in the office and retail sectors. Economic uncertainty and reduced revenues are prompting some companies to scale back expansion plans or reduce their footprints, most notably in the technology sector.

- Banking turmoil has sparked greater caution in the CRE market despite three quarters of tighter underwriting standards. A slow first quarter, combined with the historic failures of Silicon Valley Bank and Signature Bank in March and First Republic Bank in May, affected previous forecasts for a more robust second half of 2023. Lending will likely be more constrained during the next few quarters as the market seeks reassurance the banking system is on solid footing.

- Hiring decreases: Staffing plans are a direct function of market confidence, so while it is encouraging that only 7% of respondents are reducing headcount, there is a notable decrease in hiring compared to LightBox’s fall market sentiment survey, from 60% to 25%.

- Brokers and investors are seeking new opportunities: Amid a bid-ask gap between buyers and sellers, growing recessionary concerns, and difficulty getting bank financing, brokers and lenders are dealing with office space vacancies fueling decreased values, too many assets incurring deferred maintenance and vacancies, an increase in delinquent real estate taxes, and banks purging under-performing assets. Financing is challenging in high-risk asset classes.

- Commercial real estate lenders have largely adopted a risk-averse posture: Scrutiny on lenders’ risk exposure is intense and some banks are already actively planning to divest some commercial real estate loans to reduce risk, redeploy capital, and drop potentially distressed assets. Regulatory pressure seems certain to continue particularly on institutions with a high percentage of loans backed by office properties on their books.

- Environmental consultants report increased pressure to address clients’ demands for more thorough property investigations in response to market uncertainty. Clients have tightened their environmental due diligence standards and are more demanding.

- Appraisers are challenged by lower volume. Tighter capital, the higher costs of financing and refinancing, and weaker economic conditions will result in a lower overall valuation of commercial real estate prices. Near-term appraisal demand is likely to remain muted as lenders adjust to further interest rate hikes, loan maturities, and the fallout from bank failures.

- Climate risk has taken on new importance with property managers, owners, and investors. Nearly one-quarter of survey respondents (22%) across the LightBox sample noted climate risk plays a “very important” role in commercial real estate deals today, and another 32% see a “somewhat important” role.

- Technology is playing an increasingly important role in enabling professionals across the industry to improve efficiency, accuracy, and reporting. Respondents view the benefits of technology in terms of operational benefits like addressing process inefficiencies and workflow rather than any competitive advantages or quantifying outcomes to better serve customers.

- In terms of the risk spectrum, office ranks first, yet there are opportunities investors are pursuing in certain metros, particularly those that experienced post-Covid population booms. The concern is that office buildings face a larger share of loans and leases coming due in a higher interest rate environment.

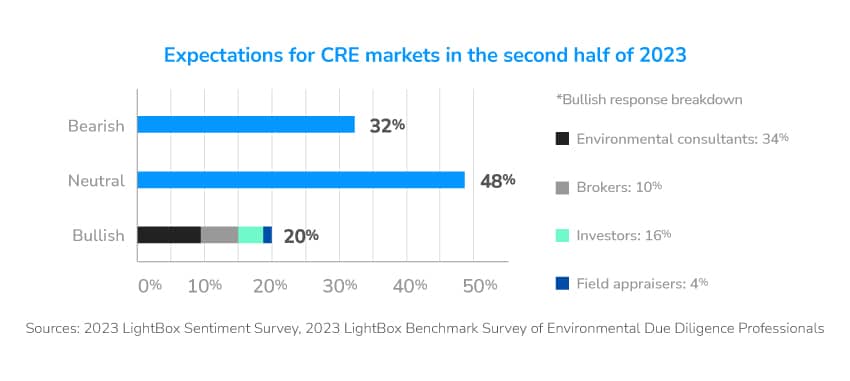

Because of the high level of market uncertainty, survey responses about the near-term outlook are mixed. Only one in five respondents was bullish about the second half of 2023, while most respondents (48%) were neutral. Environmental consultants are more bullish than professionals in other sectors. The stage is set for a challenging second half. There is excitement and cause for concern, with potential for opportunities and distress ahead. Capital will be poised to jump on green shoots, and the banking system remains fundamentally strong, which should help contain any fallout from recent bank failures. LightBox will continue to monitor the market and provide insights to help our customers successfully navigate it.

For a more in-depth understanding, read the LightBox 2023 Mid-Year Sentiment Report — you’ll gain insights from commercial real estate industry experts on the critical role of technology in solving business challenges, the use of new AI applications like ChatGPT, and the growing importance of climate risk in dealmaking.